This week we saw the USDA release their July World Agricultural Supply and Demand estimates, the market has reacted to this news. In this update, we take a short look at Chicago futures & the dollar.

This week we saw the USDA release their July World Agricultural Supply and Demand estimates, the market has reacted to this news. In this update, we take a short look at Chicago futures & the dollar.

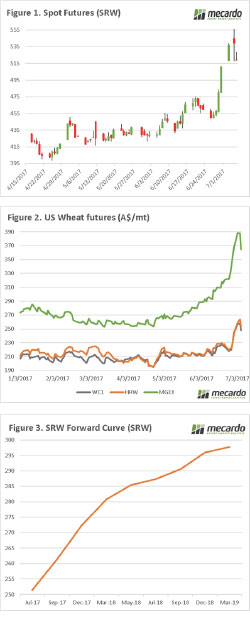

The last two sessions in the wheat market have been in the red (figure 1). The market has been on a skyward journey over the past two weeks, however it came to an end when the USDA report came out. The WASDE report was bearish with world stocks up 1.62mmt.

This bearish report, alongside welcome rains in the US has spooked the speculators in the market. However, the SRW futures falling should not be much of a surprise, as the world issues are largely around quality not quantity. It must be noted that we typically expect any falls in production to have a 2-month lag before appearing in the WASDE report. Therefore, the August report might provide some fireworks.

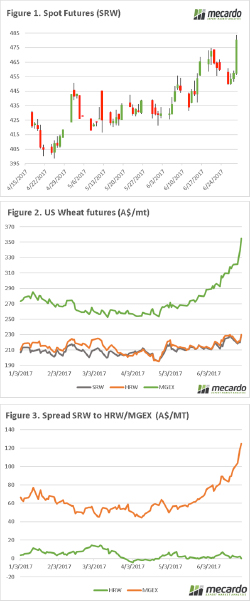

To add insult to injury, the AUD has reached four-month highs (figure 2), barrelling above 77¢. This makes our wheat more expensive to export. The AUD has gained value after better than expected Chinese trade data, and remarks from the US Fed Reserve that interest rates in the US may not be as soon or as frequent as expected.

Next Week/ What does it mean?

The commitment of trader’s report will give an indication into how the speculators in the market are positioned, and we would expect them to have reduced their long positions.

There will be another weekly crop report released, and we would expect the spring crop ratings to be reduced. Although at this time of year, a large degree of quality risk will already be priced in.

In the late 1600’s Sir Isaac Newton, developed the theory of gravity. It seems that in addition to determining that apples will fall from trees, it seems that what goes up in the grain market also comes down. After a sustained rally over recent weeks, some of the gains have been lost, however there are still good opportunities.

In the late 1600’s Sir Isaac Newton, developed the theory of gravity. It seems that in addition to determining that apples will fall from trees, it seems that what goes up in the grain market also comes down. After a sustained rally over recent weeks, some of the gains have been lost, however there are still good opportunities.

Well this is good news, wheat is on a journey to the moon, and at this rate beyond the planets. The downtrend of the past week has been reversed in dramatic fashion, is this a sign of things to come?

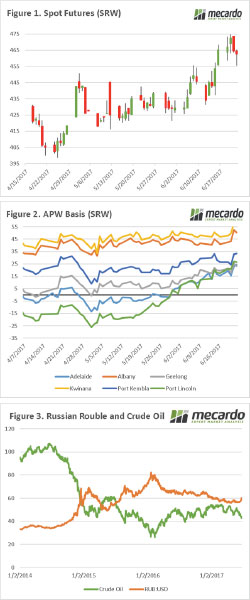

Well this is good news, wheat is on a journey to the moon, and at this rate beyond the planets. The downtrend of the past week has been reversed in dramatic fashion, is this a sign of things to come? There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it. This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market.

This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market. In our grain article yesterday, we picked out a few bullish factors at play in the market. Our view is that based on current market factors that pricing is close to the floor. In this weekly comment, we look at current pricing and the situation in Spain.

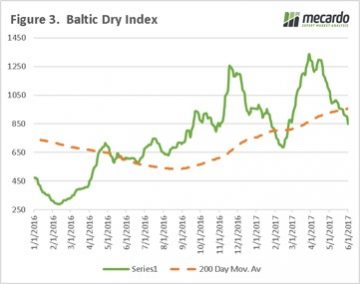

In our grain article yesterday, we picked out a few bullish factors at play in the market. Our view is that based on current market factors that pricing is close to the floor. In this weekly comment, we look at current pricing and the situation in Spain. In the past week, we have also seen the Baltic Dry Index (BDI) fall below the 200-day moving average (Fig 3). The BDI is considered a leading economic indicator as the cargoes typically transported by bulk vessels are commodities requiring further processing (iron ore, coal, grains etc) to create an end product, thereby giving an insight into future economic performance. The poor economic data in China, and declining Iron Ore returns could place further pressure on the A$.

