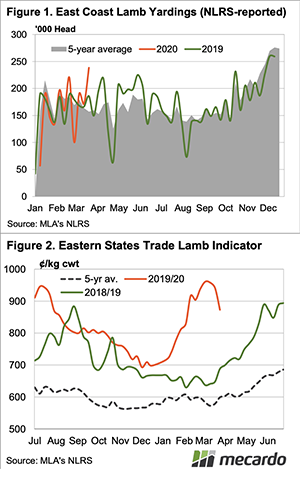

With no saleyard indicators available tracking lamb and mutton markets becomes a bit difficult. Meat and Livestock Australia are reporting a Processors Lamb (CV-19) Indicator, and the trend is believable if the actual pricing is not. Other evidence is supporting the idea we may have seen the bottom for a little while.

The indicators being produced in the CV-19 era lack available historical data, but you can find the pricing and charts here. To the week ending Tuesday, the Processor Lamb (CV-19) was quoted at 943¢/kg cwt. Anecdotal evidence and over-the-hooks prices suggest this is a great price.

The quote is very high due to the calculation of the indicator. It is an average of the dollar per head value of all lambs sold in MLA saleyards to processors, divided by the five year average weight for the month. The national average carcase weight for April is a bit over 19kgs. This appears to be a bit light for lambs currently being sold to processors. It is probably closer to 21 or 22kgs, giving an average price of 820-850¢/kg cwt.

The trend of prices is supported by moves in over the hooks prices this week. Anecdotally we hear export processors have lifted rates from 750-780¢ up to 800¢, while supermarkets are in the mid-800¢ range.

Price movements this week could be due to markets closing for the Easter break, and processors chasing lambs for next week’s kill. However, the panic sell may have also washed through the market, leaving supplies to drift back towards winter lows, but earlier than normal

Next Week.

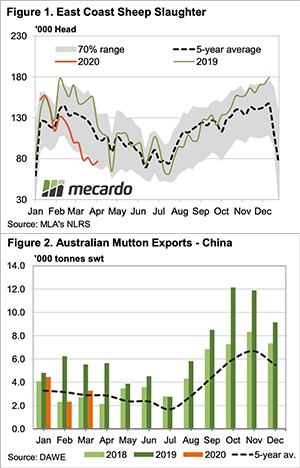

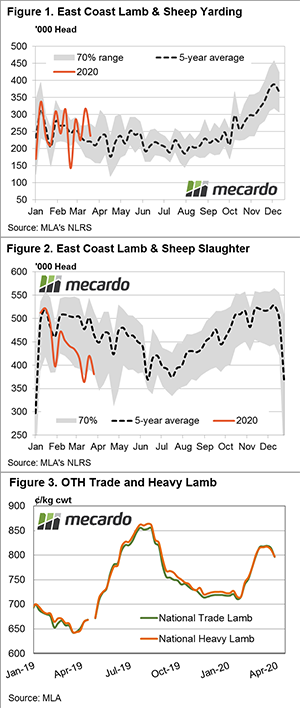

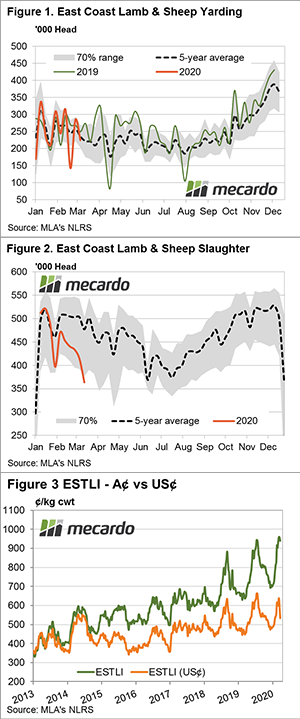

If anything is going to benefit from China emerging from a COVID19 shutdown it will be mutton. You can’t panic sell something you don’t have, and figure 1 shows how little the rush to sell lamb has translated into mutton. In fact, for the last couple of weeks sheep slaughter has been half last year’s levels.

Mutton exports to China also rallied in March (figure 2), and we can expect demand to continue to grow, although there simply won’t be enough to satisfy demand, and this is good for all ovine pricing.

