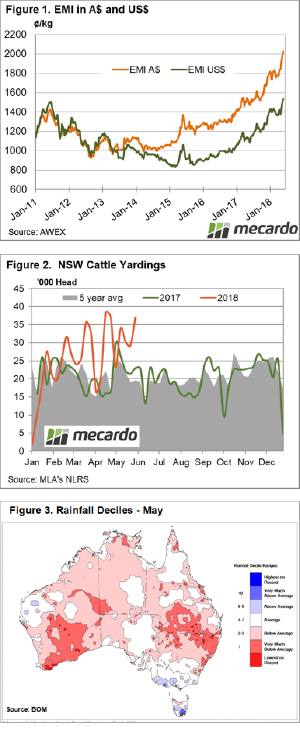

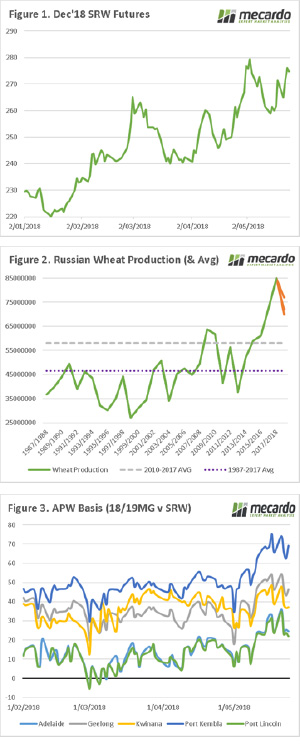

The Eastern Young Cattle Indicator (EYCI) continues to trek lower as cattle yardings reach a five-week peak, underpinned by high NSW cattle throughput. The EYCI closed this week 1.1% lower at 466.5¢/kg cwt, while its Western counterpart shed 3.2%. Despite the bigger fall in WA young cattle prices, producers there are still enjoying an 11% premium over their East coast neighbours, with the Western Young Cattle Indicator (WYCI) closing the week at 523.75¢/kg cwt.

The Eastern Young Cattle Indicator (EYCI) continues to trek lower as cattle yardings reach a five-week peak, underpinned by high NSW cattle throughput. The EYCI closed this week 1.1% lower at 466.5¢/kg cwt, while its Western counterpart shed 3.2%. Despite the bigger fall in WA young cattle prices, producers there are still enjoying an 11% premium over their East coast neighbours, with the Western Young Cattle Indicator (WYCI) closing the week at 523.75¢/kg cwt.

East coast cattle prices were posting slightly mixed signals at the close of the week with Trade and Heavy Steers gaining 1-2% while the Medium Steer, Medium Cow and Feeder Steer Indicators softened between 1.5% to 4%.

Across the east coast states, cattle prices reflected either the presence or lack of rainfall during the week. In Queensland most cattle categories were flat on the week, except for Trade and Heavy Steers, acting as market book-ends. QLD Trade Steers are finding it tough with a 5.1% drop to 256¢/kg lwt, while QLD Heavy Steers posted a 2% gain to 261¢/kg lwt. NSW cattle categories are mostly 1-2% softer, with NSW Trade and NSW Restocker steers bucking the trend to see them gain 1.5%. In Victoria, gains were noted between 1-4% for all categories of steer, but Vic Medium Cow was the only disappointment to producers – off 4% to 169¢/kg lwt.

The dry conditions prevalent in NSW and Southern Queensland pushed additional cattle to market this week and is underpinning the 23% lift in east coast cattle throughput to nearly 72,000 head – figure 1. NSW sale yard yarding levels are remaining the key driver of the higher east coast throughput with a 27% surge in numbers this week to sit just shy of 37,000 head (Figure 2).

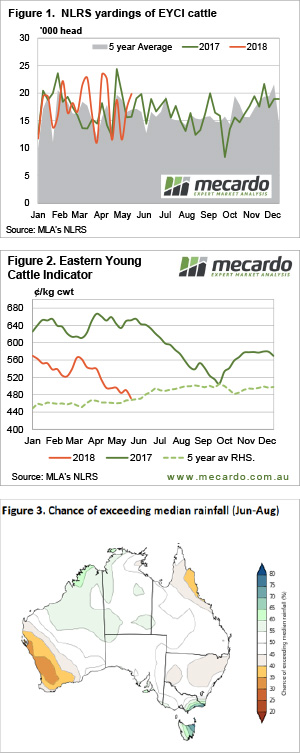

The rainfall deciles map for May highlights the plight of cattle producers across much of the country in the past month. Victorian and Tasmanian regions were the only parts of the country to see reasonable areas of average to above average falls, and hardly any below average areas present (Figure 3.) This was a stark contrast to the rest of the nation – and perhaps a mostly red continent embarrassed by a lack Autumn rain.

