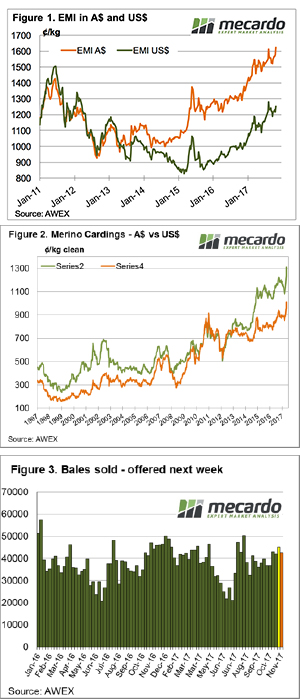

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced.

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced.

It was a steadier week with the Eastern Market Indicator (EMI) finished the week at 1,683¢, gaining 2 cents and AWEX reporting this another new record high in Australian dollar terms. The Australian dollar was slightly lower over the week, with the EMI in US$ terms losing 13¢ to end the week at 1,279¢.

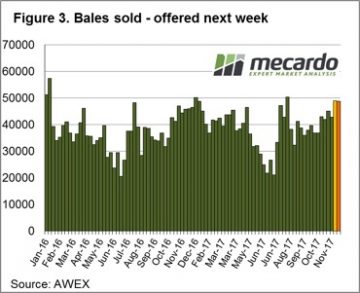

Again, a small pass-in rate this week of only 3.2% of the offered bales, resulting in 49,009 bales cleared to the trade. This is one of the largest weekly sale volumes for this selling season, with only the first week after the winter recess larger. Fig 3.

Some of the recent “heat” dissipated from the market this week with reports of “mixed results” where quality again was a factor; or more accurately lower quality wool at times struggled. This has been a pattern for the year however in recent weeks when the market rallied lower grades were supported.

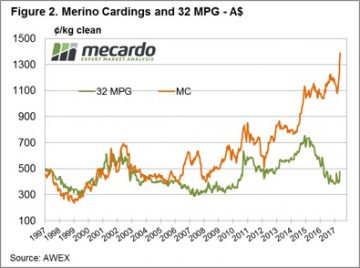

Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week.

Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week.

We have commented previously that the current market conditions are unique in our time of observation. Supply is moving through the system quickly; that is there are little stocks held either on farm, in broker stores or in mills. Sheep farmers are experiencing record income inflows; with not only wool prices good but so too are sheep and lamb prices. This will mean that any retracement in price in the future will be met with “cashed up” wool producers holding back wool from the market and reducing supply to processors.

As we said, these are unique times where it could be argued that the producer is able to influence the market by withholding supply. The qualifier is that any supply “squeeze” may have short term market influence but it is unlikely to be a long term positive factor on price. In the end, customers will adjust orders to meet supply and pay a price that works for their customers at retail level.

The question of “when or if” the market reaches a top is coming to mind now, we know markets don’t rally forever and that they don’t track sideways for long either. Mecardo had a look this week in the article What is the risk in the wool market at present

The week ahead

The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

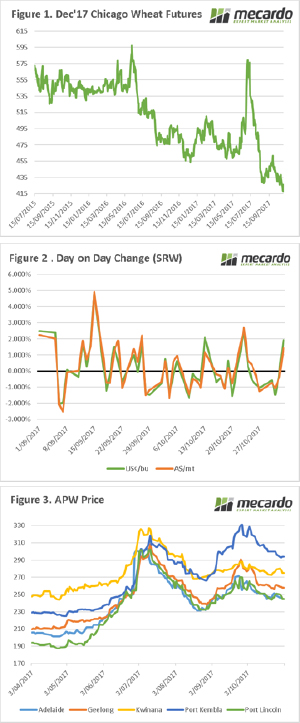

The US Department of Agriculture released their World Agricultural Supply and Demand Estimates overnight. In this week’s comment, we will take a look at the impact on wheat, and report on new import barriers being erected in India.

The US Department of Agriculture released their World Agricultural Supply and Demand Estimates overnight. In this week’s comment, we will take a look at the impact on wheat, and report on new import barriers being erected in India.

