Cattle markets have opened 2017 with a bit of a bang,

with extraordinary restocker demand, and very good

feeder demand driving prices higher. Cattle supply in

saleyards has been similar to last year, so it would

seem demand is the driver.

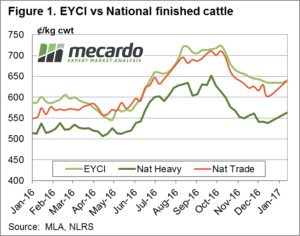

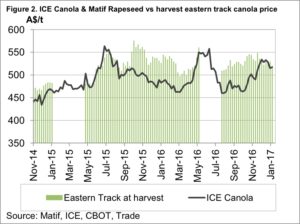

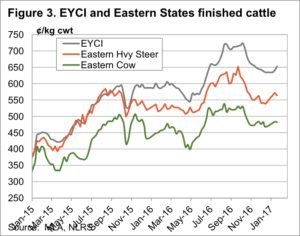

The Eastern Young Cattle Indicator (EYCI) has

rallied back above 650¢/kg cwt this week, hitting a

six week high (figure 1). With the dearth of quotes for

the cattle market last week, it’s hard to pinpoint who

is driving the stronger prices. However, with the east

coast trade steer sitting at 632¢, and feeder cattle

around 10¢ higher, it would seem restockers are

dragging the EYCI higher.

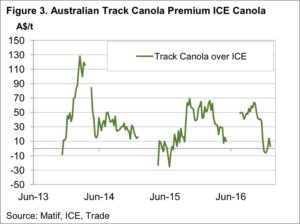

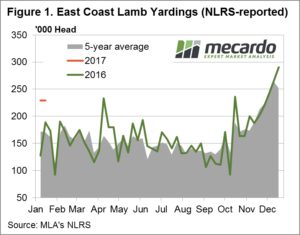

East Coast cattle yardings rallied higher this week,

which is not unusual as normal sales resume. Usually

the pent up supply from the break sees prices move

sideways in January, but it appears it is pent up

demand pushing prices higher.

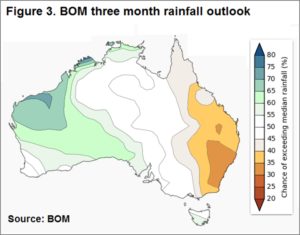

Some recent rain in Queensland has no doubt helped

push demand in the north, but large parts of

southern Queensland and NSW are still 25-100mm

below the January average.

After opening up much stronger, heavy steers eased

marginally this week (figure 3) as the strong price

drew out supply, while cows were also a little lower.

Despite the wide spread between finished and store

cattle prices, the numbers seem to still be working for

those purchasing expensive young cattle.

The Week Ahead

There has been a few positives for the cattle market of late,

and this has resulted in higher prices early this year.

Add to this the widespread rain which is forecast

for the next week and we could see a little more

upside for prices in the short term.

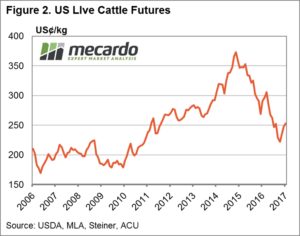

However, unless we see a strong rally in export values,

it’s hard to see cattle getting back to the levels of last

spring, with 5% upside probably the limit.

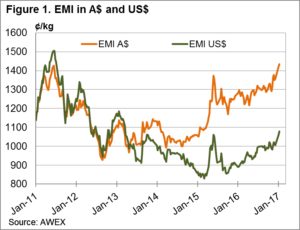

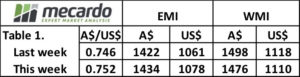

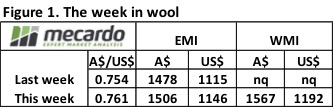

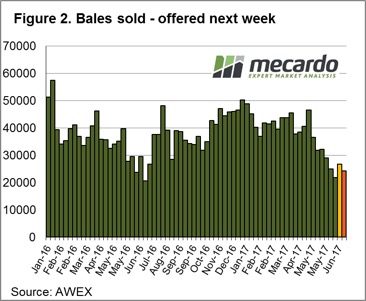

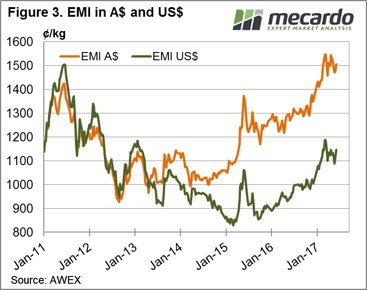

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

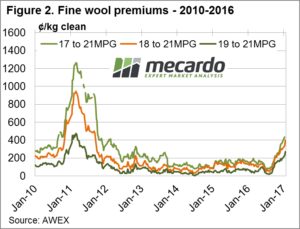

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢. Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

