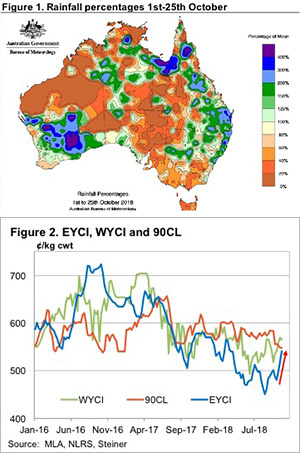

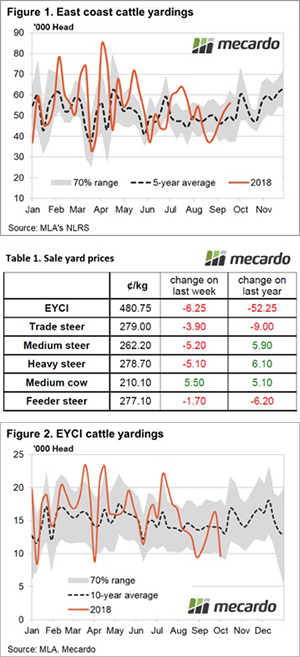

The recent rain has provided a lift to cattle prices last week across the East coast and producers responded this week to the improved prices with increased offering at the sale yard. The extra numbers putting a bit of a dampener on the rally for most categories of cattle.

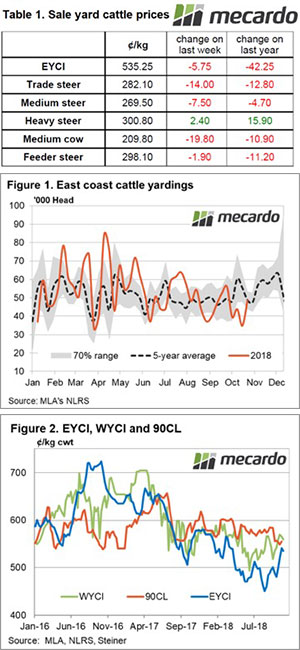

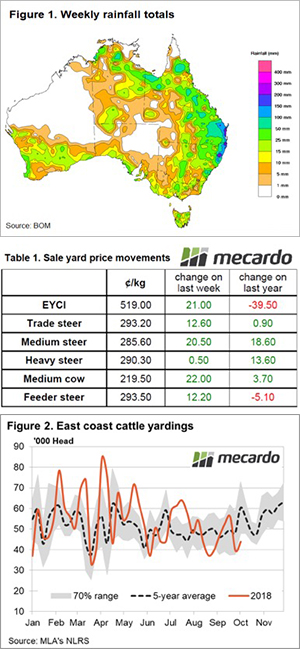

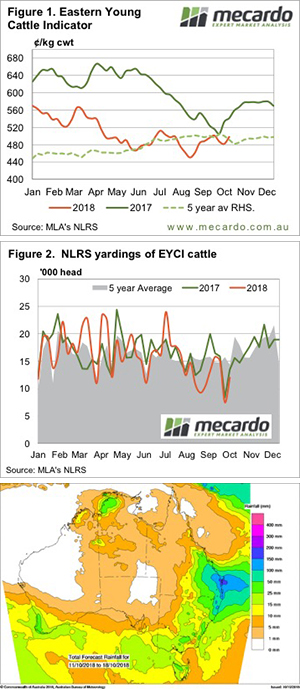

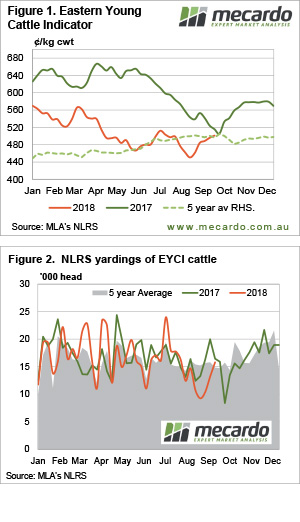

The Eastern Young Cattle Indicator (EYCI) eased 1% this week to close at 535.25¢/kg cwt. Given that yarding of EYCI eligible cattle was up 40% on last week’s figures the magnitude of reduction in price isn’t too bad. EYCI eligible cattle averaged 18,636 head per day this week compared to the 13,303 head seen last week and yesterday saw the first yarding in excess of 20,000 head since July.

