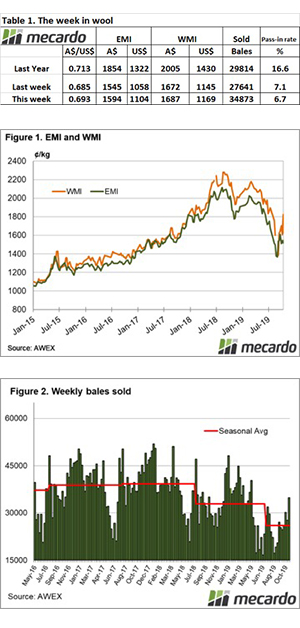

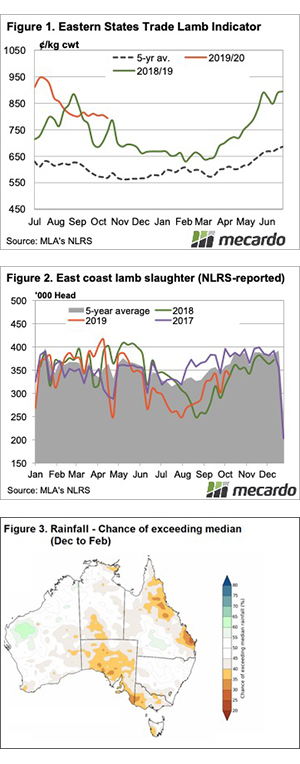

As reported last week, sellers have been prepared to step out of the market when demand is weak, and this week the high pass-in rate told the story of the wool market performance.

There is no doubt that demand is not great right now, however, if the supply was not lightened by the high pass-in rates in the weeks where the market retreat, we could well be seeing bigger falls and greater fluctuation. It is hard to quantify the effect this grower response is having, but it must be supportive for the market.

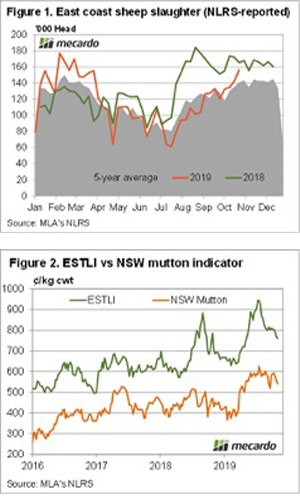

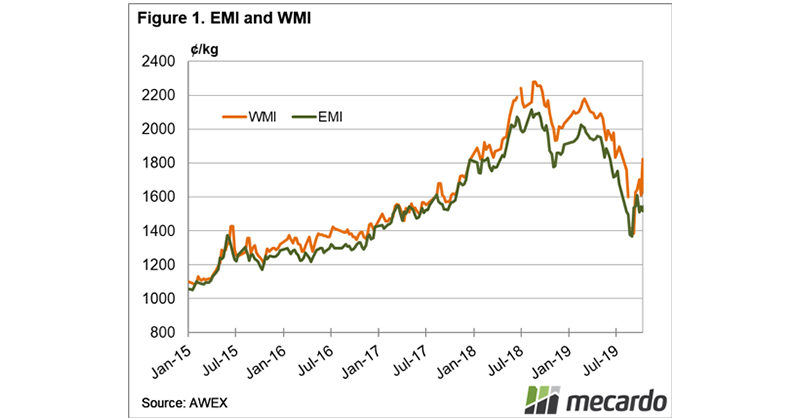

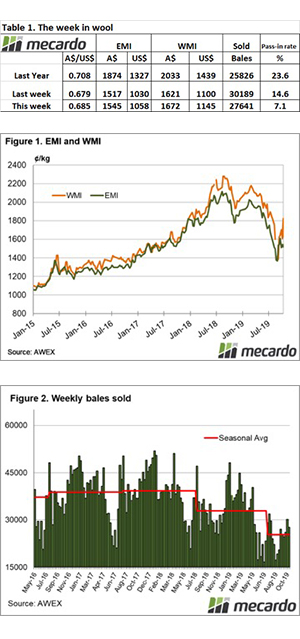

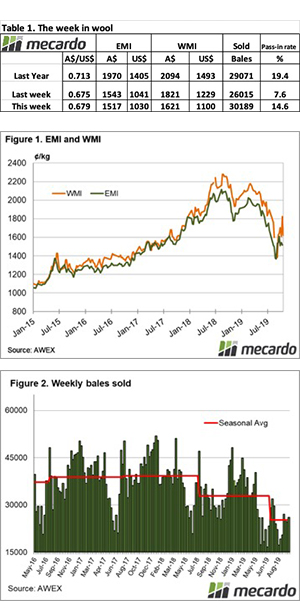

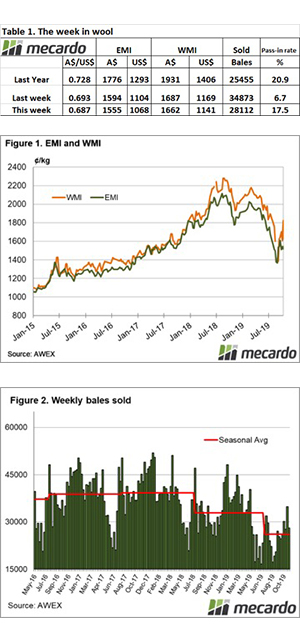

This week the Eastern Market Indicator (EMI) lost 39 cents (after rising 77 cents over the last 2 weeks), to close at 1555 cents. The Au$ fell over 0.5 cents to US $0.686, causing the EMI in US$ to also fall 36 cents to 1,068 cents. The WMI also fell, albeit with a stronger finish in Fremantle (with a gain of 10 cents on Thursday), however for the week the loss was 25 cents for a WMI close of 1662 cents.

As the three-week run of improving markets came to an end, so too did the single-digit pass-in rates, – sellers again deciding to hold wool back on a falling market. This week the PI rate was 17.5% nationally. As a side note, almost 25% of Merino Fleece wool nationally was passed in on Thursday; in the West almost 26% of the offering was passed.

Sydney seemed to struggle to find a footing all week, with a specialty fine wool sale unable to inspire, although buyers selectively bid on wool with good measurements. Melbourne and Fremantle reported a positive tone towards the end of selling on Thursday, no doubt supported by firm grower reserves limiting sales.

There was a slightly smaller offering of 34,084 bales, just over 4,000 bales fewer compared to last week’s volumes. The high pass-in rate meant that there was also a big drop in in the number of bales sold, over 6,000 fewer compared to last week at 28,112 bales. The supply shortfall continues, with 105,884 fewer bales sold compared to the same period last year. This equates to an average weekly gap of 6,617 bales since July.

The dollar value for the week was $48.84 million, with a bale average value of $1,737, down $87 per bale on last week. The combined value so far this season is $726.90 million.

AWEX reported that the Crossbred and Cardings sections were not spared and gave up significant ground, however, a mild recovery in the Cardings in Fremantle was in line with the generally positive close to the week.

The week ahead

Next week an increased offering is listed, with 38,500 bales across the three centres.

We have been taking the lead for the upcoming week based on the closing sentiment in Fremantle, so we have a cautiously positive outlook for next week.