Cattle

In this series of blog articles, we’re taking a look back at the year that was for agricultural commodities and provide our insight for the year ahead. This instalment highlights 2018’s key movements in the cattle market and what to keep your eye on in 2019.

The 2018 season saw tough trading conditions for cattle farmers with a drier than average rainfall pattern impacting across the entire continent from April to September, which saw restocker activity curtailed and prices for store/young cattle ease.

The climate impact put a halt to the herd rebuild with the female slaughter ratio climbing rapidly during the first quarter of 2018 as the dry conditions  intensified. Since April 2018 the female slaughter ratio extended beyond levels experienced during the last significant reduction in the cattle herd, during the 2014/15 drought, and with an annual average female slaughter ratio for 2018 above 50% demonstrates that the herd liquidation remains well entrenched.

intensified. Since April 2018 the female slaughter ratio extended beyond levels experienced during the last significant reduction in the cattle herd, during the 2014/15 drought, and with an annual average female slaughter ratio for 2018 above 50% demonstrates that the herd liquidation remains well entrenched.

The 2018 drought saw feed grain prices surge placing pressure on feedlot margins. However, falling feeder values and firm finished grainfed cattle prices allowed enough margin to encourage an increase in cattle on feed to record levels beyond 1.1 million head.

What to keep an eye on in 2019

- Climate

Global forecast models continue to suggest an El Nino is likely early in the 2019 season with warmer and drier conditions to persist for much of the country. A late start to the northern monsoon season appears likely which will continue to limit northern producer’s appetite to restock.

If the 2019 season brings another failed autumn break to the south restockers here will remain on the sidelines and will continue to pressure young/store cattle prices. However, a return to more favourable conditions will see restockers encouraged back into the market with a vengeance.

- USA moving to herd liquidation

The USA is our main beef competitor into the key Asian markets of Japan and South Korea, and it is also a key export destination for Australian beef, holding the second spot in annual beef export trade volumes behind Japan, so what happens in the USA can influence our cattle markets.

The USA is on the verge of entering a liquidation phase for their cattle herd during the 2019 season, which will mean additional supply will flow into the global market. Demand for beef from Asia remains strong and should be able to soak up some of the increased US production if they move into destocking phase. However, any hiccup in Asian demand could see global beef prices come under pressure and flow through to Australian markets.

- China

The swine flu epidemic in China will impact upon their local pork production and Chinese consumers will have to source pork elsewhere. Ongoing trade tensions between the USA and China and tariff increases during the 2018 season will mean that the US pork industry may not be a viable solution to satisfy the gap in Chinese pork supply. This could see demand for meat protein in China transition toward increased consumption of chicken, beef and mutton during the 2019 season. An increased appetite for beef from China will be a positive for Australian beef producers.

Nevertheless, concern remains regarding a looming debt crisis within China. A financial shock in the form of debt induced drop in economic growth could see Chinese wealth and consumption levels take a hit, including the consumption of beef. The contagion of a Chinese debt crisis into Asian neighbouring countries and potentially spreading to the rest of the world could set off a second global financial crisis which would have disastrous consequences for Australia, beyond the beef industry. In terms of boxed beef product China takes around 10% of our export volumes. However, Australia is heavily tied to China across a range of export commodities and they are our top trading partner, so we need to keep a close eye on developments in China during the 2019 season.

