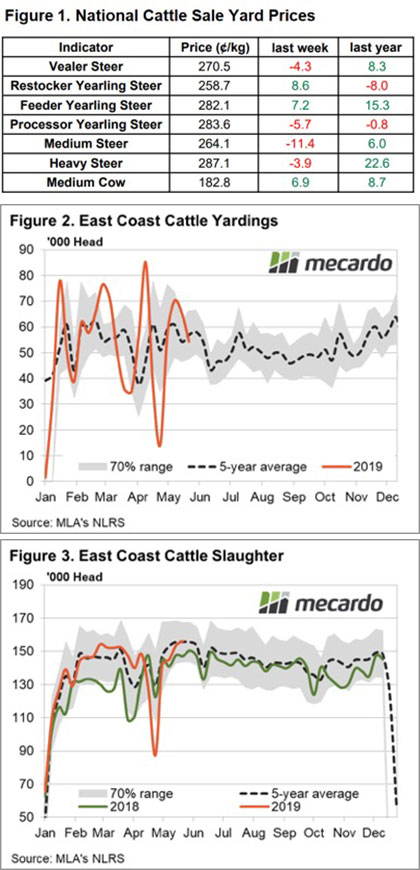

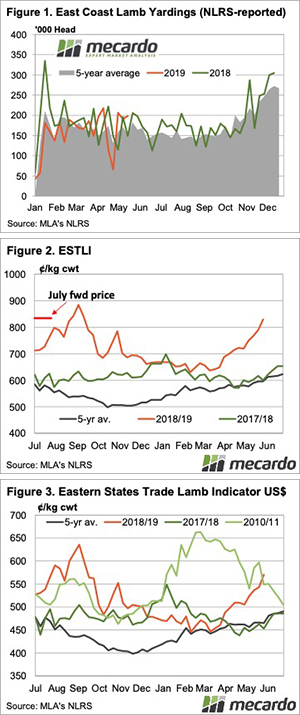

The rally in lamb prices is yet to slow, as you will have no doubt heard. The Eastern States Trade Lamb Indicator (ESTLI) hit a new record yesterday and it has come at least a month earlier than expected.

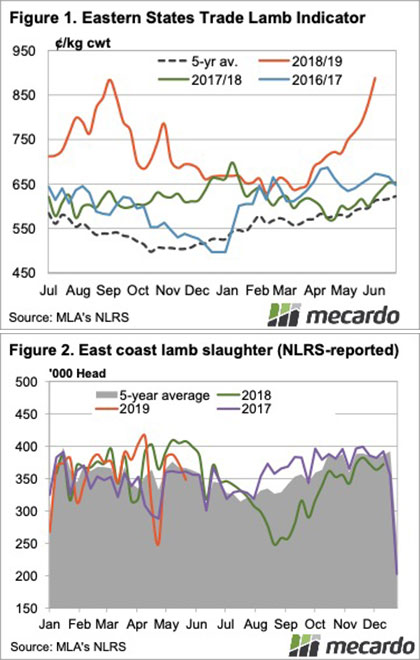

There are a lot of talking points this week, but the ESTLI breaking into new territory is a good place to start. With a 57¢ rally this week the ESTLI finished yesterday at 888¢/kg cwt. The previous record set last year was 884¢ on the 31st of August.

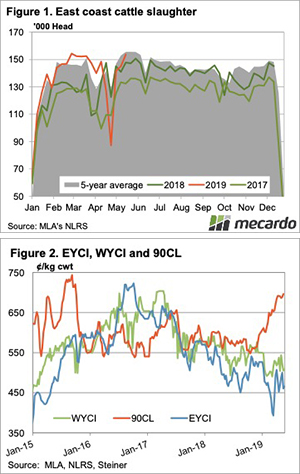

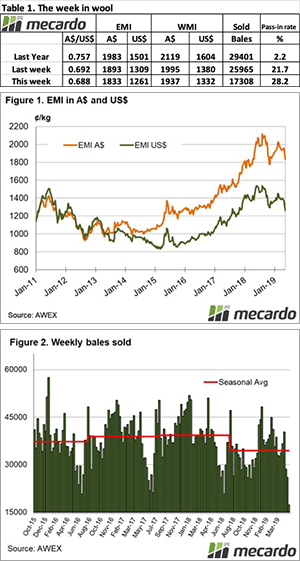

We talk about supply and demand, and all the pointers are that demand is much stronger. Figure 2 shows east coast lamb slaughter last week tipped just below the 2017 level. Prices back then were strong for the time, at 650¢/kg cwt (Figure 1). With slaughter at the same levels last week, the price was 830¢. The same supply with prices 27% higher suggests much stronger demand.

Even when supply was at similar levels last year in early July, the ESTLI was only at 720¢. It seems likely that lamb supply will hit the doldrums seen last August, but it’s yet to be seen if prices can rise further.

Mutton also continued its record run, with the east coast indicator pulling up just 1¢ shy of 600¢/kg cwt. There were sheep quoted at over 700¢ at Wagga yesterday.

It was unusual to see SA with the most expensive lambs this week, trade lambs were just over 900¢. By contrast, WA lambs are making 755¢. A 22kg lamb is $22 cheaper in the west, which is enough to see lambs cross the Nullabor.

What does it mean?:

The most common questions are ‘how high will it go?’ and ‘how long will it last?’ We know sheep and lamb supply isn’t going to improve until August at the earliest. New Zealand supply won’t improve until the end of the year, and goat prices are over $10.

Much depends on how much lamb importers will pay for lamb and mutton, as processors will keep killing as long as the losses don’t outweigh the cost of shutting down.