Recent sales volumes and AWTA data have shown strong increases in the supply of broad merino wool in Australia. While the supply was expected to pick up on the back of improved seasonal conditions in 2016, the rise has been faster than anticipated. This article takes a look at where the wool is coming from.

Recent sales volumes and AWTA data have shown strong increases in the supply of broad merino wool in Australia. While the supply was expected to pick up on the back of improved seasonal conditions in 2016, the rise has been faster than anticipated. This article takes a look at where the wool is coming from.

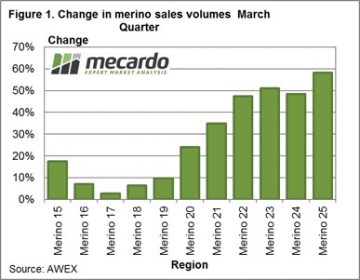

Figure 1 shows the year on year change in auction volumes for merino wool from 15 through to 25 micron, in the January to March period for this year. The stand out change is the big (30-50%) rise in the 21 micron and broader merino categories. Fine wool volumes have also been ahead of year earlier levels but the small increases in the face of massive prices rises indicates there is not a lot of spare supply of fine merino wool in Australia.

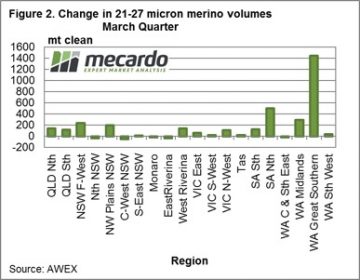

The question is where is the extra broad merino wool coming from? As Mecardo showed in an article a couple of weeks ago (Merino means different things) around half of the broad merino production comes out of pastoral regions with the balance coming from cropping regions. Figure 1 shows the year on year change in the supply of 21-27 micron merino wool for the past three months by region, around Australia. One region stands out as contributing extra 21-27 micron wool in the March quarter. This region was the Great Southern from Western Australia. In recent years this region has been the dominant supplier of greasy wool to sale in the January through April period, accounting for 15-18% of sales by volume. This year the fibre diameter of wool coming out of the Great Southern has swung broader, so it has supplied nearly half of the extra 21-27 micron wool sold during the past three months. The Midlands, also from Western Australia, has helped as has northern South Australia and the pastoral regions running northern and east from South Australia.

The question is where is the extra broad merino wool coming from? As Mecardo showed in an article a couple of weeks ago (Merino means different things) around half of the broad merino production comes out of pastoral regions with the balance coming from cropping regions. Figure 1 shows the year on year change in the supply of 21-27 micron merino wool for the past three months by region, around Australia. One region stands out as contributing extra 21-27 micron wool in the March quarter. This region was the Great Southern from Western Australia. In recent years this region has been the dominant supplier of greasy wool to sale in the January through April period, accounting for 15-18% of sales by volume. This year the fibre diameter of wool coming out of the Great Southern has swung broader, so it has supplied nearly half of the extra 21-27 micron wool sold during the past three months. The Midlands, also from Western Australia, has helped as has northern South Australia and the pastoral regions running northern and east from South Australia.

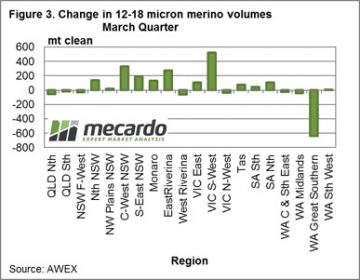

As a check on this change, Figure 3 shows the year on year change in the volume of 12-18 micron wool sold by each region in the March quarter. The big swing to broader wool in the Great Southern region is matched by a big drop in 12-18 micron volumes. Notice the higher rainfall NSW regions have had increased fine wool sales this year, along with south-west Victoria (which was coming off a drought induced low base). The expected decrease in supply of fine wool from NSW has not eventuated, except for the western Riverina. Good seasonal conditions in 2017 (which has started in the Monaro) will be required to pull the micron broader in the regions, in order to lower the supply of fine merino wool.

As a check on this change, Figure 3 shows the year on year change in the volume of 12-18 micron wool sold by each region in the March quarter. The big swing to broader wool in the Great Southern region is matched by a big drop in 12-18 micron volumes. Notice the higher rainfall NSW regions have had increased fine wool sales this year, along with south-west Victoria (which was coming off a drought induced low base). The expected decrease in supply of fine wool from NSW has not eventuated, except for the western Riverina. Good seasonal conditions in 2017 (which has started in the Monaro) will be required to pull the micron broader in the regions, in order to lower the supply of fine merino wool.