What does it mean/next week?

The three-month rainfall outlook released by the Bureau of Meteorology yesterday doesn’t paint a great picture for NSW, SA, Northern Victoria and Southern Queensland. Much of the South-East corner of the nation is set for a dry Winter so don’t hang your hopes on a recovery in cattle prices in the near term.

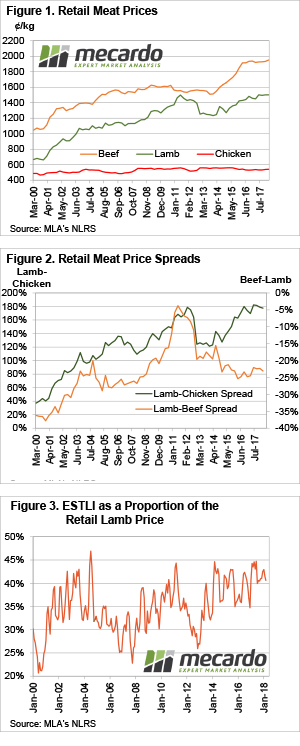

Since hitting a peak back at the start of the year, lamb prices have eased and found somewhat of a base around the 600¢/kg cwt mark. We know that strong demand has been driven by export markets, but there appears to be a limit to how much the local consumer is prepared to pay for their lamb.

Since hitting a peak back at the start of the year, lamb prices have eased and found somewhat of a base around the 600¢/kg cwt mark. We know that strong demand has been driven by export markets, but there appears to be a limit to how much the local consumer is prepared to pay for their lamb.

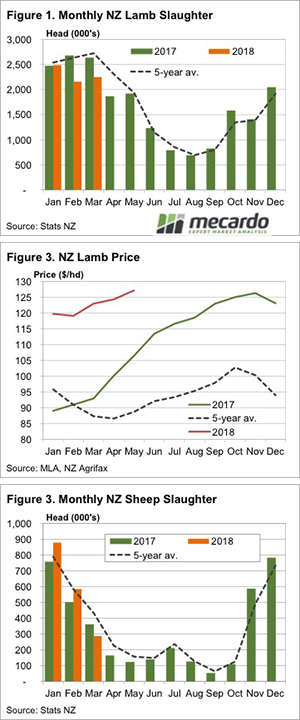

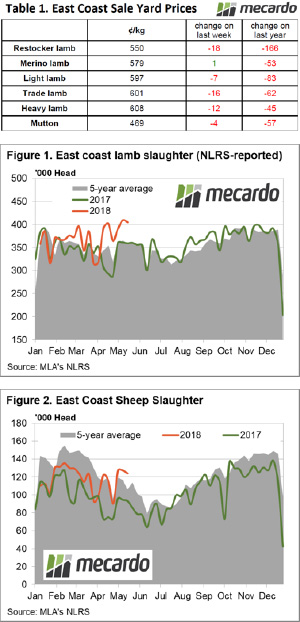

After the TFI fire in January, you’d have been thought crazy if you said that weekly east coast lamb slaughter would spend most of May above 400,000 head. Even crazier if you said sheep slaughter would be 30,000 head higher than last year, yet here we are.

After the TFI fire in January, you’d have been thought crazy if you said that weekly east coast lamb slaughter would spend most of May above 400,000 head. Even crazier if you said sheep slaughter would be 30,000 head higher than last year, yet here we are.

