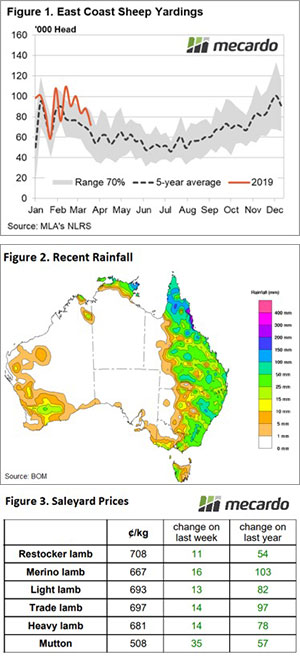

The title of this commentary isn’t referring to the grass but the sale yard price board for lamb and sheep across the east coast. Although, if we keep seeing rain falling in all the right places it won’t be long before the pasture starts to green up as well.

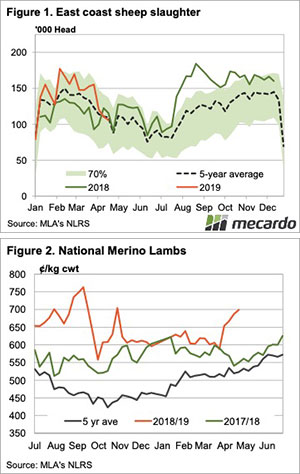

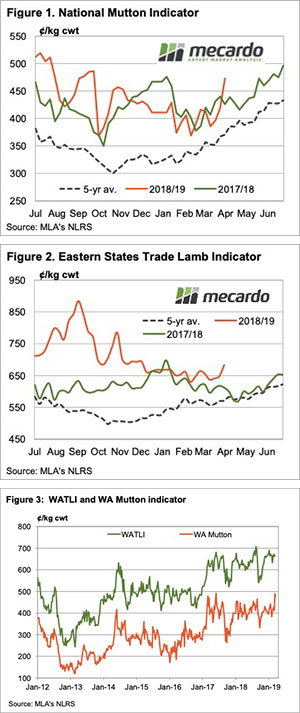

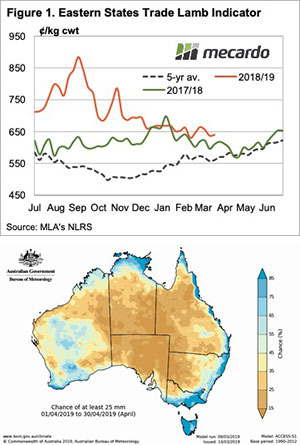

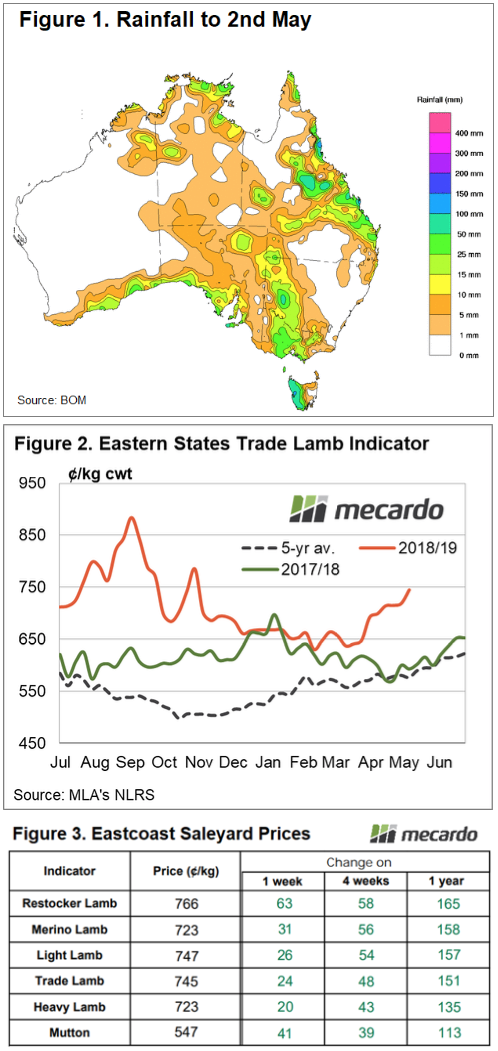

This week finally saw some decent rain to large parts of Western Victoria and Western NSW with falls extending beyond 50mm in some areas – Figure 1. A welcome relief to those that have seeded crops but also bringing optimism to sheep producers hoping to get some pasture growth before the winter chill sets in earnest.

