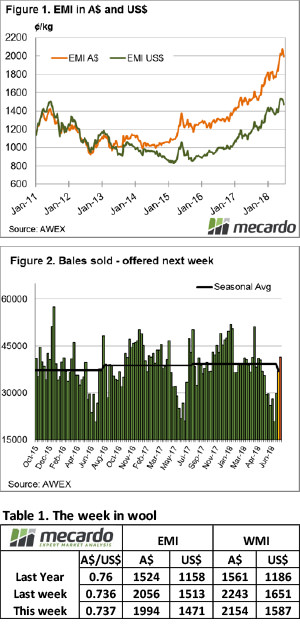

The wool market has now closed for the annual 3-week winter recess, and all industry players would have been pleased with the final sales.

A solid and well supported market leading into a break provides all with confidence, especially wool exporters travelling overseas to visit mills and set in place plans for a new season supply.

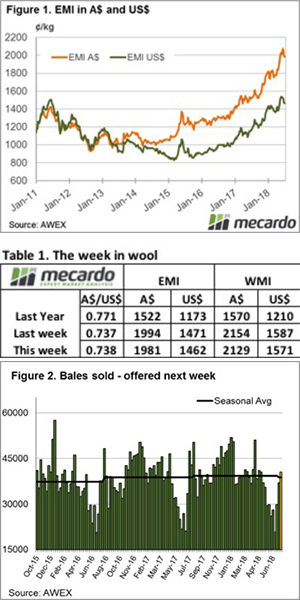

The Eastern Market Indicator gave up 13 cents over the week to settle at 1,981 cents AU$ terms (Figure 1).

The EMI was also weaker in US$ terms although not to the same scale as in Au$ terms, closing at 1,462 US cents, down 9 on the week.

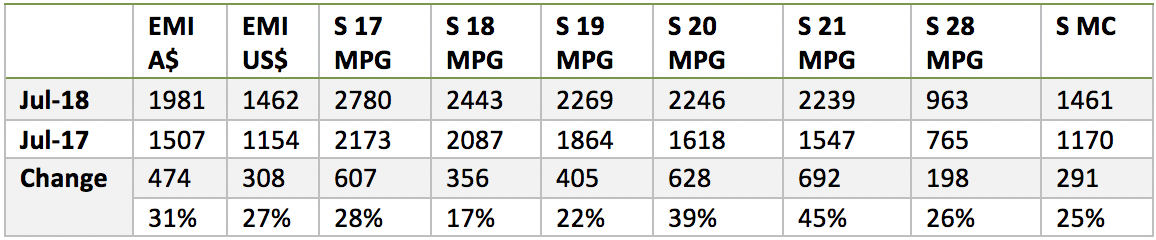

Comparing the wool market performance over the season, a 31% lift for the EMI is an excellent result. The bulk of the clip now sits in the 18 to 19 MPG range, and this area showed the least gains at 17 & 22% respectively, while 20 & 21 MPG which has seen continued decline in supply performed best.

Again, sellers exercised restraint, with 11.2% passed in on Wednesday and a further 5.3% on Thursday for a total of 8.5% over the week. Still a significant pass-in rate given the level of the market but well back on the double-digit figures of last week.

An offering of 40,544 bales resulted in 37,095 bales sold, well above the 27,000 averages for June but in line with the season average of 39,000 per week.

The first day saw a continuation of the softer trend of last week before a recovery on Thursday with Fremantle off the market. This was especially evident in the 19 and broader types, all quoted dearer, with the finer types fully firm although 16 & 17 MPG were irregular.

Crossbreds also finished on a solid note; with AWEX noting that better prepared lots sold best. This is now a feature of this market where poorly prepared or unskirted lots are not well regraded and buyers are selective.

Merino Skirtings eased in line with fleece wool, however lines containing >5% VM again were not keenly sought.

Merino Cardings also eased with the Cardings Indicator in Sydney – 17, Melbourne – 29 and -21 in Fremantle.