Sheep

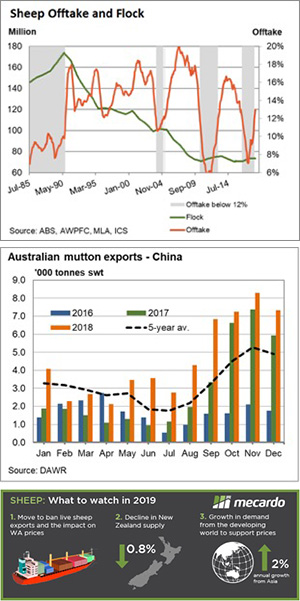

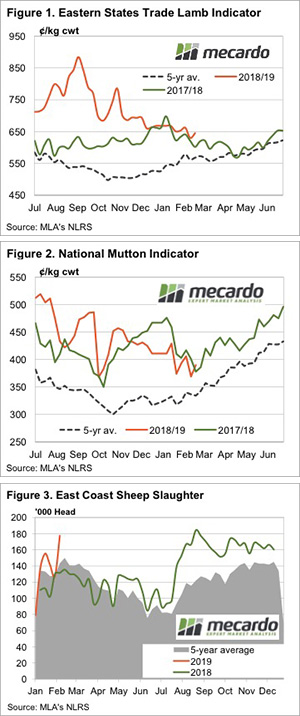

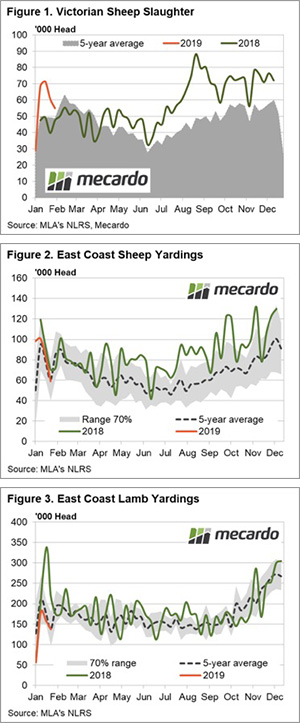

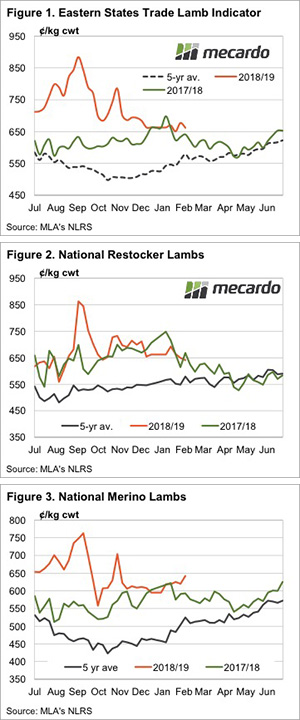

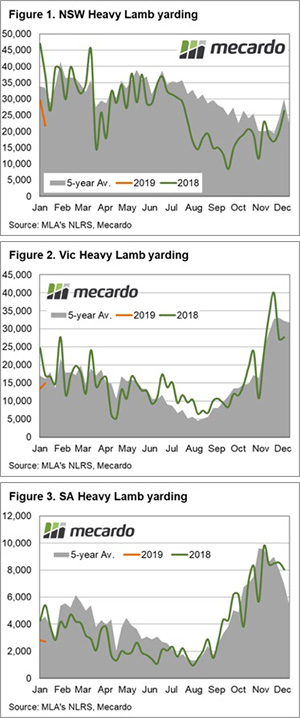

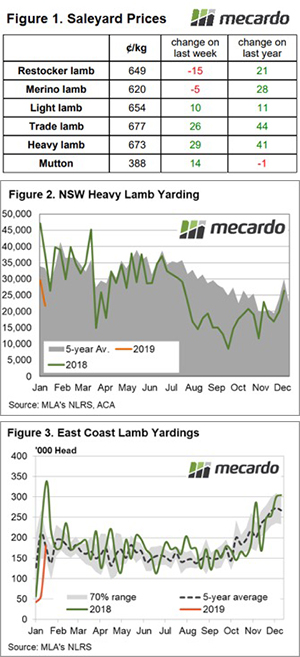

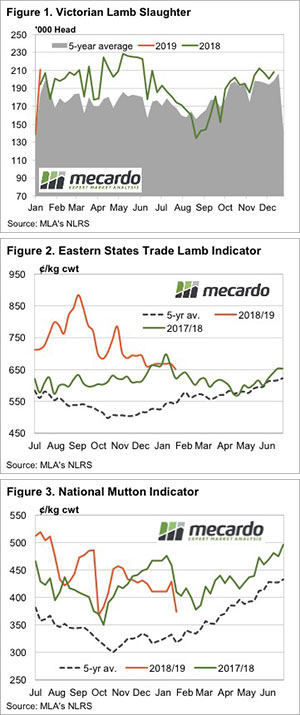

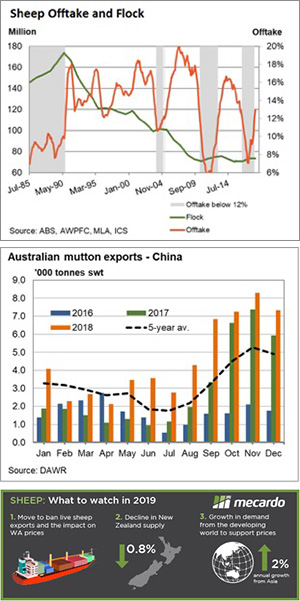

Dry conditions during the 2018 season saw the sheep offtake ratio climb back above the 12% thresh-hold during the middle of the year. The sheep offtake ratio measures the level of sheep turnoff into meatworks or live export as a proportion of the total flock expressed as a rolling 12- month average. Historically, when the sheep offtake ratio lifts above 12% the flock numbers begin to decline. 2016 was a wet year and this allowed the offtake ratio to fall below 8% in mid-2017. Since then, seasonal conditions have been generally dry, so the sheep offtake has risen. Since July 2018 this rolling measure of offtake has been indicating downward pressure on the sheep flock by rising above 12%.

