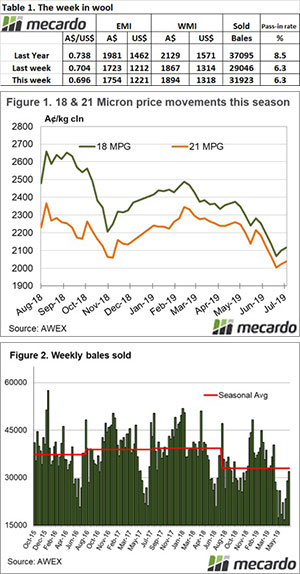

The wool market is now taking the Winter recess over the next three weeks. Buyers were active as they completed delivery orders, lifting the market into a positive finish. Generally, a 10 to 40 cent lift across the individual MPG’s was observed, with the Sydney & Fremantle markets seemingly the strongest.

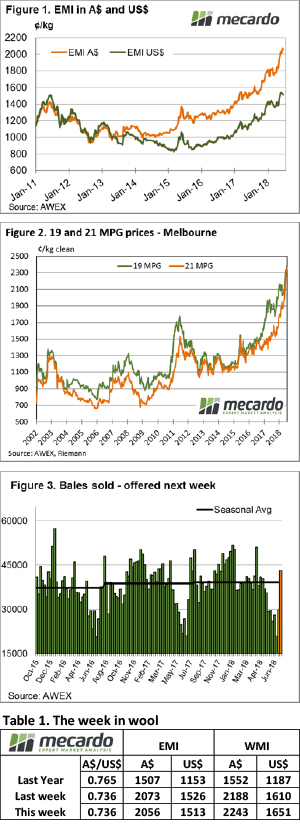

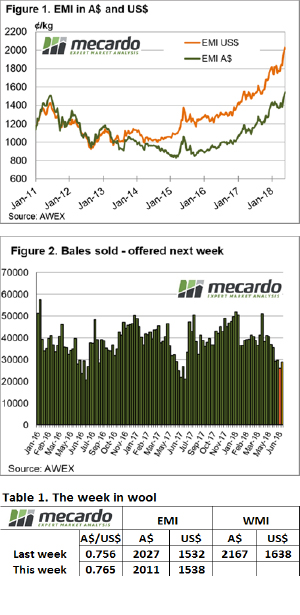

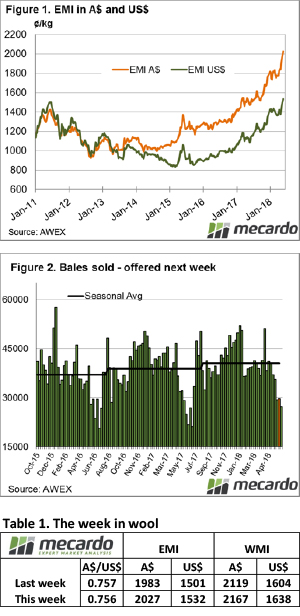

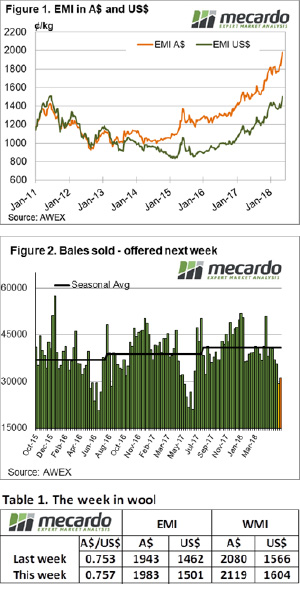

The Eastern Market Indicator (EMI) was slightly higher on Wednesday but by the close on Thursday had found a 31 cent gain for the week to end at 1754¢/kg clean. The Australian dollar eased again to below US 70 cents closing at US$0.696 on Thursday. This resulted in the EMI in US$ terms to increase by 9 cents to end at 1,222.

The wool market opened at historically high levels in August last year, peaked in September before finding its low point at the end of the season. The EMI opened at 1990, rallied strongly into September to find a peak of 2094, before closing at 1754 this week, close to the low for the season of 1723. Across the season a fall of 11.5%.

