All markets have taken an absolute hammering since the start of March. The closure of many borders and the curtailing of global trade has resulted in red across the entire grid. However, the fall in the Australian dollar has propelled us into pole position.

The Australian dollar has declined rapidly and has fallen to its lowest level since 2008. When there is uncertainty in the global economy there tends to be a move away from our currency. The uncertainty caused by the US banning inbound flights from the EU has really put the jitters on the market.

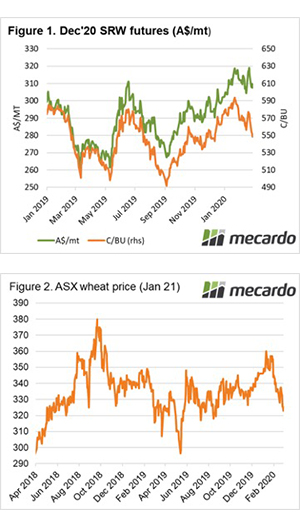

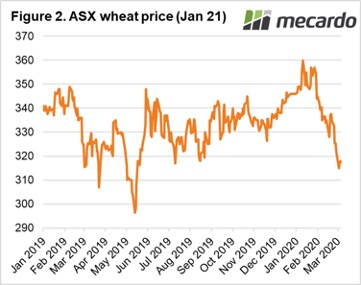

The Australian dollar has fallen from 70¢ to 62.9¢ in the course of less than three months (figure 1). At the start of the year, most of the banks were optimistic and forecasting the dollar at over 70¢. Those forecasts are being rapidly redrawn.

In figure 2 the current December futures price is shown with the fx rate on 1st of January, 1st of March and today. If the exchange rate was the same as the start of the year the swap price for December would currently be at A$275/mt, at present, it sits at A$306/mt.

This provides an opportunity to again lock in a swap value at above A$300/mt. In the current environment of extreme uncertainty the market could go either way. This global pandemic is unprecedented and governments and traders have no real previous lessons to learn from.

What does it mean/next week?:

The Australian dollar has saved grain growers bacon with its recent fall. If we see rises in the dollar then we can rapidly see gains lossed. It is worthwhile having a chat with your advisor about risk management strategies.

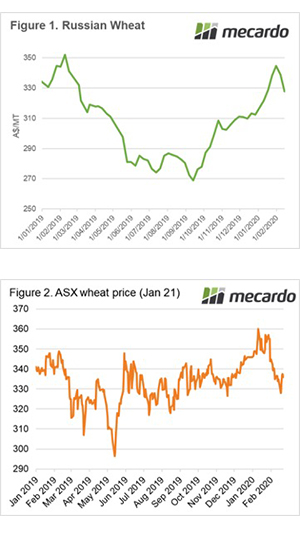

There has been a run on toilet roll in Australia, however, we will likely have plenty of cereal. In this update, we step away from COVID-19 and look at some of the fundamentals driving the market.

There has been a run on toilet roll in Australia, however, we will likely have plenty of cereal. In this update, we step away from COVID-19 and look at some of the fundamentals driving the market.

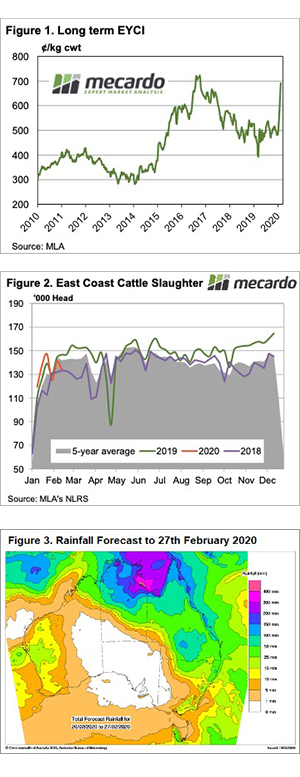

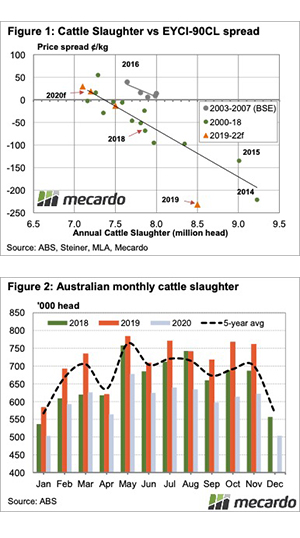

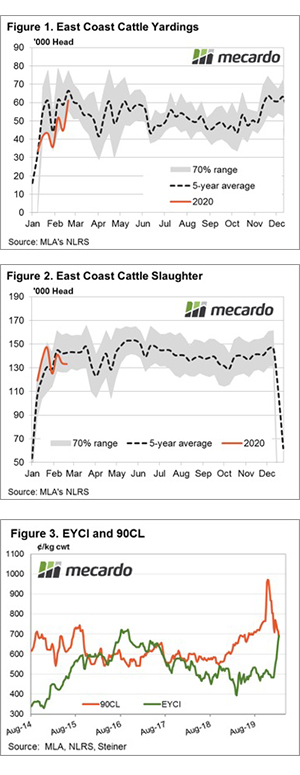

Increased cattle yarding across the eastern seaboard hasn’t slowed demand for young cattle this week but concern over export markets and the prospect of tighter margins appears to be slowing meat works appetite for finished cattle.

Increased cattle yarding across the eastern seaboard hasn’t slowed demand for young cattle this week but concern over export markets and the prospect of tighter margins appears to be slowing meat works appetite for finished cattle.