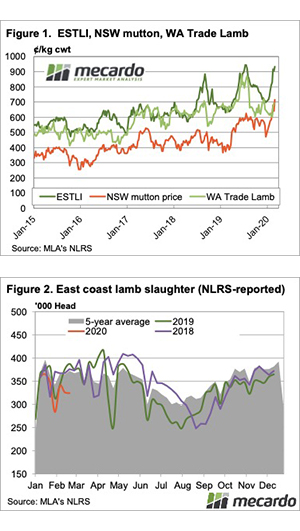

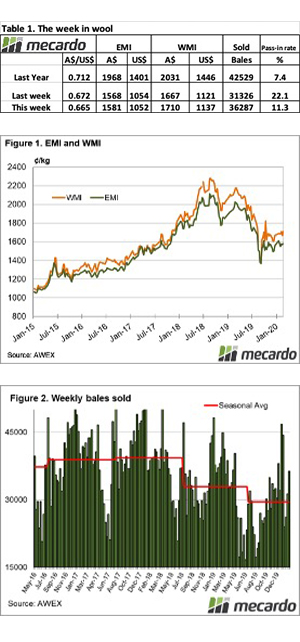

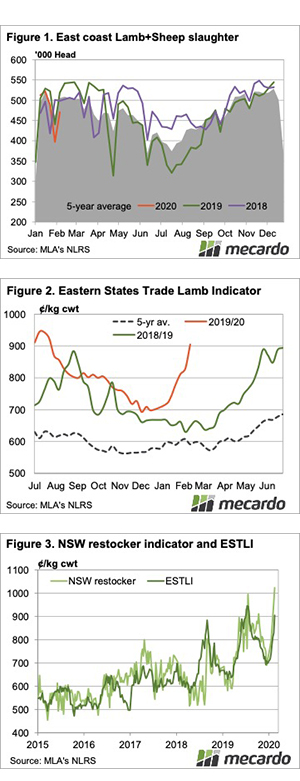

In what was a somewhat stellar performance this week, the wool auctions returned after the ransomware attack on the Talman system, to post a result that underpins the current strong demand for wool. The market was able to absorb a record volume and hold prices relatively steady. This at a time when the world of commerce is impacted by COVID-19 virus spreading across the globe, giving support to the notion that the tight stocks situation will support prices in the medium term.

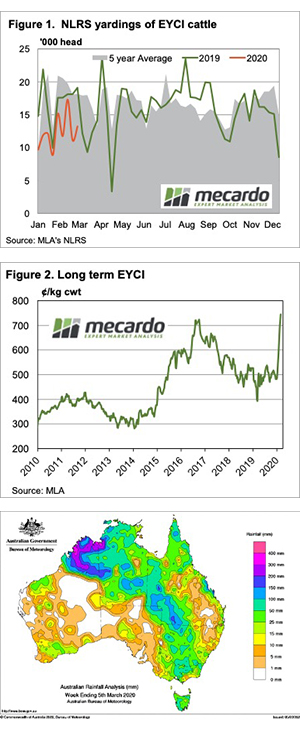

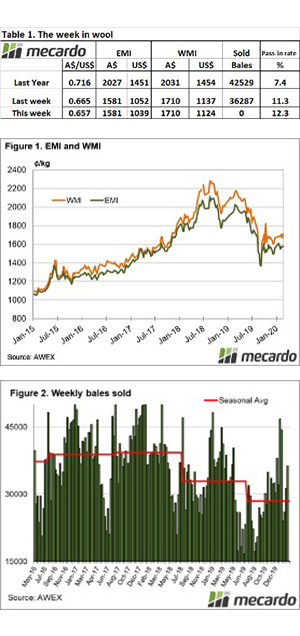

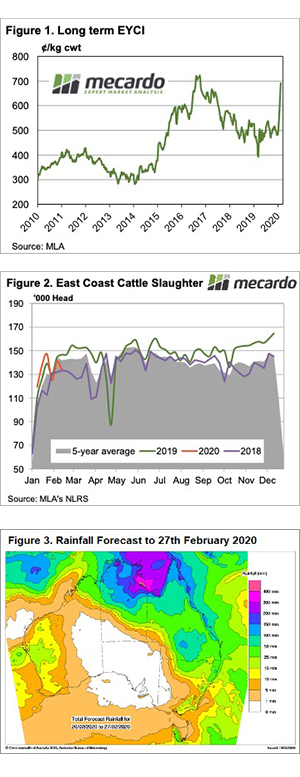

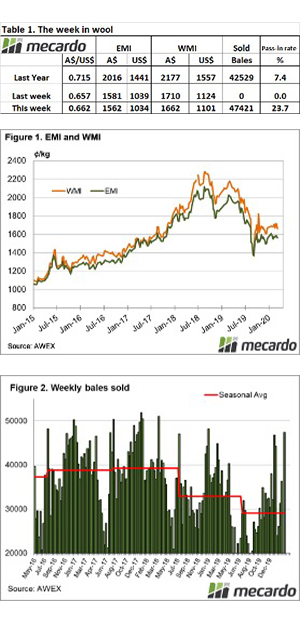

The Eastern Market Indicator (EMI) compared to 2 weeks ago overall lost 19 cents to close at 1,562 cents. The Australian dollar remained under pressure at 0.662 cents. This pulled the EMI in US terms down 17 cents to 1,034 cents.

In the West, the market had a tougher week, The Western Market Indicator giving up 48 cents on the week to 1,662 cents.

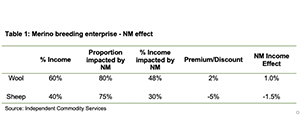

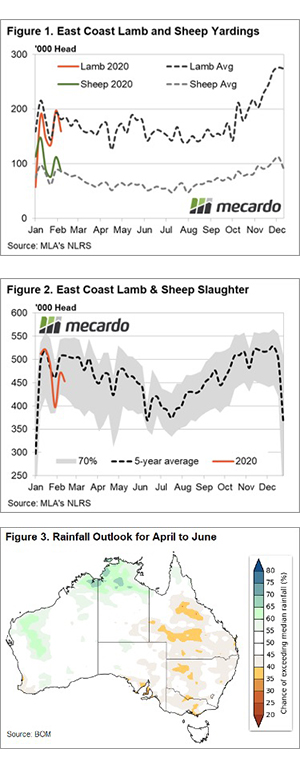

The backlog of wool as a result of last week’s sale cancellation meant a massive 62,166 bales were offered to the trade, with a clearance of 47,421 bales. AWEX report this was the largest weekly offering since 2008, and the largest clearance since April 2018. While on the opening day the market held firm, towards the end of the week the increased volume caused prices to soften (especially for secondary types) and the pass-in rate to lift, averaging 23.7% over the week.

The dollar value for the week was $81.07 million, for a combined value so far this season of $1.492 billion. The average bale value was $1,709.

Crossbred types held steady with small gains; 26-micron wool again showed strength on limited volume gaining 8 cents in the South. The Cardings indicators eased in all centres giving up 15 – 24 cents over the week.

The week ahead

AWEX advises the roster for next week is 46,680 with all centres selling on Wednesday & Thursday.

The market then reverts to its usual volumes of 34,000 & 37,000 bales in subsequent weeks. This indicates that the backlog of wool as a result of the cancellation of sales last week will be cleared by the end of next week.

The market eased as the week progressed, however, this could be a response to the record weekly volume, so a close watch on pre-auction sales activity and Riemann Futures trades will provide the best indication of next weeks price direction.