Key points:

- Broad merino sales volumes have been some 30-50% higher in the March quarter.

- AWTA volumes correlate with the sales volumes.

- Half of the increase has come from Western Australia.

- Fine merino volumes have been maintained in the higher rainfall regions of NSW.

What does this mean?

The extra volume of broad merino wool (in the order of 30-50%) will continue to put downward pressure on broad merino prices. Seasonal conditions in Western Australia (where half of the increase has come from) are shaping up in 2017 to support this increased supply. The chance of the 21 MPG breaking the 1500 cents barrier looks to have well and truly slipped away. NSW has maintained its volume of fine wool production in recent months, above expectations. The expected boost to fine wool prices from a drop in supply looks as though it will be weaker than expected.

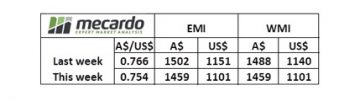

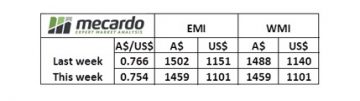

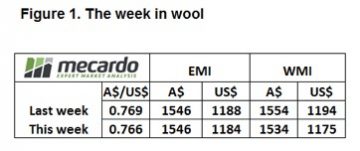

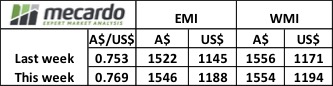

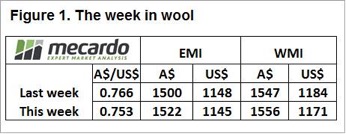

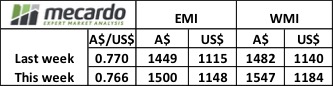

The EMI closed up a whopping 53 cents in A$ terms at 1512¢ while in Fremantle, the strong finish to the last week continued with a A$0.73 rise, the west closing at 1532 – Fig 1.

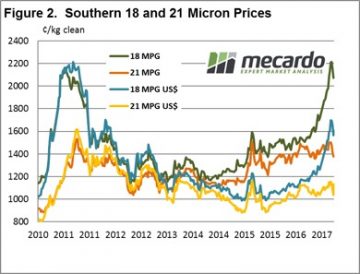

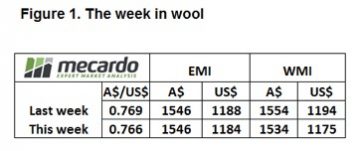

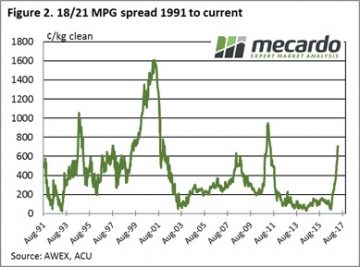

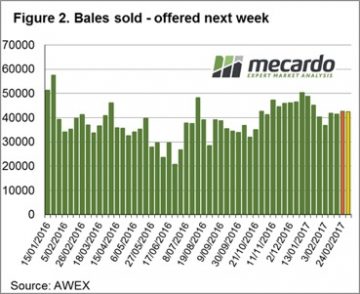

The EMI closed up a whopping 53 cents in A$ terms at 1512¢ while in Fremantle, the strong finish to the last week continued with a A$0.73 rise, the west closing at 1532 – Fig 1. While the market in general benefited, it was the 21 MPG that was the stand out, with the market in Melbourne actually closing at a higher level than before the correction. This is quite remarkable given the increased supply of medium wool coming forward post the drought conditions of the past couple of years. Fig 2.

While the market in general benefited, it was the 21 MPG that was the stand out, with the market in Melbourne actually closing at a higher level than before the correction. This is quite remarkable given the increased supply of medium wool coming forward post the drought conditions of the past couple of years. Fig 2. Growers are in the driving seat (not often this is the case!!), as the shortage of any buffer stocks means sellers can confidently withdraw wool from the market and have little risk that better prices won’t appear later. When combined with record income from any sheep or lamb sales (

Growers are in the driving seat (not often this is the case!!), as the shortage of any buffer stocks means sellers can confidently withdraw wool from the market and have little risk that better prices won’t appear later. When combined with record income from any sheep or lamb sales (

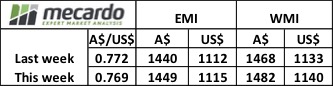

The EMI closed down 43 cents in A$ terms at 1449¢ and also softer in US$ terms at 1101¢, down 50¢. In Fremantle, the later selling time and strong finish to the week resulted in an indicator less effected with a 29¢ decline in A$. terms for the week – Fig 1.