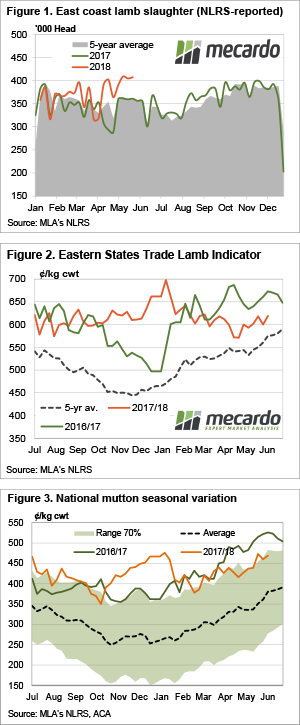

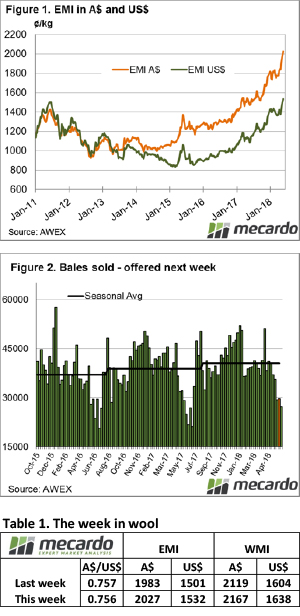

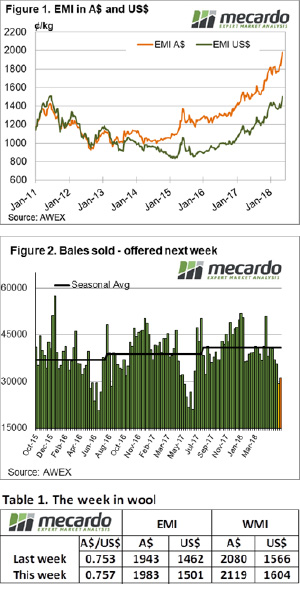

Who would have thought that 2,000 cents were possible for the EMI, or that only the 25 MPG and broader would sit below the 2000 cent level?

Who would have thought that 2,000 cents were possible for the EMI, or that only the 25 MPG and broader would sit below the 2000 cent level?

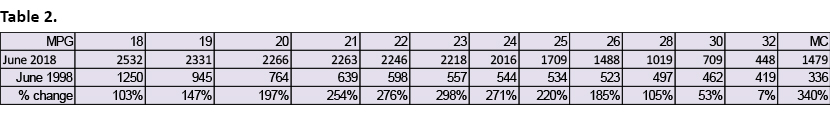

In recent years our comrades in Russia have been the most important driver of the wheat market. Their technology and logistics have improved to ensure that they are efficiently (& cheaply) producing a huge exportable surplus. When there is a hiccup in this region, the impact is felt around the world. In this comment, we look at the past weeks performance, and specifically what is happening in Russia.

In recent years our comrades in Russia have been the most important driver of the wheat market. Their technology and logistics have improved to ensure that they are efficiently (& cheaply) producing a huge exportable surplus. When there is a hiccup in this region, the impact is felt around the world. In this comment, we look at the past weeks performance, and specifically what is happening in Russia.

After a brief respite in the downward trend, young cattle prices continued their drift lower this week. With grain prices on the up, hay in short supply and more depressing forecasts it is no surprise that sellers are taking advantage of what are relatively strong prices.

After a brief respite in the downward trend, young cattle prices continued their drift lower this week. With grain prices on the up, hay in short supply and more depressing forecasts it is no surprise that sellers are taking advantage of what are relatively strong prices.

In the commentary last week, we noted that demand for lamb and sheep was keeping sale yard prices supported. Alas, it seems that supply has got the upper hand this week with East coast prices broadly softer. The Eastern States Trade Lamb Indicator (ESTLI) off 2.5% to 601¢/kg cwt and East Coast Mutton shaved off 1% to close at 469¢/kg cwt.

In the commentary last week, we noted that demand for lamb and sheep was keeping sale yard prices supported. Alas, it seems that supply has got the upper hand this week with East coast prices broadly softer. The Eastern States Trade Lamb Indicator (ESTLI) off 2.5% to 601¢/kg cwt and East Coast Mutton shaved off 1% to close at 469¢/kg cwt.

Winter officially arrives next week, and with it, we expect lamb slaughter to decline from recent record highs. Traditionally lamb supply throughout the winter is sustained by the last of the old season lambs, and the arrival of new season spring lambs out of NSW in the second half of July. With the dry continuing, we ask whether these lambs will finished on time, and whether they’ll be there at all.

Winter officially arrives next week, and with it, we expect lamb slaughter to decline from recent record highs. Traditionally lamb supply throughout the winter is sustained by the last of the old season lambs, and the arrival of new season spring lambs out of NSW in the second half of July. With the dry continuing, we ask whether these lambs will finished on time, and whether they’ll be there at all. Another week, another record. The wool market was again lit up with green across the board. But where one wins, one must loose. We’re seeing the effects of what has been a remarkably strong season play out on supply, and this means buyers are having to fight it out.

Another week, another record. The wool market was again lit up with green across the board. But where one wins, one must loose. We’re seeing the effects of what has been a remarkably strong season play out on supply, and this means buyers are having to fight it out.