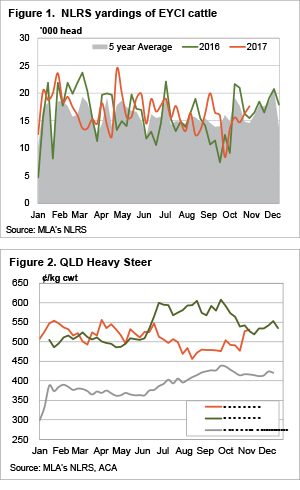

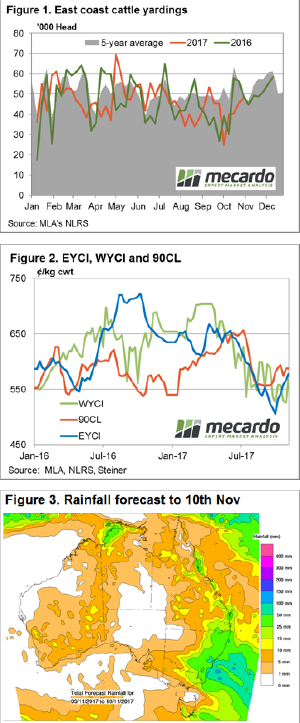

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

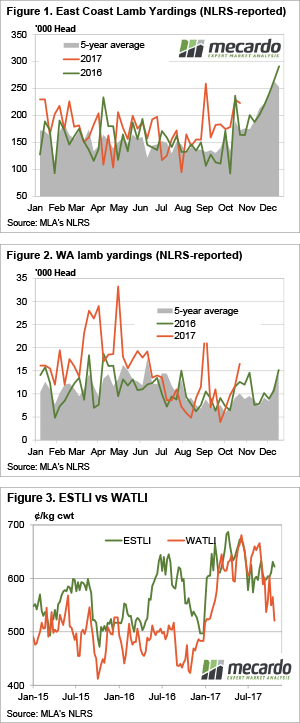

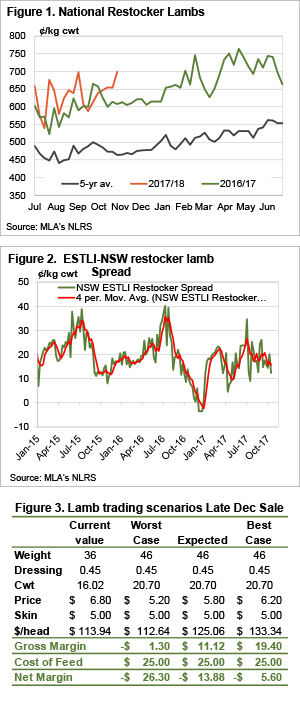

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.  It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

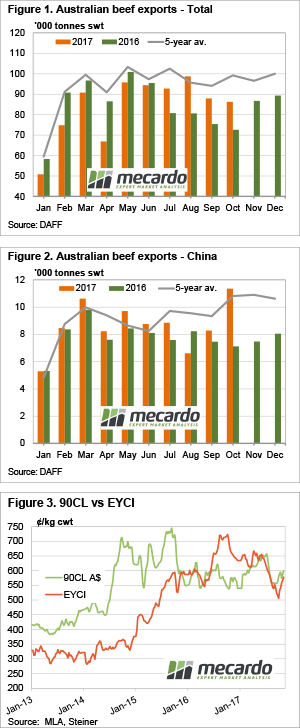

It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.

What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.

Australian is on the cusp of being full blown harvest, with all states (ex Tasmania) showing some activity. In the coming weeks, harvest proper will be upon us, and we will start to see how accurate the crop forecasts have been.

Australian is on the cusp of being full blown harvest, with all states (ex Tasmania) showing some activity. In the coming weeks, harvest proper will be upon us, and we will start to see how accurate the crop forecasts have been.

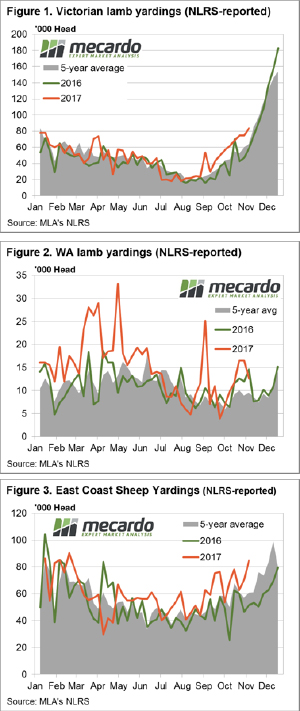

Sheep and lamb yardings had another strong week, with Victorian lambs starting to run. Yet prices continued their solid reluctance to fall, maintaining levels well above last year in the east. Things are easing in the west, but also remain better than last year.

Sheep and lamb yardings had another strong week, with Victorian lambs starting to run. Yet prices continued their solid reluctance to fall, maintaining levels well above last year in the east. Things are easing in the west, but also remain better than last year.

Trade Lamb prices are continuing to defy gravity, and carrying other categories along with them. Store lamb prices are at record highs for October, and some forward contracts have just been released. The equation is pretty simple for January, when prices can be locked in, with profits likely to be smaller for lambs sold in December.

Trade Lamb prices are continuing to defy gravity, and carrying other categories along with them. Store lamb prices are at record highs for October, and some forward contracts have just been released. The equation is pretty simple for January, when prices can be locked in, with profits likely to be smaller for lambs sold in December. Most of the eastern states received rainfall this week and despite higher throughput young cattle prices continued to climb, with the benchmark Eastern Young Cattle Indicator (EYCI) closing up 1.8% to see it at 577.50¢/kg cwt this week.

Most of the eastern states received rainfall this week and despite higher throughput young cattle prices continued to climb, with the benchmark Eastern Young Cattle Indicator (EYCI) closing up 1.8% to see it at 577.50¢/kg cwt this week.