The EMI closed down 43 cents in A$ terms at 1449¢ and also softer in US$ terms at 1101¢, down 50¢. In Fremantle, the later selling time and strong finish to the week resulted in an indicator less effected with a 29¢ decline in A$. terms for the week – Fig 1. The reversal on Thursday saw the EMI gain 2 cents, however the WMI finished plus 19 cents for the day with reports of a strong finish to the market. Gains were across the Merino combing section, 18 MPG plus 16 and 21 plus 19 cents in Melbourne.

The reversal on Thursday saw the EMI gain 2 cents, however the WMI finished plus 19 cents for the day with reports of a strong finish to the market. Gains were across the Merino combing section, 18 MPG plus 16 and 21 plus 19 cents in Melbourne. It seems that the falls on Wednesday encouraged exporters to book business and when they returned on Thursday to a reduced offering we saw the resultant rally. This caused the pass-in rate to fall compared to Wednesday, in Fremantle for example the first day a total of 29% was passed-in, however the next day this rate fell to 11.4%. Also impacting was the withdrawal of 20% in reaction to the price falls of the previous day.

It seems that the falls on Wednesday encouraged exporters to book business and when they returned on Thursday to a reduced offering we saw the resultant rally. This caused the pass-in rate to fall compared to Wednesday, in Fremantle for example the first day a total of 29% was passed-in, however the next day this rate fell to 11.4%. Also impacting was the withdrawal of 20% in reaction to the price falls of the previous day. Wool producers are not in any hurry to sell wool if the market retraces like this week, and conversely, they have been keen to sell wool as the market rallied.

Wool producers are not in any hurry to sell wool if the market retraces like this week, and conversely, they have been keen to sell wool as the market rallied. The EMI closed down 44 cents in A$ terms at 1502¢ and also softer in US$ terms at 1151¢, down 33¢. In the West, the indicator was off slightly more with a 46¢ decline in A$. terms. – figure 1.

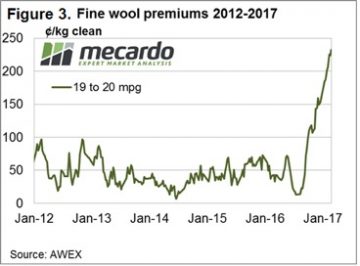

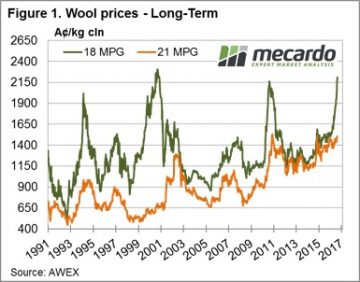

The EMI closed down 44 cents in A$ terms at 1502¢ and also softer in US$ terms at 1151¢, down 33¢. In the West, the indicator was off slightly more with a 46¢ decline in A$. terms. – figure 1. On a slightly different tack, the 18 – 21 MPG Basis (or 18 MPG premiums over 21 MPG) has lifted from 242 cents in January to 740 cents this week; a lift of 498 cents this year. The improving fine wool basis is a clear signal that the fine wool doldrums of the past 7 – 8 years are behind us. Previously the fine wool rallies have been short & sharp, we will need to watch closely over the next 12 months to be alert to any future retracements.

On a slightly different tack, the 18 – 21 MPG Basis (or 18 MPG premiums over 21 MPG) has lifted from 242 cents in January to 740 cents this week; a lift of 498 cents this year. The improving fine wool basis is a clear signal that the fine wool doldrums of the past 7 – 8 years are behind us. Previously the fine wool rallies have been short & sharp, we will need to watch closely over the next 12 months to be alert to any future retracements. With the market at record levels (still!!), it is a good time to look at the forward price relative to your expected shearing and also in relation to your financial budget. Reducing risk and locking in profit generally makes sense, but in this environment, it is even more compelling.

With the market at record levels (still!!), it is a good time to look at the forward price relative to your expected shearing and also in relation to your financial budget. Reducing risk and locking in profit generally makes sense, but in this environment, it is even more compelling. Reports around the sale this week however, are that this is only a “hick-up” to the market, not a serious concern. Stocks are still reported as “very tight” along all sections of the wool pipeline. We tend to agree that the market is not under great pressure, and with growers prepared to pass-in large volumes the market should find support.