In the past week, we have also seen the Baltic Dry Index (BDI) fall below the 200-day moving average (Fig 3). The BDI is considered a leading economic indicator as the cargoes typically transported by bulk vessels are commodities requiring further processing (iron ore, coal, grains etc) to create an end product, thereby giving an insight into future economic performance. The poor economic data in China, and declining Iron Ore returns could place further pressure on the A$.

The grain market continues to consolidate over the past week, after the large rise early in the month on the back of the Kansas snow event. There are some small glimmers of hope which are starting to crack through the bearish wall, and lend some support to prices.

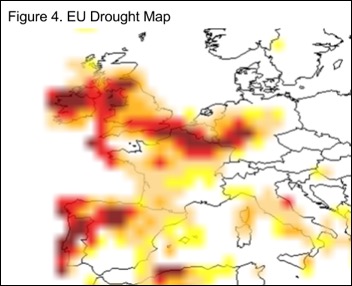

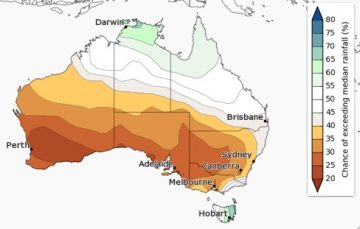

The grain market continues to consolidate over the past week, after the large rise early in the month on the back of the Kansas snow event. There are some small glimmers of hope which are starting to crack through the bearish wall, and lend some support to prices. At the moment, we think that we are close to the floor of the market and downside is quite limited. There are a number of weather woes around the world with the possibility of drought across the parts of the northern plains of the US. Locally it is increasingly looking like conditions will be dry over the next three months.

At the moment, we think that we are close to the floor of the market and downside is quite limited. There are a number of weather woes around the world with the possibility of drought across the parts of the northern plains of the US. Locally it is increasingly looking like conditions will be dry over the next three months. The International Grain Council released their monthly crop forecasts, reducing global end stocks for 2017/18 down 2mmt. This is largely insignificant; however, corn was reduced by 34mmt on the back of increased demand, which will help with sorghum and barley pricing if forecasts are accurate.

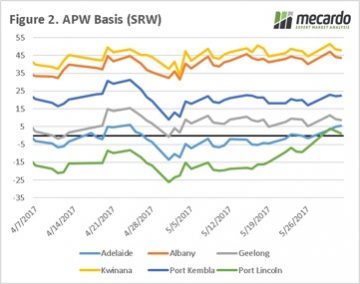

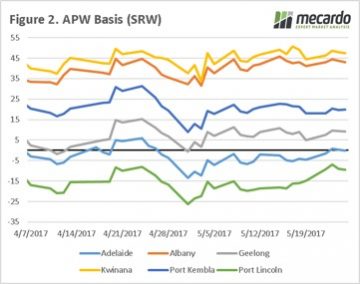

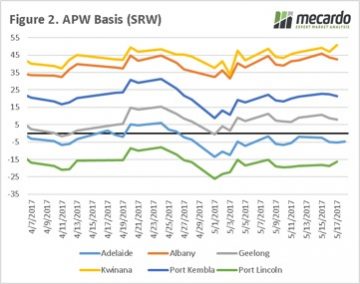

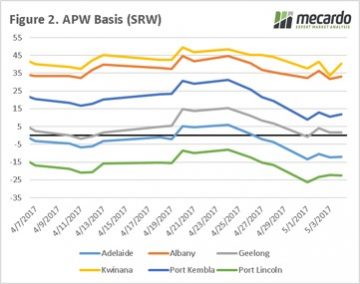

The International Grain Council released their monthly crop forecasts, reducing global end stocks for 2017/18 down 2mmt. This is largely insignificant; however, corn was reduced by 34mmt on the back of increased demand, which will help with sorghum and barley pricing if forecasts are accurate. This week the wheat market was largely quiet (figure 1) with a lack of fresh news, there are still continuing concerns in Kansas, however the worries have switched from snow to excess waterlogging. In the coming weeks, we will start to gain more clarity. At a local level basis levels were fairly static with the exception of small increases in Port Lincoln and Kwinana (figure 2). Particularly in Port Lincoln, where there are concerns about lack of moisture for seeding, and with it looking increasingly likely they will miss any falls this weekend.

