On the radio in today the weather report included a brief from BOM saying that June has been the driest in Victoria since records began and its taking its toll on the price of lamb and sheep. East coast figures show price falls in all categories other than Restocker lambs on the week and Light, Heavy and Trade lambs are now trading lower than this time last year.

On the radio in today the weather report included a brief from BOM saying that June has been the driest in Victoria since records began and its taking its toll on the price of lamb and sheep. East coast figures show price falls in all categories other than Restocker lambs on the week and Light, Heavy and Trade lambs are now trading lower than this time last year.

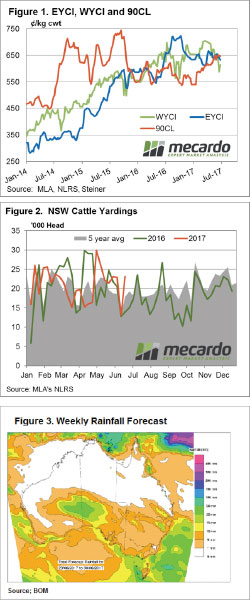

The Eastern States Trade Lamb Indicator dropped 3.8% this week to close at 625¢/kg cwt and National Mutton shaved off 5.7% to see it at 467¢/kg cwt. East coast supply metrics providing a clue to the weaker prices with lamb and sheep throughput and slaughter tracking well above last season and the longer-term average levels for this time in the year. Drilling into the figures on a state by state basis shows that NSW is leading the pack in bringing forward supply.

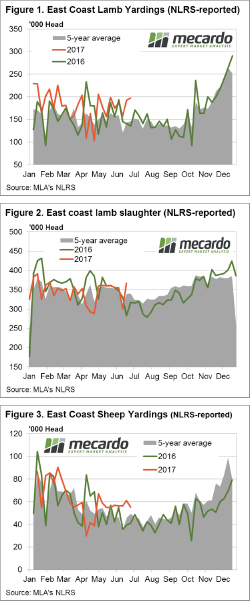

East coast lamb throughput up 2.5% on the week to over 197,000 head, and while the weekly change isn’t too earth shattering a look at the trend compared to this year and the five-year average shows it to be 35% higher than it normally is this time of year – figure 1. NSW lamb yardings are currently sitting 50% above the five-year average, with over 138,000 head going to the saleyards this week, clearly having an impact on the East coast figures.

A similar pattern displayed in lamb slaughter for the week ending 23rd June with a jump in head of 22% to just over 367,000 this week – figure 2. NSW, again the key state behind the surge with a 26% lift in lamb slaughter on the period. East coast mutton yardings levels dipped on the week, but remain persistently high when compared to this time last season and against the five-year average, figure 3.

The week ahead

A look at the rainfall forecast for the next week doesn’t hold much promise for a surge in prices with the best falls noted out at sea across the Great Australian Bight, Bass Straight and the Tasman Sea. The Tasmanian West and North-west will get some reasonable levels and parts of the WA, SA and Victorian coastline look promising, but for much of the sheep rearing regions it is going to be pretty light on. Happy end of financial year.

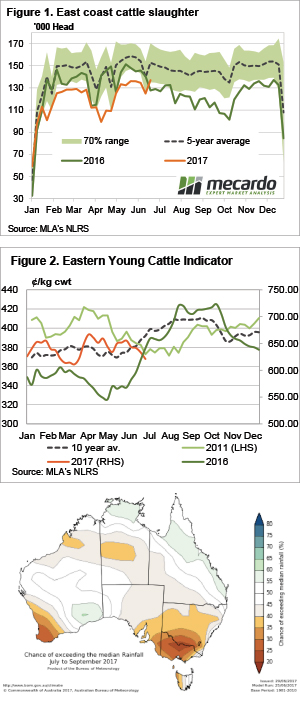

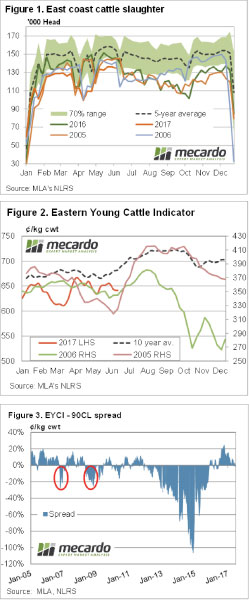

Here’s a quiz question. When was the last time the Eastern Young Cattle Indicator (EYCI) finished June lower than it started? You’ll have to read the article to find out….