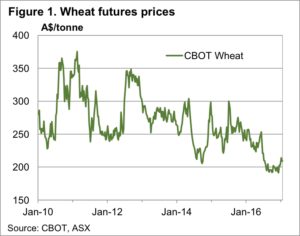

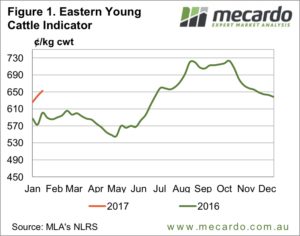

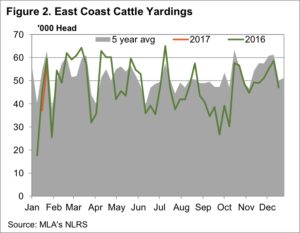

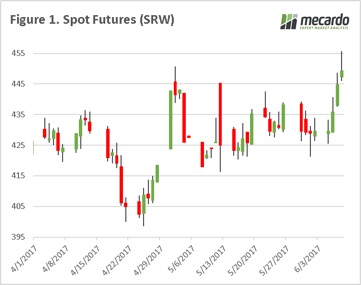

A great week for farmers on the grain markets. The speculators whom many like to chastise for being involved in the grain markets, in combination with worsening weather, have helped put a little fire under the wheat market.

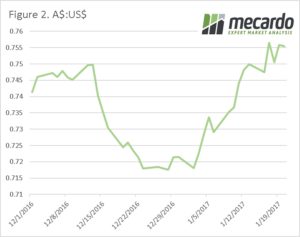

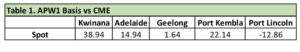

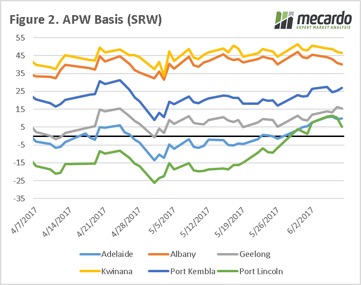

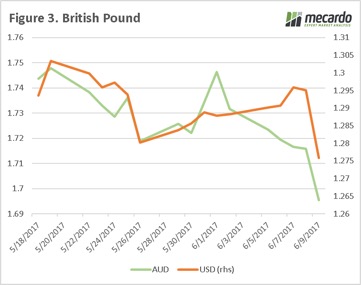

A great week for farmers on the grain markets. The speculators whom many like to chastise for being involved in the grain markets, in combination with worsening weather, have helped put a little fire under the wheat market. East coast basis levels have conserved their gains from last week, and continue to be in positive territory across all zones which we regularly monitor (figure 2). Although basis and futures have both risen, unfortunately for growers the A$ has also risen to 75.2¢ which has reduced some of the benefits but still overall positive for pricing.

East coast basis levels have conserved their gains from last week, and continue to be in positive territory across all zones which we regularly monitor (figure 2). Although basis and futures have both risen, unfortunately for growers the A$ has also risen to 75.2¢ which has reduced some of the benefits but still overall positive for pricing. The USDA will release the June WASDE overnight. Will there be any surprises in this month’s report? We have seen issues in Europe, and it wouldn’t be a surprise to see some production downgrades.

The USDA will release the June WASDE overnight. Will there be any surprises in this month’s report? We have seen issues in Europe, and it wouldn’t be a surprise to see some production downgrades.

At a local level, we continue to see basis come under pressure. In figure 2, we can see that Geelong has now joined Port Lincoln in the negative basis club, with likely Adelaide to follow soon. The weight of harvest could likely keep basis levels depressed for sometime.

At a local level, we continue to see basis come under pressure. In figure 2, we can see that Geelong has now joined Port Lincoln in the negative basis club, with likely Adelaide to follow soon. The weight of harvest could likely keep basis levels depressed for sometime.