Key Points

- There are 5.1 million dogs in Australia. One for every 4.9 people.

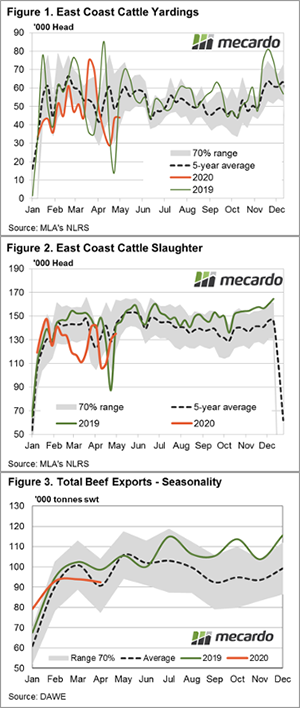

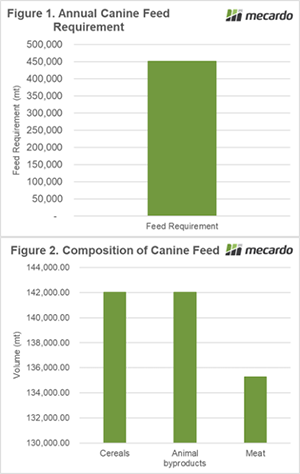

- The theoretical dog food demand is 451kmt.

- This comprises 135kmt meat, 142kmt cereals and 142kmt animal byproducts.

I was pawndering the value our canine friends had on the grain market. So now is a good oppawtunity to do some ruff calculations on the impact of dogs, and put a new leash of life on supply and demand. Let’s get into the ultimutt review of man’s best friends dinner.

Animal Medicines Australia is the peak body representing the leading animal health companies in Australia. They produced a national survey of pets in Australia (2019) which highlighted that there were a whopping 5,104,700 dogs in the country. That represents 1 hound for every 4.9 humans.

There are many different breeds ranging in size from the diminutive chihuahua to the gargantuan great dane. Therefore, its necessary to work what is the average size of an Australian dog. This is where the Australian National Kennel Council helped. They produce an annual report on the number of animal registrations for their membership on a per breed basis, which represents 67,900 dogs.

The Australian National Kennel Council is the administrative body for pure breed canines in Australia. It would be logical that their registrations would be representative of the overall population.

However, this dataset does not include the weights of each breed. So to provide a robust analysis for our readers I spent my night finding the average weight for each of the 220 breeds of dog listed. I was then able to produce a weighted average of dogs to determine what is the average dog weight. Through an analysis of the 2010-2018 year average, the weight is 22kg per dog.

The feed requirements for dogs are based on a conversion of grams of food per kg of bodyweight. There are numerous levels quoted by different manufacturers, however I have opted to go with 11g per kg of bodyweight.

On our average dog size of 22kg, this amounts to 242g of food per day. Across our average population of dogs this is a whopping 1235mt of food fed to dogs every day or 451,000mt per year (figure 1).

A highly esteemed pet food expert informed me that pet food sold in Australia is roughly on a 70% dry to 30% wet (canned meat) basis. Additionally, the composition of dried products is approx. 45% cereals and 45% animal by products.

We can then refine this further into three main dog food elements:

- 135,300mt of meat in the form of canned products

- 142,000mt of meat byproducts

- 142,000mt of cereals*

It must be noted that this is a theoretical feed demand for dogs in Australia. There are a few caveats to this analysis:

- Not all dogs eat store bought food. This analysis does not consider the feeding of food scraps etc.

- Although the local demand is theoretically >450kmt, there are volumes of pet food imported into Australia.

*Cereal incorporates wheat, sorghum, corn, rice, barley and byproducts (soymeal etc).

What does it mean/next week?:

Pet food is an oft-forgotten industry in Australia. However, this analysis shows that they are an important part of a diversified agricultural supply chain.

As we potentially move into a future with more home-based working, we could see an increase in the dog population as workers look for company at home.

If we want to decrease our reliance on agricultural exports, we should consider supporting great dane breeders. As a move to a 100% great dane population would increase demand to approx. 1.5mmt per year.