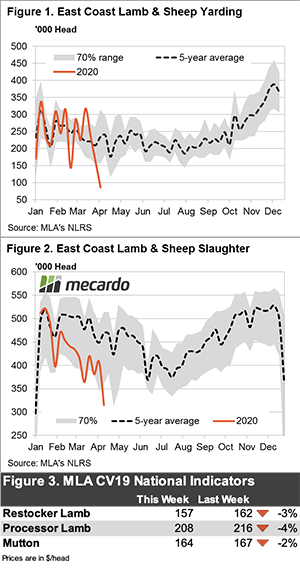

Sheep and lamb markets are past the Easter break, but we’ll have to wait until next week to see how supply came through. The two Easter impacted weeks saw very low slaughter, and it will have picked up this week, with prices seemingly maintaining historically strong levels.

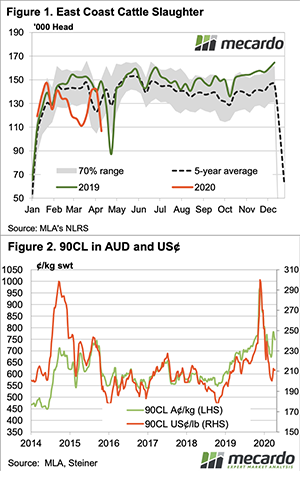

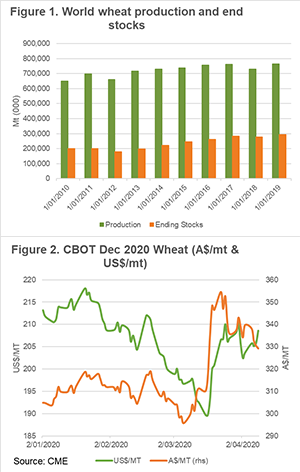

We can see in figure 1 that processors took the opportunity to cut back kills markedly over Easter. In the week before Easter, there were 66,270 lambs killed per day (assuming a 5 day week). The two weeks either side of Easter saw daily slaughter down to 36,046 head, that is 24% fewer lambs per day.

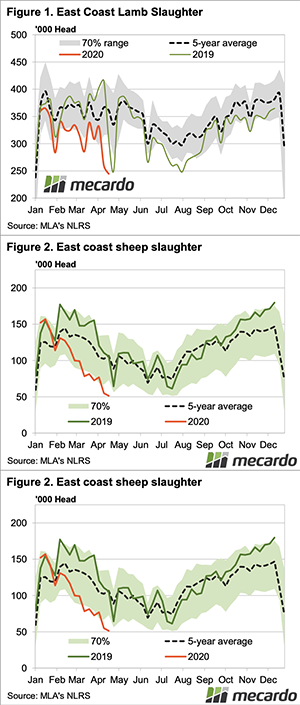

For mutton, the fall was even more marked, down 31% to just 10,306 head per day. In winter last year we saw daily kills test these levels, but we haven’t seen things tighter at any other in recent memory.

Low slaughter rates are likely a combination of tight supply and weakening margins for export processors impacting demand. Usually, when supply tightens like this, prices rally strongly, but the last couple of weeks has seen the CV-19 Indicator sit at $214/head.

Restockers remain very active, with social media pictures illustrating the plentiful green grass in NSW. Why wouldn’t you pay $158 (the CV-19 Indicator) for a store lamb, when grass is cheap and it can be turned out in July at $200+.

Mutton prices are benefitting from tight supply, and the weak slaughter is likely solely due to that. At $175/head on average and over $200 for heavier sheep, there aren’t too many unproductive sheep which will survive the winter.

What does it mean/Next week

The tight supply is likely to continue which will support prices in the week ahead. There is still plenty of scope for re-stockers to build numbers on the available grass, and with the forecast for further rain, they are likely to be further encouraged.