Here’s a quiz question. When was the last time the Eastern Young Cattle Indicator (EYCI) finished June lower than it started? You’ll have to read the article to find out….

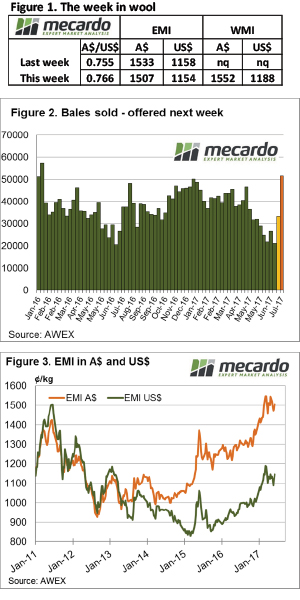

The fragility of the wool market was evident this week in what was the final sale for the financial year where increased supply (Fremantle back selling again) and a rising A$ pushed all types lower however, the strong Crossbred types showed some resilience. The EMI shed some weight nearing 1500¢, down 26¢ to 1507¢ and also falling a more modest 4US¢ to 1154US¢.

The fragility of the wool market was evident this week in what was the final sale for the financial year where increased supply (Fremantle back selling again) and a rising A$ pushed all types lower however, the strong Crossbred types showed some resilience. The EMI shed some weight nearing 1500¢, down 26¢ to 1507¢ and also falling a more modest 4US¢ to 1154US¢.  There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

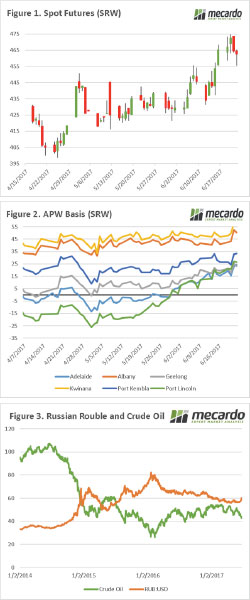

There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

A good recovery staged by Queensland across the board, while NSW disappoints… no I’m not talking about the State of Origin – although the phrase fits there too! Actually, it’s the cattle market this week. Despite the national market indicators posting largely flat results, with weekly moves of less than 2% either way some state based indicators saw more substantial action.

A good recovery staged by Queensland across the board, while NSW disappoints… no I’m not talking about the State of Origin – although the phrase fits there too! Actually, it’s the cattle market this week. Despite the national market indicators posting largely flat results, with weekly moves of less than 2% either way some state based indicators saw more substantial action.  Whether or not you believe the Bureau of Meteorology (BOM) three month forecast, there is always the chance the current dry spell could continue. Dry winter’s and springs are not great for cattle prices, but given the current historically strong values, how bad could it get?

Whether or not you believe the Bureau of Meteorology (BOM) three month forecast, there is always the chance the current dry spell could continue. Dry winter’s and springs are not great for cattle prices, but given the current historically strong values, how bad could it get?

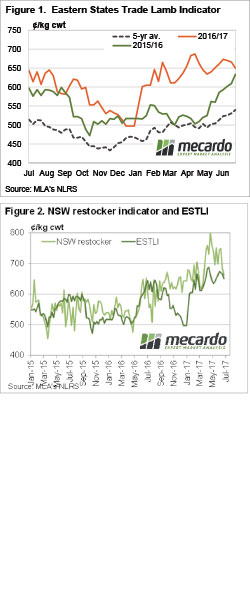

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market.

This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market. It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices.

It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices.