Key points:

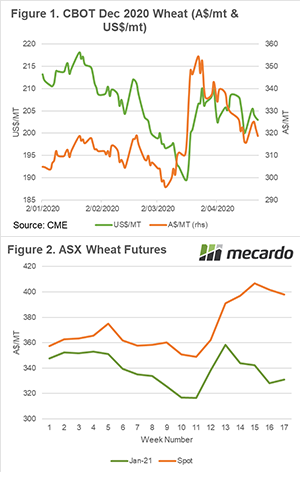

- The monthly flow of Australian live cattle exports for the first quarter of 2020 are running 28% above the average seasonal trend.

- Flows to Indonesia during March dropped to nearly 10% below their normal seasonal levels, according to the five-year average trend.

- Exports to Vietnam during the January to March period have averaged 189% ahead of the five-year trend, lifting market share of export volumes to Vietnam markedly in 2020.

Live cattle export flows have been strong for the first quarter of 2020, despite Covid-19 disruptions. Although there has been a noticeable shift in market share with Indonesia giving up ground while Vietnamese demand expands.

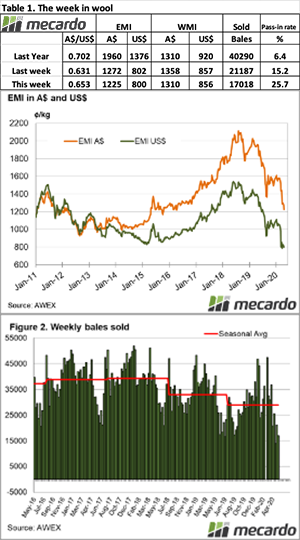

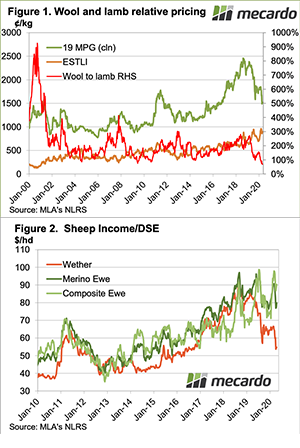

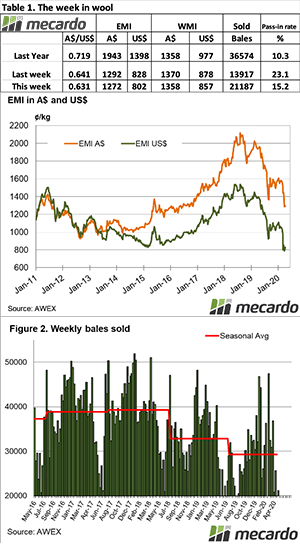

Figure 1 highlights the total flow of live export cattle for the start of the 2020 season compared to last season and the five-year trend. Average monthly flows for the first quarter of the year are running 28% above the seasonal trend with volumes near the upper end of what is considered “normal” for this time in the year (as outlined by the grey shaded 70% range).

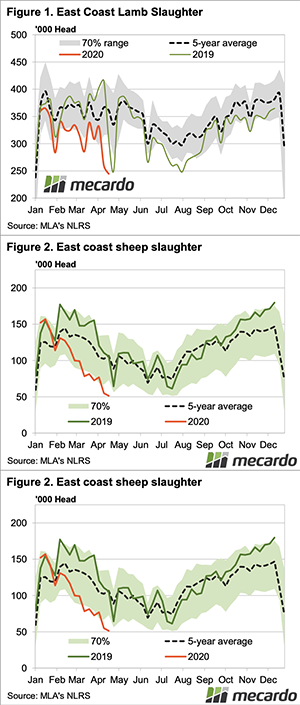

After a strong result for February at 96,174 head volumes have eased 14% in March to record 82,468 cattle sent with flows to Indonesia nearly 10% below their normal seasonal levels, according to the five-year average trend for March.

However, total flow volumes were boosted by stronger than average exports to both China and Vietnam. Over the first quarter of 2020 live cattle exports from Australia to China have averaged 73% ahead of the five-year seasonal pattern.

