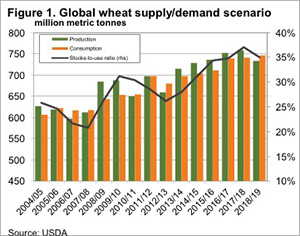

‘A big crop gets bigger and a small crop gets smaller’. This seems to be an apt statement to apply to this year’s Australian production. Continued concerns in the east coast & now in WA have led to more positive price action in the past week.

‘A big crop gets bigger and a small crop gets smaller’. This seems to be an apt statement to apply to this year’s Australian production. Continued concerns in the east coast & now in WA have led to more positive price action in the past week.

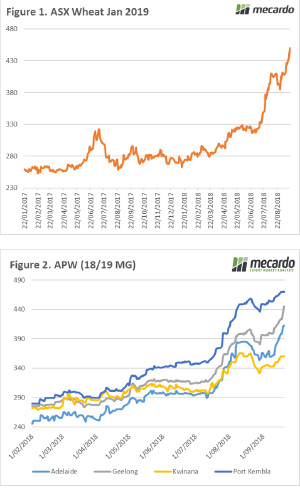

The ASX wheat contract in the past has been quite illiquid, recent months has seen reasonable volumes move into the contract. The lack of grower forward selling due to drought (& frost) concerns. The contract is deliverable; therefore it provides an opportunity for consumers to have cover to meet requirements.

After a rapid rise through July and mid-August to $400-410, the market fell to $385. This dip was short lived, and in September continued dryness and frost in both sides of the continent have led to impressive gains. In the past week the price has risen $25/mt or 6% (figure 1).

At a physical pricing level the new crop multi-grade APW contract has seen a corresponding rise, however selling has been at low. Interestingly the market in Port Kembla, has seen a more sluggish (figure 2) rise than other east coast areas (Adelaide & Geelong).

What does it mean/next week?:

At present there are a high number of growers cutting grain and canola for hay. This leaves an interesting conundrum – will this increase in hay due to drought and frost lead to a downturn in hay prices?

One thing is for sure though, it’s time to strap on our helmets as its going to be a bumpy ride.

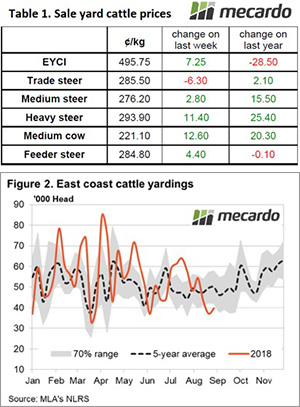

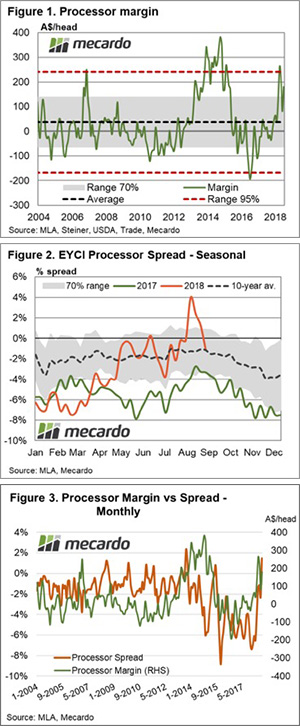

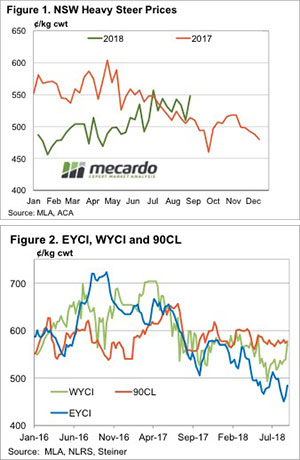

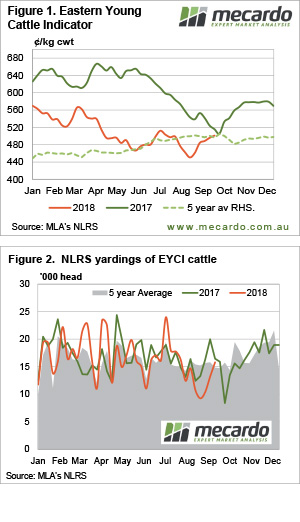

Cattle markets managed to edge higher this week, despite stronger supply. The Eastern Young Cattle Indicator (EYCI) moved back above 500¢ and within a tick of the price this time last year. It’s the spreads in restocker values we are interested in this week though.

Cattle markets managed to edge higher this week, despite stronger supply. The Eastern Young Cattle Indicator (EYCI) moved back above 500¢ and within a tick of the price this time last year. It’s the spreads in restocker values we are interested in this week though.

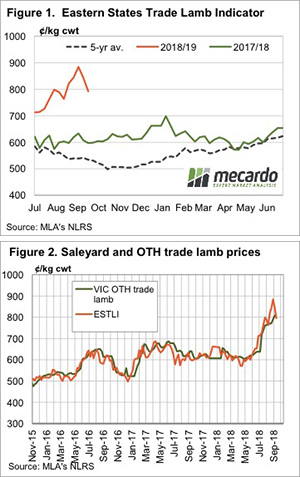

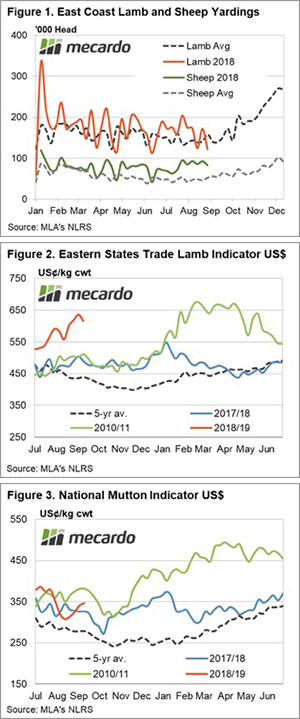

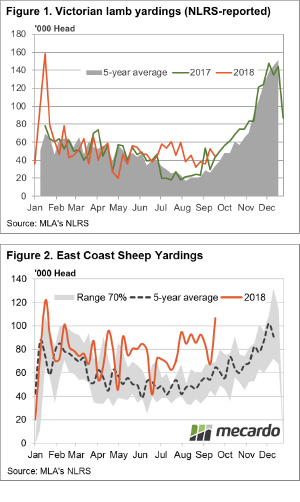

Coles and Woolies are already sprucing new spring lambs on their shelves, and we can see where they’re coming from with rising yarding levels in the south telling us the spring flush is making its move. This has already begun to take its effect on prices, with another week of declines for most lamb categories.

Coles and Woolies are already sprucing new spring lambs on their shelves, and we can see where they’re coming from with rising yarding levels in the south telling us the spring flush is making its move. This has already begun to take its effect on prices, with another week of declines for most lamb categories.