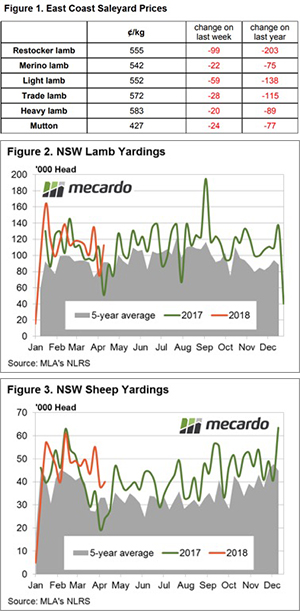

Lamb markets had their usual reaction when prices fall heavily, supply contracted as producers looked for alternatives to selling. Not all prices steadied though, with restocker lambs taking a hit and now looking very cheap.

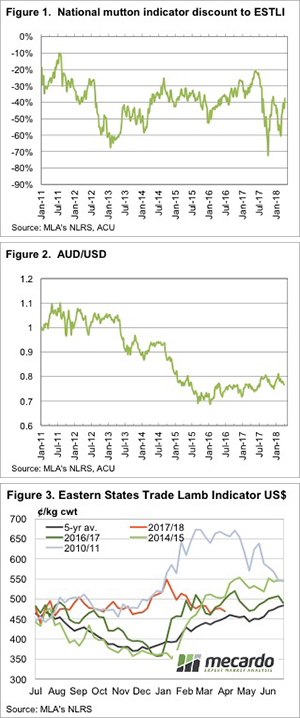

Finished lamb supply tightened, but it seems unfinished lambs kept coming. Figure 1 shows the National Restocker Indicator took a heavy hit this week, moving to a low not seen since August 2016. The difference in seasons this year and last is stark. Restocker lamb prices being 200¢ lower this year is a pretty good reflection of the lack of feed available for lambs.

Figure 2 shows NSW restocker lambs at a 60¢ discount to the Eastern States Trade Lamb Indicator (ESTLI). Even if we expected the ESTLI to stay around the 580¢ mark, we’d say restocker lambs were cheap. At 520¢ a 16kg lamb will cost $85-90. If the ESTLI gets back to 650¢/kg cwt, which it should when it rains, a 20kg lamb will make $135-140 per head. It’s a good margin.

Mutton hasn’t been so caught up in the lamb price fall. Figure 3 shows the National Mutton Indicator has lost 23¢ in the last few weeks, and is 80¢ below the same time last year.

In the West, mutton is around the same price, but WA has the most expensive lambs in the country. The Western Trade Lamb Indicator is at 614¢/kg cwt, down 18¢ on last year but still priced pretty well. There is not a lot of rain forecast for WA, so prices may start to track down towards east coast values.

The week ahead

There is not much rain forecast for anywhere over the next eight days, so it’s hard to see much upside for sheep or lamb prices in general. Don’t be surprised to see restocker prices bounce though, as figure 2 shows, they don’t stay this cheap relative to finished lambs for long.

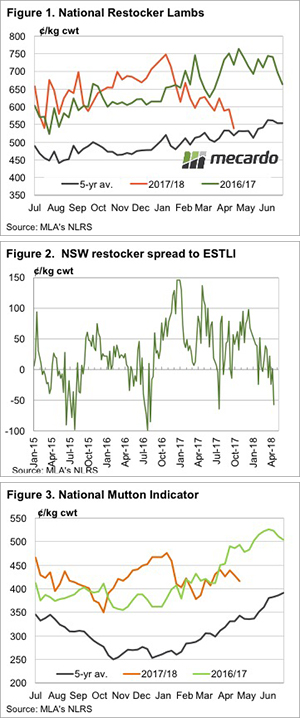

At a time when the live sheep export trade is making headlines for all the wrong reasons the big brother of the industry is quietly getting on with the job. Live cattle exports make up the lion’s share of the total trade out of Australia, with the combined beef and dairy trade representing 1.5 billion of the 1.8 billion annual farm gate returns. This piece takes a quick look at how the key markets are faring so far this season.

At a time when the live sheep export trade is making headlines for all the wrong reasons the big brother of the industry is quietly getting on with the job. Live cattle exports make up the lion’s share of the total trade out of Australia, with the combined beef and dairy trade representing 1.5 billion of the 1.8 billion annual farm gate returns. This piece takes a quick look at how the key markets are faring so far this season.

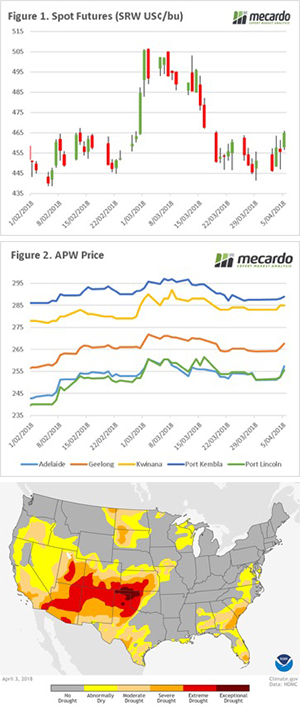

as a result of bearish data in the WASDE (more on that later), and the increasingly tense stand off between US & Syria/Russia. However, prices remain 3% higher than the close last Thursday, and 8% up on the start of the month (figure 1). So in this case we are definitely lucky, to have much higher prices than the start of the month.

as a result of bearish data in the WASDE (more on that later), and the increasingly tense stand off between US & Syria/Russia. However, prices remain 3% higher than the close last Thursday, and 8% up on the start of the month (figure 1). So in this case we are definitely lucky, to have much higher prices than the start of the month.