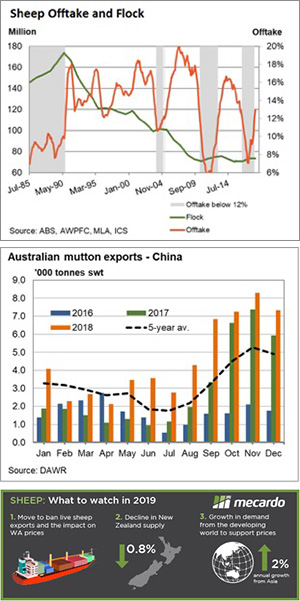

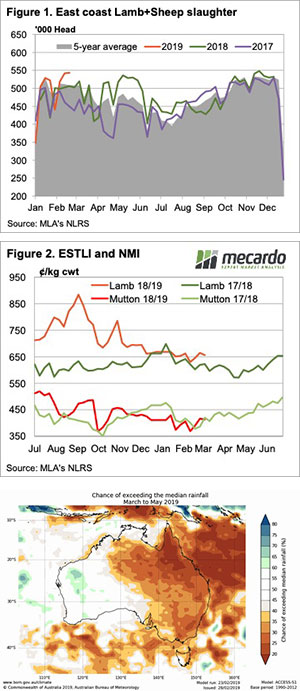

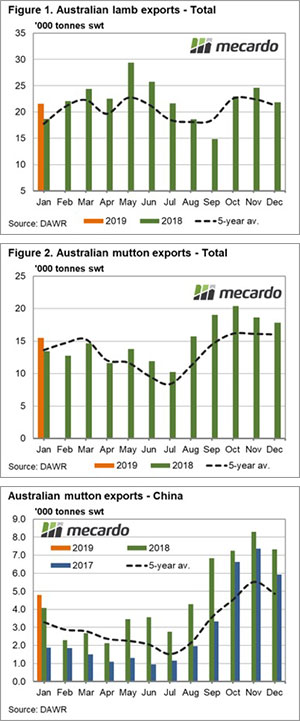

Despite the reduction in the flock and higher slaughter levels due to the dry conditions sheep and lamb prices along the East coast have managed to maintain historically high levels during the 2018 season due to robust offshore demand, particularly for mutton out of the USA and China. Indeed, from June to December 2018, average monthly exports of Australian mutton to the USA have been 88% above the five-year average level and flows to China have been 70% higher.

What to keep an eye on in 2019

- Move to ban live sheep exports

During 2018 live sheep exports came under the microscope and flows ground to a halt during the northern hemisphere summer. The impact of reduced volumes of live sheep exported saw lamb and sheep prices in Western Australia stagnate, failing to follow East coast prices higher and limiting WA sheep producer’s revenues. A third of WA sheep turnoff goes to live export each year so the live trade is a crucial component of the WA sheep and lamb market, helping to underpin prices in the west.

It is an election year in 2019 and the Australian Labour Party, along with several cross-bench senators, have indicated a preference to phase out live sheep exports. If those seeking to ban live sheep exports are successful it is likely just a matter of time before their target will shift toward other aspect of agriculture that they find distasteful. What will be their next target if they achieve success in banning live sheep exports? Banning intensive animal farming practices in the beef feedlot, pork, chicken and egg industries, banning long haul animal transport over land and/or any shipments of live animals overseas – including the sizeable live cattle trade? It’s a slippery slope and may extend to the use of glyphosate and GMO technology in cropping/horticulture or the practice of mulesing in the wool industry.

- Reduction in NZ supply

Across the ditch the switch from sheep to cattle continues with Beef and Lamb NZ forecasting further growth in the beef herd at the expense of the sheep/lamb flock during the 2018 season and this is a pattern that isn’t expected to change as we head into 2019. The net result of the contraction in breeding ewes and lambs born will push the total sheep flock in NZ to a new low of 27.3 million head, or a decline of 0.8%.

In global export terms Australia and NZ supply around 70% of the market and in many of Australia’s key international markets NZ is our only real competitor. With NZ supply forecast to continue to decline the demand from offshore will need to find a source country to secure product and Australia is the obvious solution.

- Growth in demand from developing world

OECD forecasts for the next five years suggest that demand for sheep meat from Asia is set to average a 2% growth rate, annually. While this doesn’t sound like much the trade into Asia was more than US$2.1 billion last season and 60% of global sheep/lamb exports are destined to head to Asian markets, so it represents a significant chunk.

Asian demand for Australian sheep meat has supported the robust prices sheep producers have enjoyed during the 2018 season and with the NZ sheep industry shrinking there is a fair chance we will see growing Asian demand continue to support the Australian sheep/lamb sector as we progress through 2019.

intensified. Since April 2018 the female slaughter ratio extended beyond levels experienced during the last significant reduction in the cattle herd, during the 2014/15 drought, and with an annual average female slaughter ratio for 2018 above 50% demonstrates that the herd liquidation remains well entrenched.

intensified. Since April 2018 the female slaughter ratio extended beyond levels experienced during the last significant reduction in the cattle herd, during the 2014/15 drought, and with an annual average female slaughter ratio for 2018 above 50% demonstrates that the herd liquidation remains well entrenched.