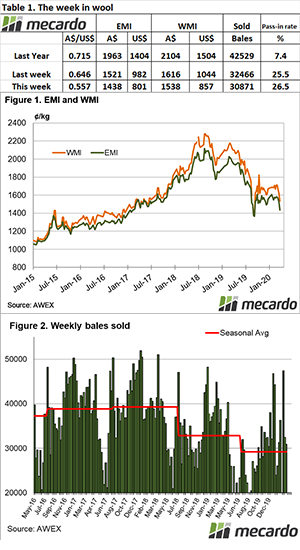

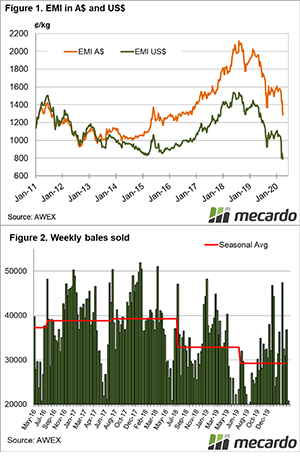

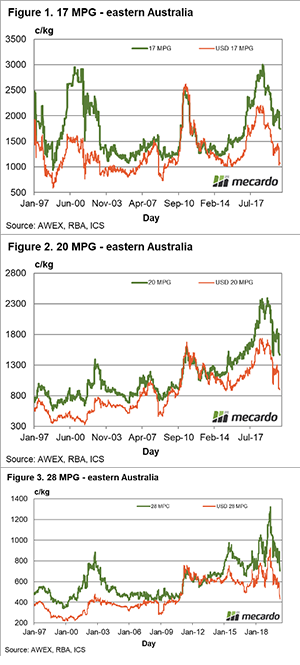

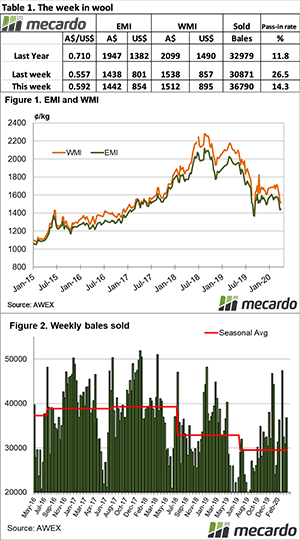

After trending lower for 18 months, wool prices would normally start to look for reasons to stabilise. That appeared to be the case in late 2019, but the occurrence of a pandemic (COVID-19) has added a further leg to the existing cyclical downturn in wool prices. This article takes a look at the latest step down in price.

After trending lower for 18 months, wool prices would normally start to look for reasons to stabilise. That appeared to be the case in late 2019, but the occurrence of a pandemic (COVID-19) has added a further leg to the existing cyclical downturn in wool prices. This article takes a look at the latest step down in price.

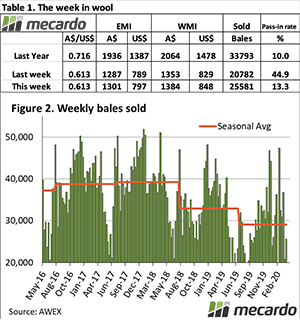

In an environment of limited price data and scant access to sheep/lamb indicators we are used to there is still the ability to see what is going on with throughput volume and slaughter. Producers respond to lower prices with a reduced offering at sale yards and meat works reluctant to increase their appetite as supply chains slow and export markets pause for Covid19.

In an environment of limited price data and scant access to sheep/lamb indicators we are used to there is still the ability to see what is going on with throughput volume and slaughter. Producers respond to lower prices with a reduced offering at sale yards and meat works reluctant to increase their appetite as supply chains slow and export markets pause for Covid19.

supermarkets are keen to restock after a run on red meat. With the A$ collapse and concern over a Covid19 economic growth hit the uncertainty has filtered through to sheep and lamb prices.

supermarkets are keen to restock after a run on red meat. With the A$ collapse and concern over a Covid19 economic growth hit the uncertainty has filtered through to sheep and lamb prices.