The Eastern Young Cattle Indicator (EYCI) is finally having a go at its winter rally. Seasonal conditions are on the improve in the south and it appears restockers might have decided it is time to take on some risk.

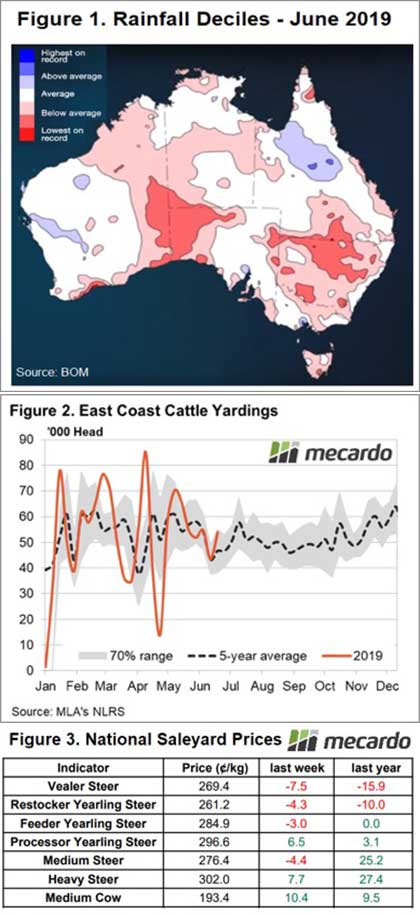

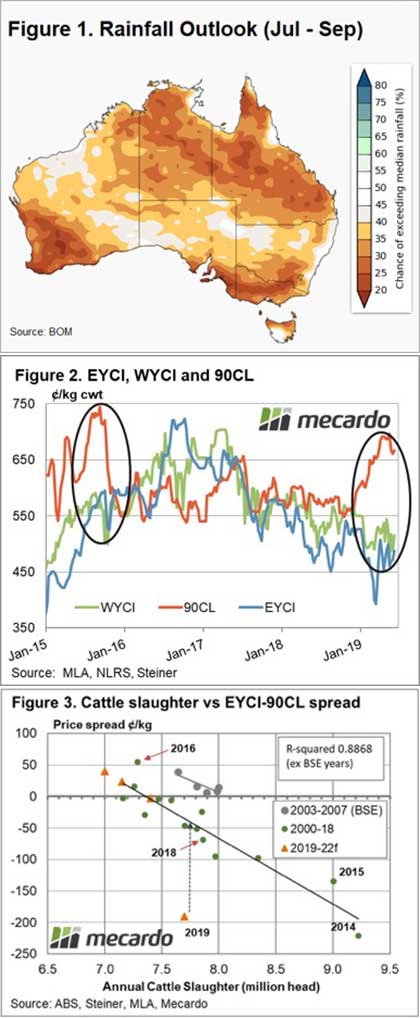

The rain was concentrated in southern areas again this week, with WA, Victoria and South East SA all receiving what could be considered normal winter falls. Parts of Queensland and NSW also got some rain, but it was a long way from drought breaking.