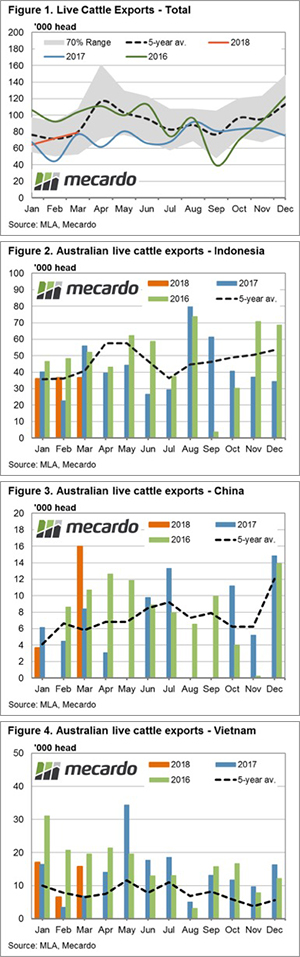

ink. Falls were recorded, ranging in magnitude from 3.5% to 17%, with Restocker Lamb taking the biggest hit, off a dollar on the week and 26.7% softer than this time last season. The Eastern States Trade Lamb Indicator (ESTLI) is mirroring the broader market decline with a 4.6% fall to close at 572¢/kg cwt.

ink. Falls were recorded, ranging in magnitude from 3.5% to 17%, with Restocker Lamb taking the biggest hit, off a dollar on the week and 26.7% softer than this time last season. The Eastern States Trade Lamb Indicator (ESTLI) is mirroring the broader market decline with a 4.6% fall to close at 572¢/kg cwt.

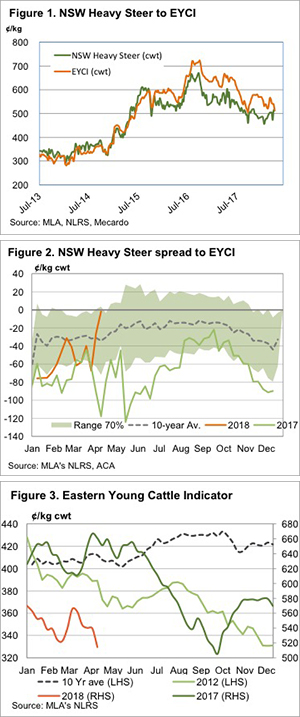

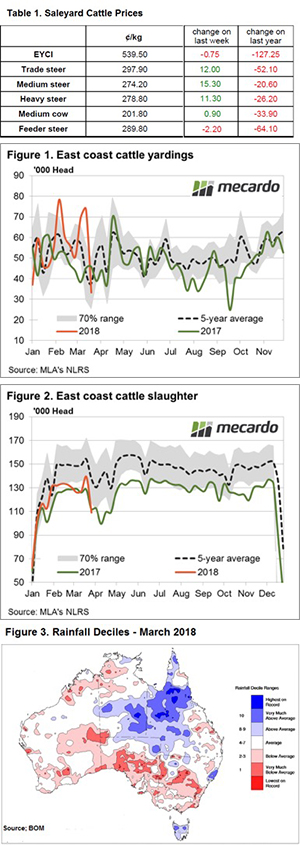

has been no real rain in April, in addition to the usual increase in young cattle supply in Northern NSW, is helping drive the EYCI lower.

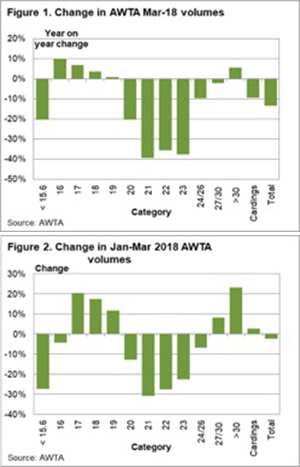

has been no real rain in April, in addition to the usual increase in young cattle supply in Northern NSW, is helping drive the EYCI lower. and less on the left through to greater than 30 micron, then cardings and finally total volume on the right. The 20 through 23 micron categories, effectively the merino production on the broad side of the average fibre diameter of 19 micron, stand out as having the largest fall in March. 21 to 23 micron volumes are down by 35-40%, which is a large fall, complicated by the continued high level of vegetable fault in eastern Australia.

and less on the left through to greater than 30 micron, then cardings and finally total volume on the right. The 20 through 23 micron categories, effectively the merino production on the broad side of the average fibre diameter of 19 micron, stand out as having the largest fall in March. 21 to 23 micron volumes are down by 35-40%, which is a large fall, complicated by the continued high level of vegetable fault in eastern Australia.

¢ to close at 289.8¢/kg lwt.

¢ to close at 289.8¢/kg lwt.