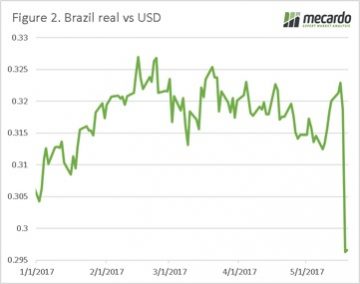

This week the wheat market was largely quiet (figure 1) with a lack of fresh news, there are still continuing concerns in Kansas, however the worries have switched from snow to excess waterlogging. In the coming weeks, we will start to gain more clarity. At a local level basis levels were fairly static with the exception of small increases in Port Lincoln and Kwinana (figure 2). Particularly in Port Lincoln, where there are concerns about lack of moisture for seeding, and with it looking increasingly likely they will miss any falls this weekend. The scandal has reached the top tier of the government with President Michel Temer being placed under investigation for alleged payments of to keep witnesses quiet. All in all, it’s a messy situation which has impacted the Real (figure 3) which plummeted against the US dollar a whopping 7%.

The scandal has reached the top tier of the government with President Michel Temer being placed under investigation for alleged payments of to keep witnesses quiet. All in all, it’s a messy situation which has impacted the Real (figure 3) which plummeted against the US dollar a whopping 7%. What does this mean?

What does this mean?

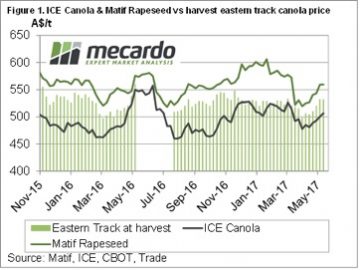

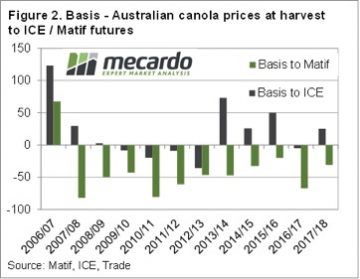

Old crop canola prices have been frustratingly sticky, for those who are still holding onto inventory. The market is stuck around the $520-525 port level, or $540 delivered Melbourne. This is a slight discount on harvest, so not much has been gained or lost through holding Canola.

Old crop canola prices have been frustratingly sticky, for those who are still holding onto inventory. The market is stuck around the $520-525 port level, or $540 delivered Melbourne. This is a slight discount on harvest, so not much has been gained or lost through holding Canola. Since Anzac Day delivered wheat and barley prices have gained some ground. With growers busy on seeders, no one is driving the trucks so this market has tightened somewhat. SFW wheat has hit $218/t delivered Melbourne, while F1 Barley is up to $200. These prices are 10-20% better than harvest, and are worth considering.

Since Anzac Day delivered wheat and barley prices have gained some ground. With growers busy on seeders, no one is driving the trucks so this market has tightened somewhat. SFW wheat has hit $218/t delivered Melbourne, while F1 Barley is up to $200. These prices are 10-20% better than harvest, and are worth considering.

The background to the issues at the early part of this week are explained in Tuesdays analysis piece “

The background to the issues at the early part of this week are explained in Tuesdays analysis piece “ This yield estimate is therefore based on the fields with the smallest impact by recent weather, and yield/hectare losses will most likely be revised in the coming ten days. This may cause another short rally when the snow-covered fields are estimated, but likely the damage will not be as bad as previously expected.

This yield estimate is therefore based on the fields with the smallest impact by recent weather, and yield/hectare losses will most likely be revised in the coming ten days. This may cause another short rally when the snow-covered fields are estimated, but likely the damage will not be as bad as previously expected. We need to keep a very close eye on the market as it may present selling opportunities over the 1-2 weeks, if (as I expect) the Kansas crop is re-estimated to take into account the snow-covered fields. This may potentially result in speculators with short positions being spooked again. The commitment of trader’s report for this week will be of interest as it will give an indication of whether the funds are still bearish on agricultural commodities or has this week made them reassess.

We need to keep a very close eye on the market as it may present selling opportunities over the 1-2 weeks, if (as I expect) the Kansas crop is re-estimated to take into account the snow-covered fields. This may potentially result in speculators with short positions being spooked again. The commitment of trader’s report for this week will be of interest as it will give an indication of whether the funds are still bearish on agricultural commodities or has this week made them reassess.