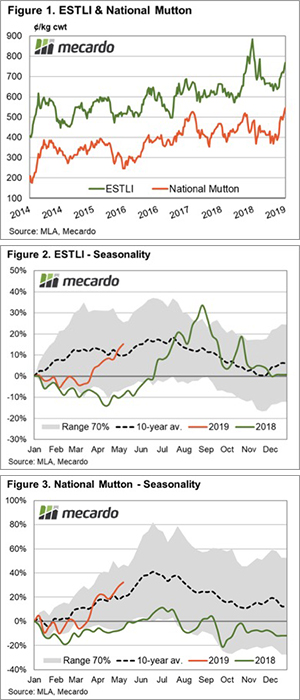

- The ESTLI is trading 28% higher than this year’s low but is yet to break all-time price highs.

- The NMI is 47% higher than this season’s low and has pushed above the record high price set in 2016 of 526¢.

- Seasonal percentage price gain/loss patterns suggest that an ESTLI peak near 900¢ and NMI peak approaching 660¢ this year is not out of the question.

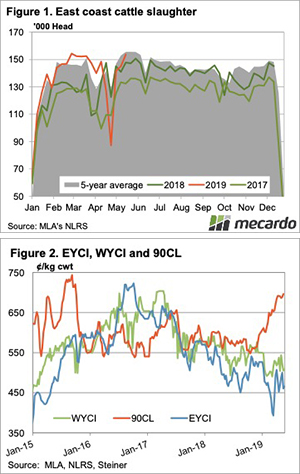

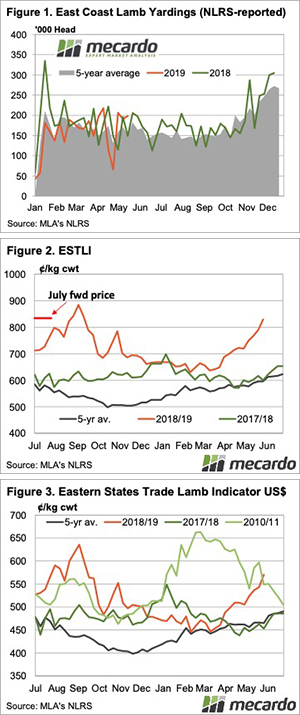

This time of the season we expect to see sheep and lamb prices testing higher and the National Mutton Indicator (NMI) hasn’t disappointed, reaching record heights last week of 544¢/kg cwt. The Eastern States Trade Lamb Indicator (ESTLI) has been pushing northward too but is yet to beat it’s 2018 winter peak of 884¢/kg cwt. What can the historic seasonal pattern tell us about this year’s peak for the NMI and ESTLI?

The ESTLI is sitting around 28% higher than the February 2019 seasonal low of 619¢ but is yet to crack the 800¢ level. It’s still nearly 11% short of the winter record peak price of 884¢ achieved last season. In contrast, the NMI has rebounded 47% from the February seasonal low of 369¢ and has well and truly sailed into unchartered territory. After eclipsing the record high of 526¢ set in June 2016 the NMI has pushed toward the 550¢ level in recent weeks (Figure 1).

Analysis of the percentage price gain/loss pattern for the ESTLI since the start of 2019 demonstrates that after a similar first quarter trend to the 2018 season, trade lamb prices across the east coast have begun their seasonal price climb earlier than last year (Figure 2).

In 2018 the ESTLI didn’t start to rally until late April/early May but this season we have seen the ESTLI gaining ground since March. The long-term seasonal average pattern for the ESTLI highlights that prices don’t usually peak until late July/early August, so we may have a way to go yet for trade lamb markets. If we assume a winter peak for the ESTLI nearer the upper end of the 70% range, at a 35% gain on the January 2019 opening price, this puts the 2019 peak at 900¢/kg cwt.

The seasonal percentage price gain/loss pattern for the NMI shows that for the 2019 season mutton prices are broadly on track to reach their seasonal peak during June/July (Figure 3). Projecting a relatively normal seasonal trend, as outlined by the ten-year average pattern, shows that a 40% gain on the January 2019 opening price isn’t unrealistic and this would see mutton peaking at around 575¢/kg cwt.

What does it mean/next week?

Interestingly, the continuation of strong export demand for mutton could see the percentage price pattern trend toward the upper boundary of the 70% range. A winter gain closer to 60% from the January 2019 opening price could see the NMI stretching towards 660¢.