In US$ terms, there was a similar patter, with the difference compared to the start of the season a decline of 16.4%.

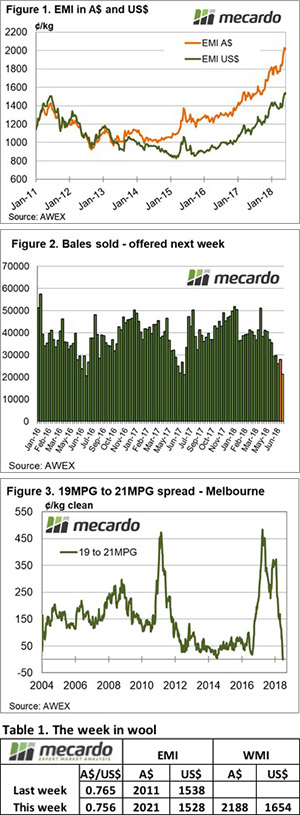

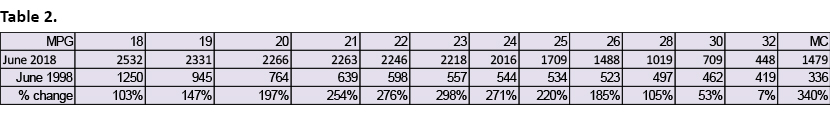

34,080 bales were offered at Sydney, Melbourne & Fremantle, almost 3,000 more than last week. The pass in rate across the selling centres remained at 6.3% for the week. This meant that 31,923 bales were cleared to the trade, almost 3,000 more than last week.

In the season just completed, the drought impact was felt both in the average merino micron which for July was 18.5 microns, down 0.4 on July 2018. Also impacted was the volume of wool offered for the season. On a monthly average 32,875 bales were cleared to the trade, compared to 39,253 for last season. This represented a 16.5% decline in the total number of bales sold at auction compared to last season.

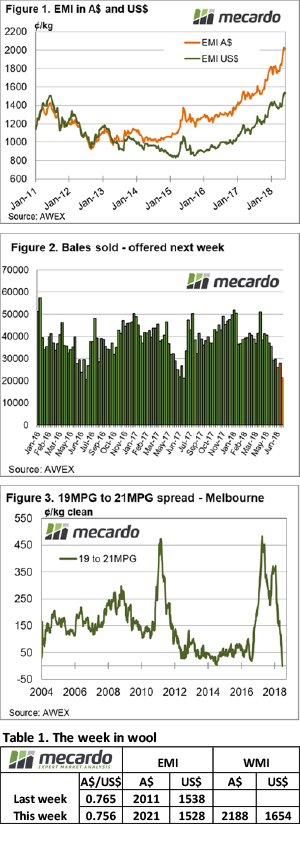

Crossbreds were amongst the strongest performers across the season, with the 30 MPG up 177 cents or 26%, while Cardings were in severe decline across the season finishing 32% lower.

This week however, the rising tide lifted all boats, Crossbreds were marginally dearer with Cardings also up and quoted in Melbourne improving 50 cents or 5.4%.

The week ahead

We now begin a three-week break. Exporters will take this opportunity to visit customers in the northern hemisphere and look to secure orders for the coming season.

The conversations will revolve around demand from retailers, and projected supply from wool producers, looking to find the match for the opening sales.

We have had reports that retail demand is soft, and we know that supply is at record low levels. Just which factor drives the opening sales is not clear making for another interesting wool market opening.

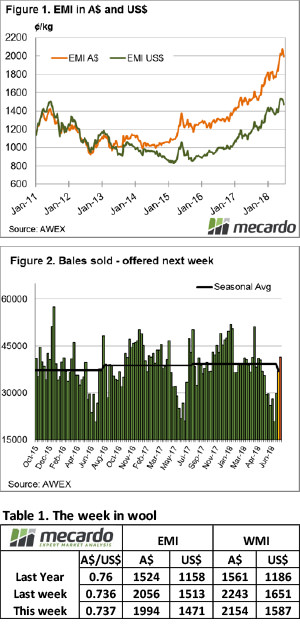

The wool market lurched into F19 with an overhang of wool producer’s bales looking to swing income from F18 to F19. If the plan was to reduce tax payable, the market assisted and pulled the market back in all centres and on both days.

