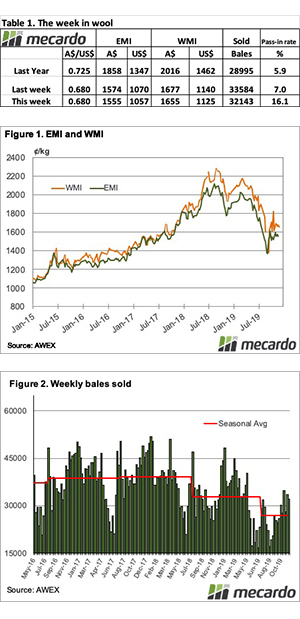

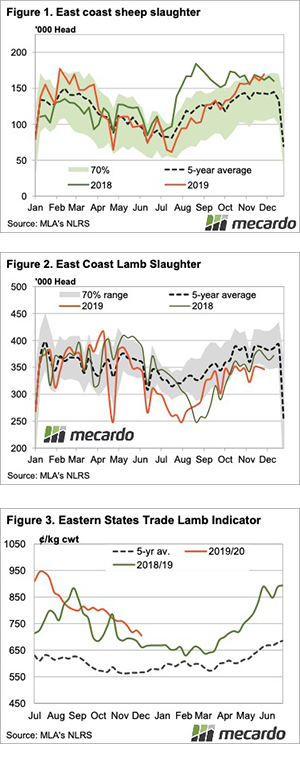

Sheep slaughter had its second highest week for the year as sheep continue to flow into markets. There has been little impact on prices however, as with lamb, slaughter is down, there is still kill space to fill.

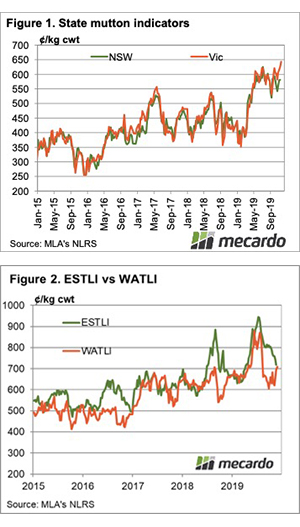

Chinese mutton demand continues to run hot. Mutton slaughter was very high last week, yet the National Mutton Indicator remains at very strong levels, at 572¢/kg cwt this week. Victorian Mutton did come back from record highs, losing 39¢ to 614¢/kg cwt. Victoria is still the strongest in the state, just not as strong as last week.

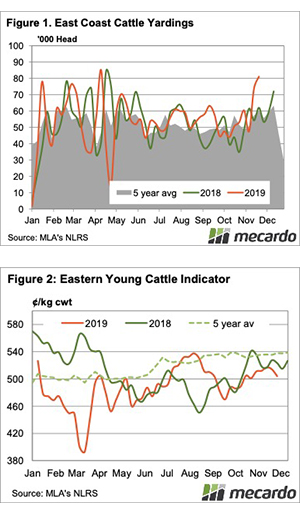

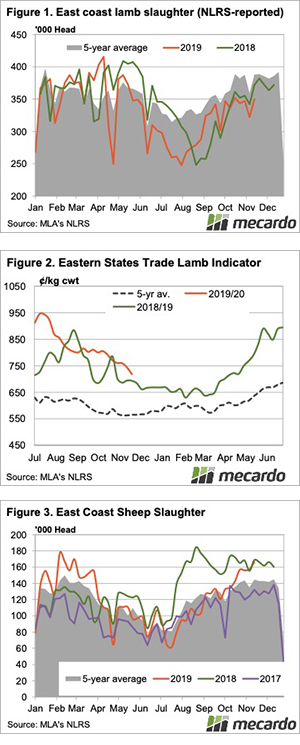

Lamb slaughter remains well below last year, despite plenty flowing out of the south. The north-south split remains, but both NSW and Victorian lamb slaughter were 10,000 head below 2018 last week.

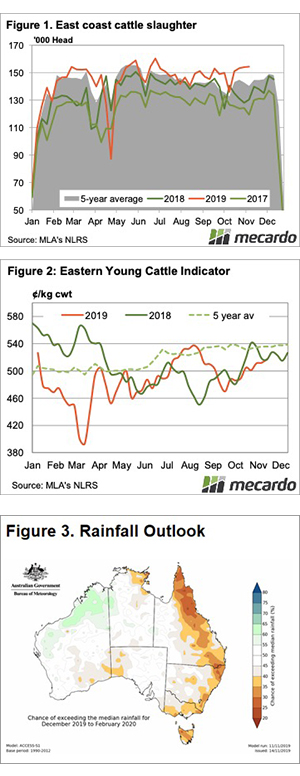

Figure 3 shows the Eastern States Trade Lamb Indicator (ESTLI) is still in decline, losing another 20¢ this week to 705¢/kg cwt. The ESTLI is still holding a 44¢ premium to last year, obviously being helped by tighter supply.

The National Mutton Indicator is at a 140¢ premium to last year, so it is doing a lot better.

WA Trade Lambs moved past the east coast this week, up 7¢ to 716¢/kg cwt, which combined with the ESTLI fall saw WA the more expensive. In Victoria you could almost say trade lamb prices (686¢) tanked, losing 35¢ to be the cheapest lambs in Australia, apart from Tasmania (646¢/kg cwt).

Next Week:

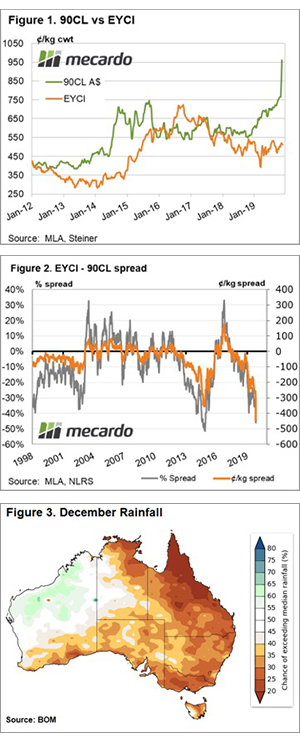

The latest BOM outlook is less than promising for the east coast. If it remains dry we could see supplies remain strong, with females and Merino wethers adding to supply. If it gets wet, lamb prices probably have further to rally than sheep.