Reports around the sale this week however, are that this is only a “hick-up” to the market, not a serious concern. Stocks are still reported as “very tight” along all sections of the wool pipeline. We tend to agree that the market is not under great pressure, and with growers prepared to pass-in large volumes the market should find support.

A bit of a mixed market this week with the very fine end still surging forward but some beginning whispers of nervousness among exporters at the auctions this week starting to creep in, although this may begin to be eased by a softening A$.

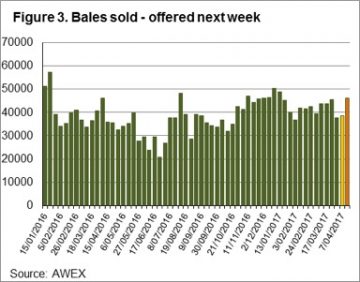

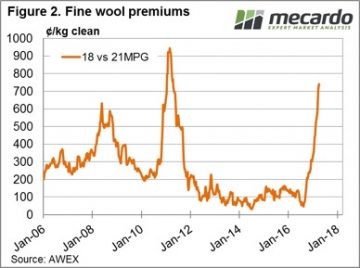

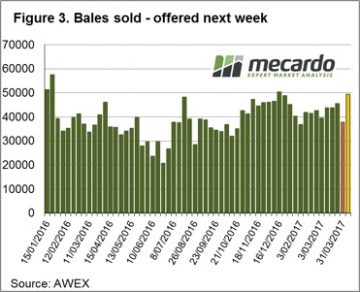

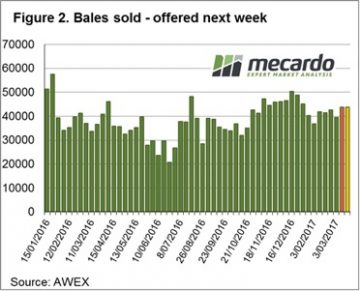

A bit of a mixed market this week with the very fine end still surging forward but some beginning whispers of nervousness among exporters at the auctions this week starting to creep in, although this may begin to be eased by a softening A$.  Given the higher volumes on offer, the reaction of the market as a whole not too bad with the 20-22 micron categories taking the most heat. A total of 45,507 bales sold out of 49,214 on offer resulting in a slightly higher pass in rate of 7.5%

Given the higher volumes on offer, the reaction of the market as a whole not too bad with the 20-22 micron categories taking the most heat. A total of 45,507 bales sold out of 49,214 on offer resulting in a slightly higher pass in rate of 7.5% Next week we have just under 47,000 bales listed for sale with trading schedule two days. A drop in volumes on offer for week 40 and 41 toward the lower 40,000 region could see further gains in price in the coming week, particularly if the A$ can slide back towards 75¢US.

Next week we have just under 47,000 bales listed for sale with trading schedule two days. A drop in volumes on offer for week 40 and 41 toward the lower 40,000 region could see further gains in price in the coming week, particularly if the A$ can slide back towards 75¢US. This was a big week for prices on top of a stellar run over the past few sales. The EMI lifted 24 cents, but with a stronger Au$ it was 43 cents higher in US$ terms. To pick a MPG category, 18.5 was quoted +80 cents in Melbourne, +95 cents in Sydney and +59 cents in Fremantle over the week.

This was a big week for prices on top of a stellar run over the past few sales. The EMI lifted 24 cents, but with a stronger Au$ it was 43 cents higher in US$ terms. To pick a MPG category, 18.5 was quoted +80 cents in Melbourne, +95 cents in Sydney and +59 cents in Fremantle over the week. One way to put perspective on where prices are relative to the past is via Percentile Tables. Since 1996 only 18, 21 & 22 MPG have reached higher levels, that is for 100% of the time since 1996 the market has been lower than the current price for all other Merino micron types. No doubt a fitting reward for those that have stayed the course and are now selling wool at very exciting prices.

One way to put perspective on where prices are relative to the past is via Percentile Tables. Since 1996 only 18, 21 & 22 MPG have reached higher levels, that is for 100% of the time since 1996 the market has been lower than the current price for all other Merino micron types. No doubt a fitting reward for those that have stayed the course and are now selling wool at very exciting prices. Coupled with the virtual non-existence of any wool stocks either on farm, in brokers stores or in mills; then the outlook has little supply pressures ahead.