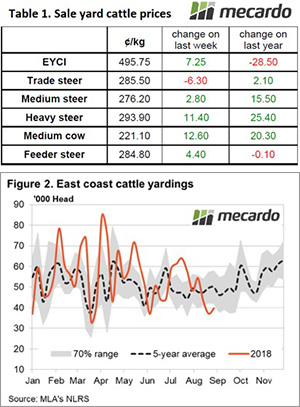

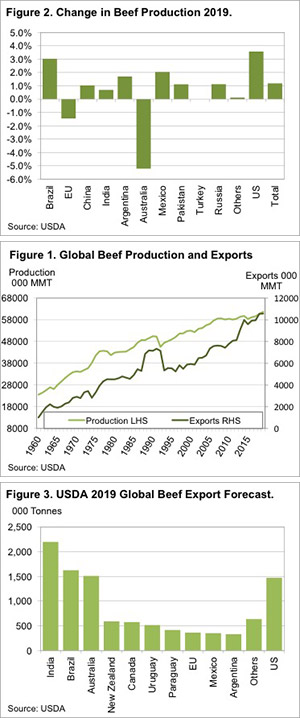

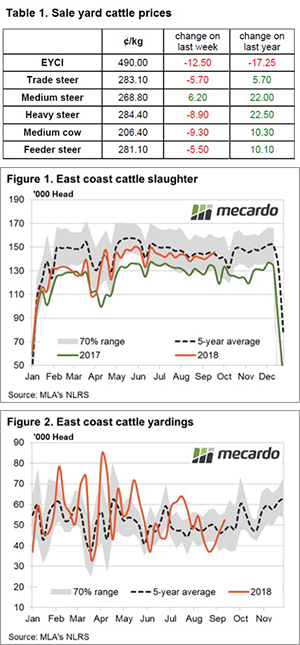

Across the Eastern seaboard cattle prices eased between 1-9% for most reported categories with Heavy Steers the only group to manage a slim price gain of 0.8% to creep back above 300¢/kg lwt – Table 1.

Increased yarding levels the likely culprit for the stalled rally with East coast throughput returning to average seasonal levels this week to see a 39% lift in numbers on the previous week to see nearly 49,000 head change hands at the sale yard – Figure 1.

Domestic and offshore prices have converged in recent weeks with the recent rain providing a boost to the EYCI. Improved demand for grinding beef from US buyers has seen the 90CL gain 1.3% to close at 555.4¢/kg CIF.

Next week

Further rain is forecast for much of the country next week, although it is a bit light on for Queensland and WA with less than 10mm anticipated there. The big falls (15-50mm) are reserved for NSW, SA, Tasmania and Victoria.

Expect the EYCI to hold its ground this week given the rainfall forecast and potentially probe a bit higher toward the 550¢ level to bring it more in line with the 90CL and young cattle prices in the west.

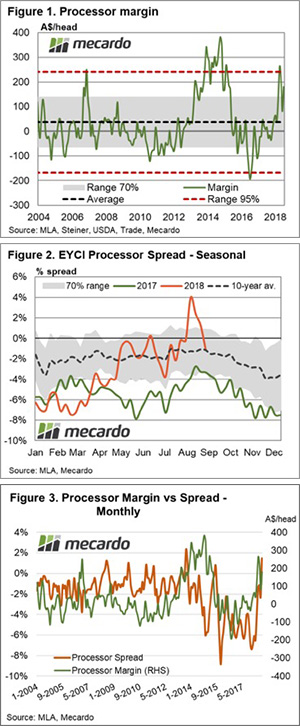

Cattle markets managed to edge higher this week, despite stronger supply. The Eastern Young Cattle Indicator (EYCI) moved back above 500¢ and within a tick of the price this time last year. It’s the spreads in restocker values we are interested in this week though.

Cattle markets managed to edge higher this week, despite stronger supply. The Eastern Young Cattle Indicator (EYCI) moved back above 500¢ and within a tick of the price this time last year. It’s the spreads in restocker values we are interested in this week though.