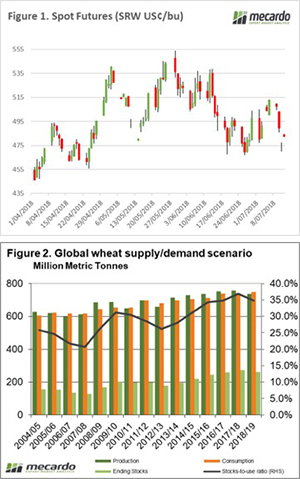

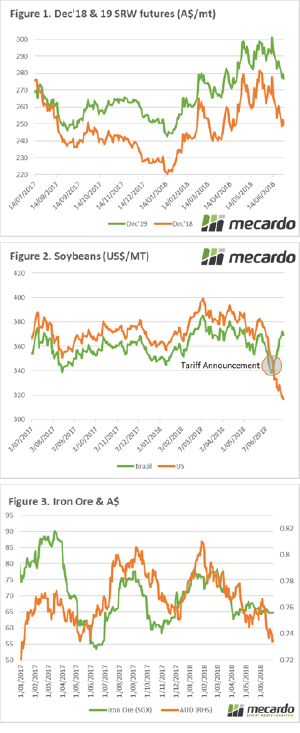

It is going to be a very interesting fortnight. All the major factors which impact grain pricing are likely to come into play, adding volatility. In this weekly update, we take a look at the two big uncertainties – geopolitics and European downgrades.

It is going to be a very interesting fortnight. All the major factors which impact grain pricing are likely to come into play, adding volatility. In this weekly update, we take a look at the two big uncertainties – geopolitics and European downgrades.

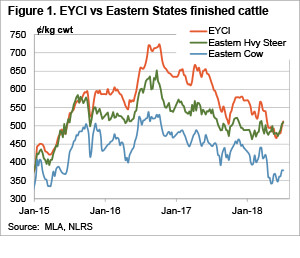

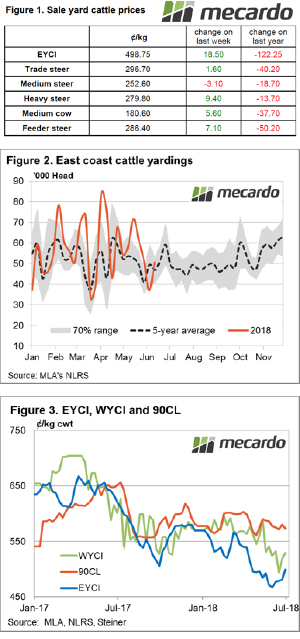

A bit of precipitation and weakening supply has seen cattle prices continue to rally this week, with the Eastern Young Cattle Indicator (EYCI) breaking back through the important 500¢ mark. Slaughter cattle prices also improved, as supply goes into its usual winter hibernation.

A bit of precipitation and weakening supply has seen cattle prices continue to rally this week, with the Eastern Young Cattle Indicator (EYCI) breaking back through the important 500¢ mark. Slaughter cattle prices also improved, as supply goes into its usual winter hibernation.

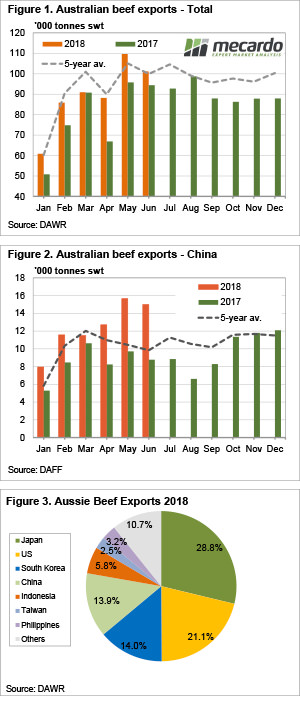

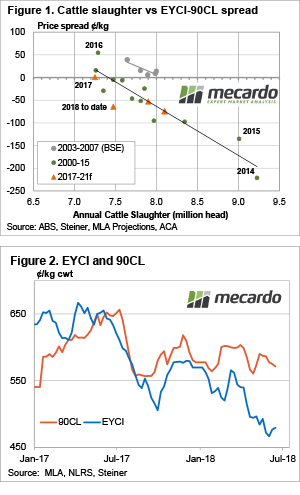

Cattle slaughter remained relatively strong in June, and this flowed through to export, which, while being down on May were still at their second highest level for the year. China maintained it’s very strong demand for frozen beef, helping keep export prices elevated despite cheaper cattle prices.