Coupled with the virtual non-existence of any wool stocks either on farm, in brokers stores or in mills; then the outlook has little supply pressures ahead. The market in Fremantle closed a little softer for 20.5 and coarser wool so some caution for the 2 day sale next week. A increased offering of 51,200 bales is rostered for next week, over 10,000 up on this week’s clearance of 39,800. In subsequent weeks though, AWEX is forecasting back to 42,000 bales per week.

The market in Fremantle closed a little softer for 20.5 and coarser wool so some caution for the 2 day sale next week. A increased offering of 51,200 bales is rostered for next week, over 10,000 up on this week’s clearance of 39,800. In subsequent weeks though, AWEX is forecasting back to 42,000 bales per week. Again, fine wool was the outstanding performer but the underpinning of the medium wool price (21 MPG) is providing support and optimism for the ongoing strong market outlook.

Again, fine wool was the outstanding performer but the underpinning of the medium wool price (21 MPG) is providing support and optimism for the ongoing strong market outlook. Cardings again were dearer, with all selling centres reporting the Carding indicator comfortably above 1200 cents. The average price for Merino wool is currently boosted by the prices for the lessor lines, all contributing to the best cash flows seem for wool producers for many a year.

Cardings again were dearer, with all selling centres reporting the Carding indicator comfortably above 1200 cents. The average price for Merino wool is currently boosted by the prices for the lessor lines, all contributing to the best cash flows seem for wool producers for many a year. The ongoing strong auction is providing good opportunities in the forward market with

The ongoing strong auction is providing good opportunities in the forward market with

The broad-based demand evident in the higher EMI in both local and US$ terms, gaining 51A¢ and 33US¢, respectively. The EMI not the only indicator to crack $15 this week with the WMI posting a 65A¢ rise, or 44¢ in US$ terms – Figure 1.

The broad-based demand evident in the higher EMI in both local and US$ terms, gaining 51A¢ and 33US¢, respectively. The EMI not the only indicator to crack $15 this week with the WMI posting a 65A¢ rise, or 44¢ in US$ terms – Figure 1. Some exporter reports of just not having access to enough wool to sell at the moment really fuelling the surge. A total of 40,626 bales offered this week with 39,461 sold on the red-hot demand kept the pass in rate contained to 2.9% – Figure 2.

Some exporter reports of just not having access to enough wool to sell at the moment really fuelling the surge. A total of 40,626 bales offered this week with 39,461 sold on the red-hot demand kept the pass in rate contained to 2.9% – Figure 2.

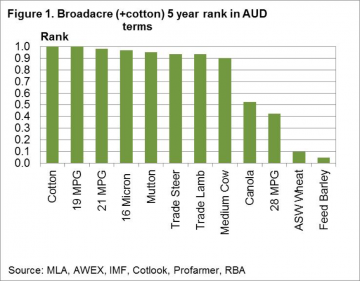

Figure 1 shows the January 2017 five year price rank for a range of broad acre (plus cotton) commodities grown in Australia. The price rank is looked at in Australian dollar terms, as farmers here in Australia see the prices.Basically the news is all good for livestock products (wool and meat) with the exception of crossbred wool (represented here by the 28 MPG). Five year price ranks are all in the top decile, meaning they have traded at lower levels for 90% of more of the past five years. Cotton also is trading in the top decile. At the other end of the scale lie canola, wheat and barley, with canola performing reasonably well by trading at median levels. Wheat and barley are in the bottom decile for the past five years.

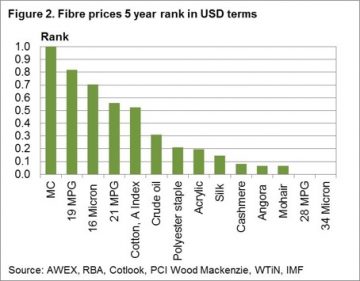

Figure 1 shows the January 2017 five year price rank for a range of broad acre (plus cotton) commodities grown in Australia. The price rank is looked at in Australian dollar terms, as farmers here in Australia see the prices.Basically the news is all good for livestock products (wool and meat) with the exception of crossbred wool (represented here by the 28 MPG). Five year price ranks are all in the top decile, meaning they have traded at lower levels for 90% of more of the past five years. Cotton also is trading in the top decile. At the other end of the scale lie canola, wheat and barley, with canola performing reasonably well by trading at median levels. Wheat and barley are in the bottom decile for the past five years. The next step is to look at these commodity prices from outside of Australia. In this case we use US dollar five year percentiles and break the commodities into groups. Figure 2 looks at fibres, including wool from Australia and a range of other apparel fibres. The price ranks range from a high top decile performance by the Merino Cardings indicator through to bottom decile performances by cashmere, angora, mohair and crossbred wool. The merino combing indicators perform well (ranging from the sixth to the ninth decile) well above oil and the synthetic fibres. Cotton comes in close to the 21 MPG in the sixth decile. The longer the disparity continues between the high merino rankings and lower rankings for the major fibres, the more likely some demand will shift out of merino (especially the broader side of 19 micron) to alternative fibres.