The wool market lurched into F19 with an overhang of wool producer’s bales looking to swing income from F18 to F19. If the plan was to reduce tax payable, the market assisted and pulled the market back in all centres and on both days.

The big upward move in the wool market last week and the return of Fremantle resulted in an increased offering this week, with the market easing slightly.

The big upward move in the wool market last week and the return of Fremantle resulted in an increased offering this week, with the market easing slightly.

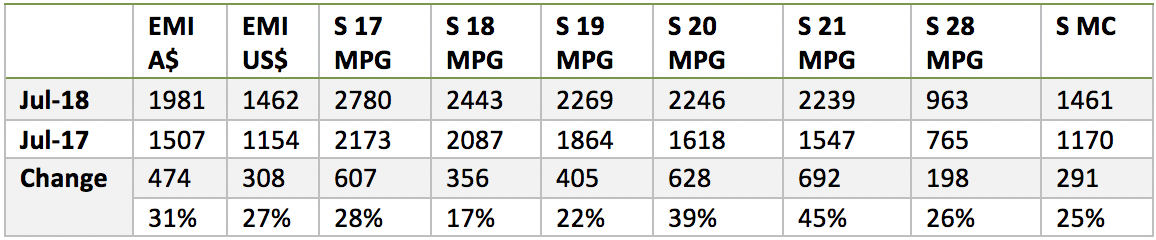

Sometimes good things come in small packages. Well at least was the case in the wool market this week. Fremantle was on recess again, leaving the East Coast to carry the weight and deliver the smallest national offering in nine years at just 20,904 bales. As a result of the lower supply, prices rallied to new heights.

Sometimes good things come in small packages. Well at least was the case in the wool market this week. Fremantle was on recess again, leaving the East Coast to carry the weight and deliver the smallest national offering in nine years at just 20,904 bales. As a result of the lower supply, prices rallied to new heights.  The wool market mended last week’s losses to see a general lift across medium and coarse fibres. Buyer attentions were again diverted away from the finer microns, which saw the price differential between medium and broad microns narrow significantly.

The wool market mended last week’s losses to see a general lift across medium and coarse fibres. Buyer attentions were again diverted away from the finer microns, which saw the price differential between medium and broad microns narrow significantly.

For the last month the wool market has gone from strength to strength, but alas, the upwards stream has come to a halt. That is, unless you look from a US$ perspective. Despite the small offering due to no sales in Fremantle, most categories retracted from the outset on Tuesday.

For the last month the wool market has gone from strength to strength, but alas, the upwards stream has come to a halt. That is, unless you look from a US$ perspective. Despite the small offering due to no sales in Fremantle, most categories retracted from the outset on Tuesday.

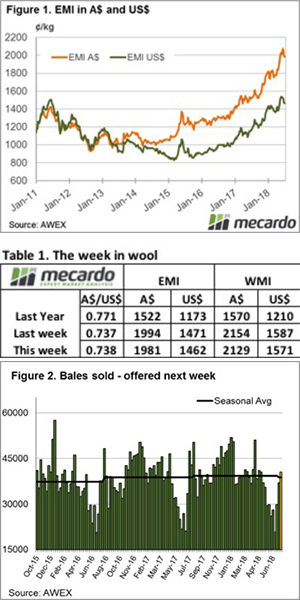

Who would have thought that 2,000 cents were possible for the EMI, or that only the 25 MPG and broader would sit below the 2000 cent level?

Who would have thought that 2,000 cents were possible for the EMI, or that only the 25 MPG and broader would sit below the 2000 cent level?

Another week, another record. The wool market was again lit up with green across the board. But where one wins, one must loose. We’re seeing the effects of what has been a remarkably strong season play out on supply, and this means buyers are having to fight it out.

Another week, another record. The wool market was again lit up with green across the board. But where one wins, one must loose. We’re seeing the effects of what has been a remarkably strong season play out on supply, and this means buyers are having to fight it out.