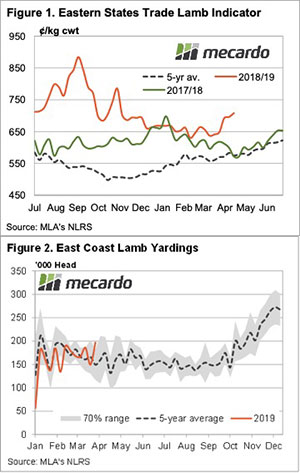

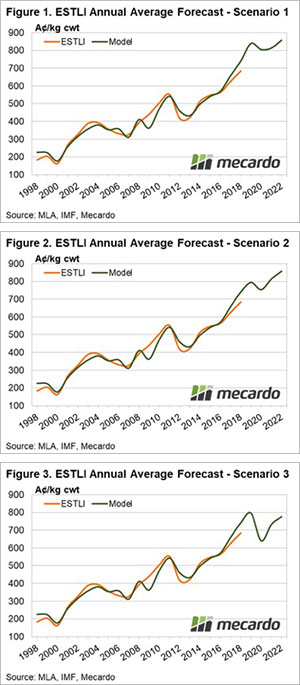

The Eastern States Trade Lamb Indicator (ESTLI) responding as expected to the improved climatic conditions with a 24¢ rally on pre ANZAC day prices from last week to close at 745¢/kg cwt yesterday. Expectations of tight lamb supplies as we head into winter has seen the ESTLI push higher earlier than last season and now sits over 150¢ higher than at this time during 2018 – Figure 2.

The Eastern States Trade Lamb Indicator (ESTLI) responding as expected to the improved climatic conditions with a 24¢ rally on pre ANZAC day prices from last week to close at 745¢/kg cwt yesterday. Expectations of tight lamb supplies as we head into winter has seen the ESTLI push higher earlier than last season and now sits over 150¢ higher than at this time during 2018 – Figure 2.

As outlined in this week’s analysis the concerns over tight winter supply has seen Coles issue forward prices for July at 830¢/kg which bodes well for producers with supply to offer over the colder months.

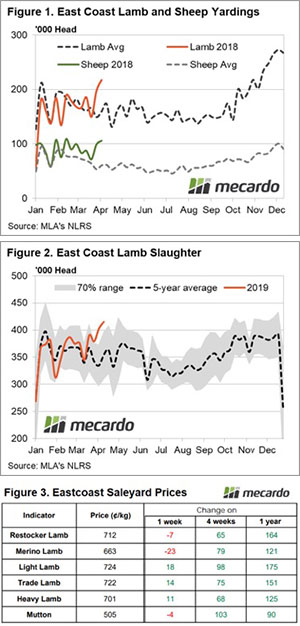

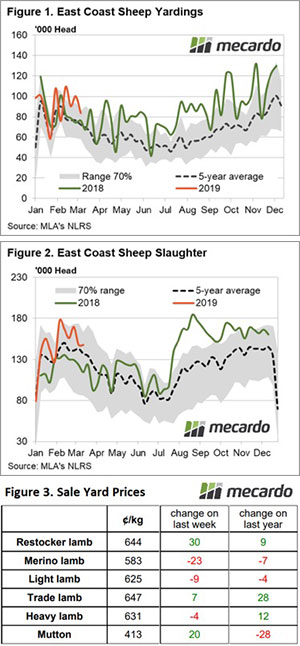

The onset of rain lifted prices for sheep and lamb categories across the eastern seaboard, with all NLRS reported east coast categories recording gains this week between 20-65¢, Figure 3. East coast mutton responding particularly well to the wet, recording an 8% lift on the week to see it testing all-time highs to close at 547¢/kg cwt yesterday – it wasn’t that many years ago that lamb producers would have been ecstatic to be getting prices near the 550¢ level.

What does it mean/next week?:

The forecast for rain into the week ahead shows lighter falls expected for Western Victoria and Western NSW with the rain band moving across to the eastern regions of both states. The sales program has returned to normal after the ANZAC and Easter disruptions, so we will get a clear picture of how late Autumn supply is stacking up in the coming weeks.

While the rain persists and as supply starts to dwindle lamb and sheep prices will continue their march northward. Despite the recent heroics of an unnamed Game of Thrones character, kept vague so as not to be accused of spoiling plot lines, “winter is coming”.