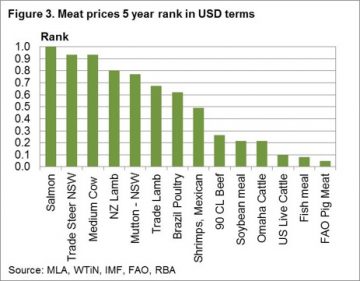

The next step is to look at these commodity prices from outside of Australia. In this case we use US dollar five year percentiles and break the commodities into groups. Figure 2 looks at fibres, including wool from Australia and a range of other apparel fibres. The price ranks range from a high top decile performance by the Merino Cardings indicator through to bottom decile performances by cashmere, angora, mohair and crossbred wool. The merino combing indicators perform well (ranging from the sixth to the ninth decile) well above oil and the synthetic fibres. Cotton comes in close to the 21 MPG in the sixth decile. The longer the disparity continues between the high merino rankings and lower rankings for the major fibres, the more likely some demand will shift out of merino (especially the broader side of 19 micron) to alternative fibres. Figure 3 looks at meat and protein prices from around the world. Salmon is the best performer followed by Australian beef and Australasian sheep meat prices. At the other end of the rankings are range of US beef quotes, along with fishmeal and the FAO pig meat index. The big discrepancy between Australian and US beef price ranks indicates some risk to Australian prices if US prices do not lift.

Figure 3 looks at meat and protein prices from around the world. Salmon is the best performer followed by Australian beef and Australasian sheep meat prices. At the other end of the rankings are range of US beef quotes, along with fishmeal and the FAO pig meat index. The big discrepancy between Australian and US beef price ranks indicates some risk to Australian prices if US prices do not lift. The EMI was up A$0.09, while in US$ terms it improved 3 cents with the Au$ quoted slightly lower for the week. Cardings continue to out-perform, with all 3 selling centres reporting strong increases and the relative Cardings indicators all nudging 1200 cents. (Fig 1.) Note that before 2011 the Cardings indicator rarely bobbed above 600 cents.

The EMI was up A$0.09, while in US$ terms it improved 3 cents with the Au$ quoted slightly lower for the week. Cardings continue to out-perform, with all 3 selling centres reporting strong increases and the relative Cardings indicators all nudging 1200 cents. (Fig 1.) Note that before 2011 the Cardings indicator rarely bobbed above 600 cents. Two points regarding clip preparation are worth noting as the wool market dynamics continue to evolve. These points are at the extreme ends of the micron spectrum with change noted in the fine & superfine market as well as the X Bred market.

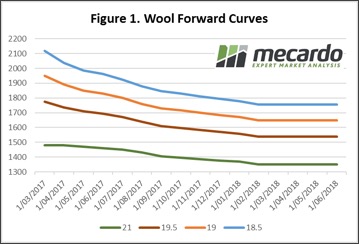

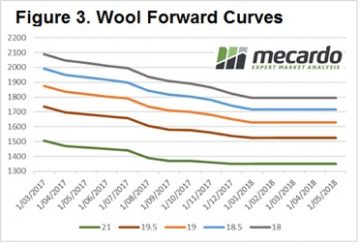

Two points regarding clip preparation are worth noting as the wool market dynamics continue to evolve. These points are at the extreme ends of the micron spectrum with change noted in the fine & superfine market as well as the X Bred market. This week Riemann traded solid volumes, with a spread of trades across the 18.5, 19 and 21 MPG types, and for settlements from March 2017 out to July 2018. Price levels were seen as attractive to growers looking to capture some of the market momentum for future clips.

This week Riemann traded solid volumes, with a spread of trades across the 18.5, 19 and 21 MPG types, and for settlements from March 2017 out to July 2018. Price levels were seen as attractive to growers looking to capture some of the market momentum for future clips.