Cattle slaughter remained relatively strong in June, and this flowed through to export, which, while being down on May were still at their second highest level for the year. China maintained it’s very strong demand for frozen beef, helping keep export prices elevated despite cheaper cattle prices.

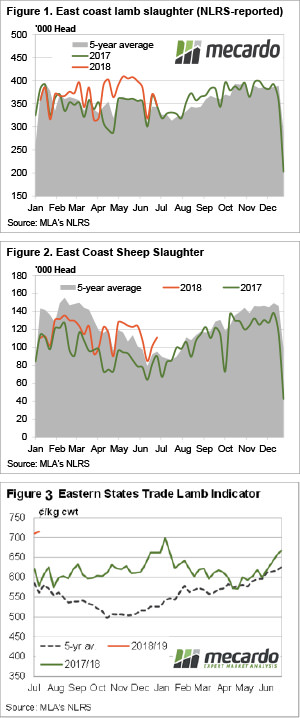

After the big spike in lamb prices last week the market steadied. There was plenty of talk about the high prices making things hard for processors, but lamb and sheep slaughter still managed to remain at or above last year’s levels.

After the big spike in lamb prices last week the market steadied. There was plenty of talk about the high prices making things hard for processors, but lamb and sheep slaughter still managed to remain at or above last year’s levels. The wool market lurched into F19 with an overhang of wool producer’s bales looking to swing income from F18 to F19. If the plan was to reduce tax payable, the market assisted and pulled the market back in all centres and on both days.

The wool market lurched into F19 with an overhang of wool producer’s bales looking to swing income from F18 to F19. If the plan was to reduce tax payable, the market assisted and pulled the market back in all centres and on both days.

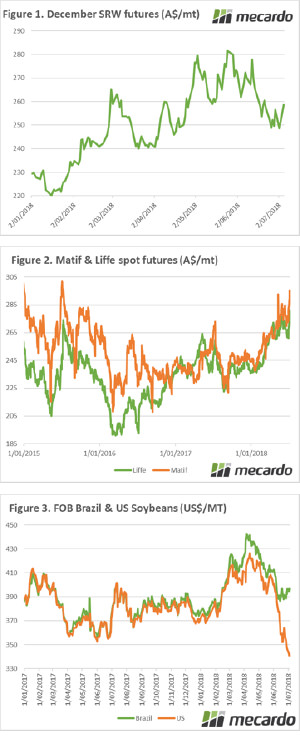

The past week has largely been void of new fundamental data to move markets. The big issues of the week are political in nature, with only one week until tariffs are in place against a multitude of US agricultural products. So, what do US soybeans and the socceroo’s have in common? They are both uncompetitive.

The past week has largely been void of new fundamental data to move markets. The big issues of the week are political in nature, with only one week until tariffs are in place against a multitude of US agricultural products. So, what do US soybeans and the socceroo’s have in common? They are both uncompetitive.  The cattle market appears to have found a base in recent weeks, and this is due to supply finding a top, and good processor margins seeing cattle being soaked up. So where to from here? This week we take a look at demand, and where the market will head when supply tightens up again.

The cattle market appears to have found a base in recent weeks, and this is due to supply finding a top, and good processor margins seeing cattle being soaked up. So where to from here? This week we take a look at demand, and where the market will head when supply tightens up again.

It does seem fashionable to take an easy dive now with the World Cup in full flight. Alas, the Socceroos are out and our ovine market commentator was right, I was up bleary-eyed mid-week to see the crashing exit. But at least there is something to cheer about when it comes to cattle prices this week.

It does seem fashionable to take an easy dive now with the World Cup in full flight. Alas, the Socceroos are out and our ovine market commentator was right, I was up bleary-eyed mid-week to see the crashing exit. But at least there is something to cheer about when it comes to cattle prices this week.