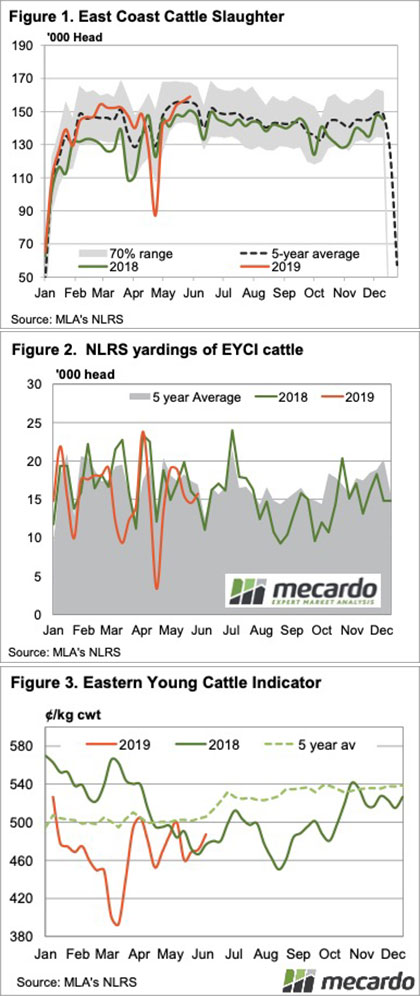

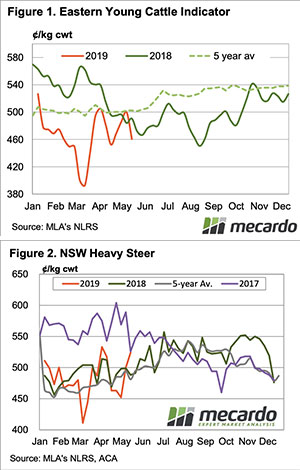

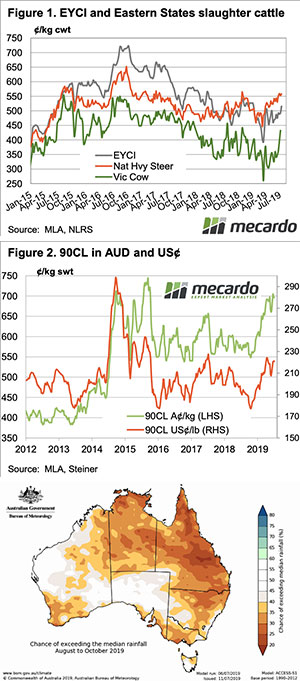

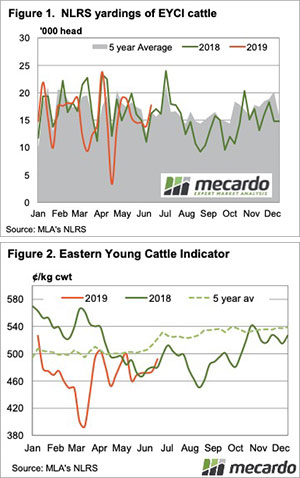

The improving season in the south appears to have given the market some impetus. The EYCI rallied 23.5¢ for the week to hit a 2019 high of 515.5¢/kg cwt (Figure 1). The price increase didn’t extend to finished cattle, with the Heavy Steer Indicator sitting well above its young cattle counterpart.

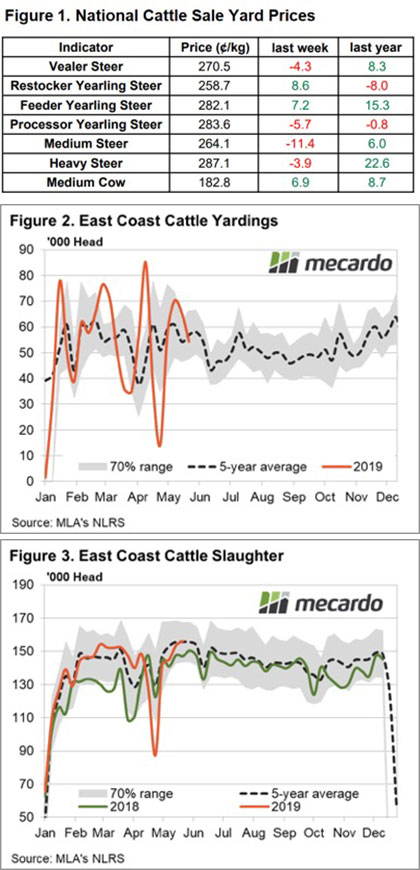

Cow prices have responded to the wet weather, however. The National Medium Cow Indicator has gained 85¢, or 29% in three weeks, also hitting a 2019 high of 435¢/kg cwt. Not surprisingly Victorian Cows are leading the charge (Figure 1), sitting this week at 478¢/kg cwt, but not quite as expensive as in Tasmania, where they are 497¢.

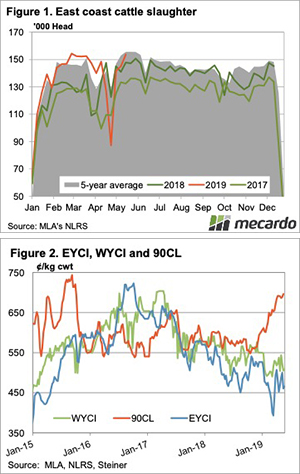

We knew cow prices had some room to move higher. Figure 2 shows the Frozen Cow 90CL export price remains close to 700¢ in our terms. Competition between China and the US for our lean trim remains strong and is keeping a floor under prices.

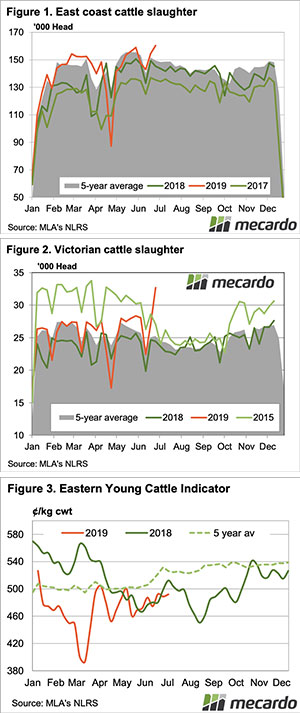

Cattle slaughter has dipped lower in recent weeks. While it is coming off a four year high, tightening supply while export prices are good will lead to higher values at the saleyard.

Next week:

The latest Bureau of Meteorology (BOM) three-month outlook, released yesterday, doesn’t offer a lot of hope for a wetter than normal spring (Figure 3). Whether you believe the BOM forecasts or not, the forecast isn’t great for store cattle prices, but does suggest finished cattle will be hard to come by for some time yet.

Restocker Steer prices between Victoria and NSW showing the impact of the recent Victoria rains with Victorian Restocker Steers commanding a 30¢ premium over NSW to record a 38¢ gain on the week to close at 258.4¢/kg lwt. Despite the rainfall in Victoria in recent weeks the longer-term outlook is worrying.

Restocker Steer prices between Victoria and NSW showing the impact of the recent Victoria rains with Victorian Restocker Steers commanding a 30¢ premium over NSW to record a 38¢ gain on the week to close at 258.4¢/kg lwt. Despite the rainfall in Victoria in recent weeks the longer-term outlook is worrying.