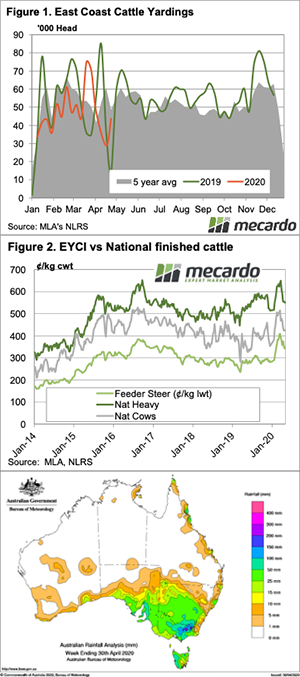

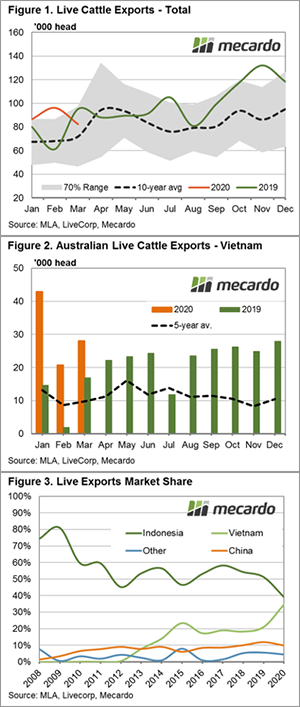

However, the real growth has come from Vietnam as flows over the January to March period have averaged 189% ahead of the five-year trend – Figure 2. Indeed, the growth in the Australian live cattle trade to Vietnam has been robust enough to see a significant lift in market share this season.

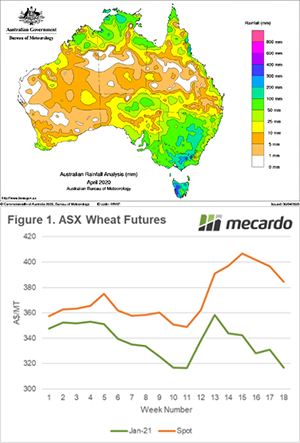

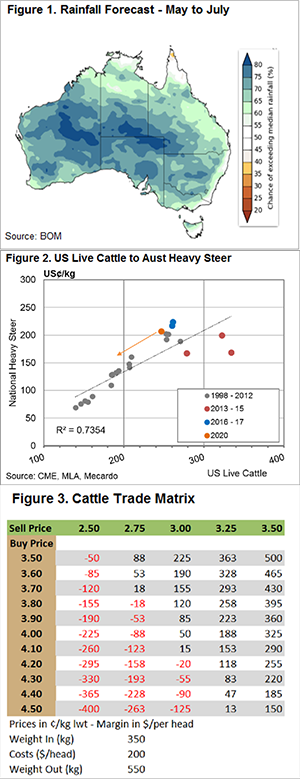

During the 2015 to 2019 seasons Vietnamese market share averaged 20%. This has lifted to 34.5% during the first quarter of 2020 and has come at the expense of flows to Indonesia, currently in the grips of a Covid-19 pandemic – Figure 3. Indonesian market share has averaged 53% over the 2015 to 2019 seasons and has dipped to 39% for the first quarter of 2020.

What does it mean?

At Mecardo we have regularly commented upon the fine work Meat and Livestock Australia have achieved in our red meat export space for chilled and frozen product helping to diversify the reach of the sector and creating high value markets for Australian producers across a range of offshore destinations.

Diversification of a customer base is a useful way to bring increased stability to an industry with less reliance on one key destination. It is comforting to see the volume of exports of live cattle continuing to expand in Vietnam, particularly at a time of significant global uncertainty.

The important role of wet markets has been discussed in the rural press recently. They perform a crucial role in food security and access to meat protein for developing countries where access to cold store in home and reliable electricity isn’t like we enjoy in the first world.

Growing diversity in the live export sector continues to support food security and wet markets in our key trading partner’s countries and is a valuable segment of the broader Australian red meat sector.