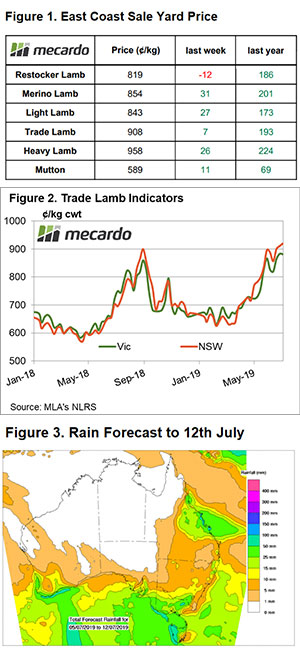

Lamb supply continues to contract and with it, prices are on the rise, mostly. There were a couple of negative spots, especially in the restocker department, but we did see an indicator break through the extraordinary 1000¢ level.

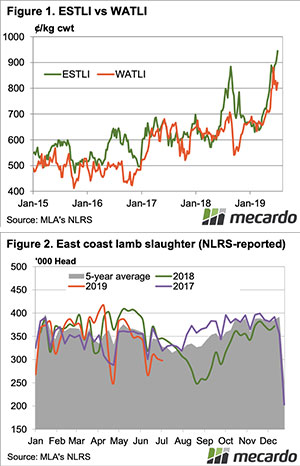

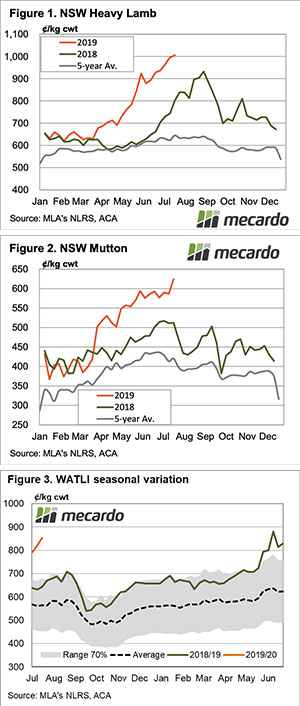

New South Wales was where the action was at. The NSW Heavy Lamb Indicator was the first to break through the $10 mark. NSW Heavy Lambs gained 28¢ this week to hit 1005¢/kg cwt (Figure 1). Last year the peak in prices saw NSW Heavy Lambs leading the charge as well, no doubt dry times makes them hard to produce and in short supply.

It is especially hard to carry heavy lambs through when prices have been at record levels for more than a month.

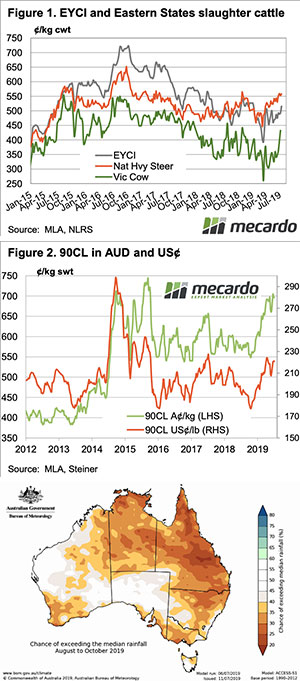

Mutton also broke through resistance this week. NSW (Figure 2) and Victorian Mutton Indicators both moved through 600¢, posting 624 and 620¢/kg cwt respectively. This time last year Mutton prices were falling, but the lack of stock left and the better season are now driving prices to new highs.

There were losers this week despite the records. Restocker lambs eased back to the 800-820¢ range. Old season lamb demand is waning as the risk of cutting teeth increases, while no one seems to be selling restocker suckers in the saleyards.

On Auctionsplus restocker suckers are making more than $10. There was one lot of first cross ewe lambs which made $20/kg cwt. They were very light, but $150/hd for a 20kg lwt lamb is extraordinary.

Things are good in the West, but not as good as the east. The WATLI gained 31¢ to 853¢/kg cwt (Figure 3) and is not far off the record high set in June. WA Mutton did hit a record however, rising 34¢ to 518¢/kg cwt.

Next week?:

The coming month will be intriguing for lamb and sheep markets. A lot will depend on how quickly new season lamb producers can get weight into lambs and get them to market. There can’t be many old season lambs left.

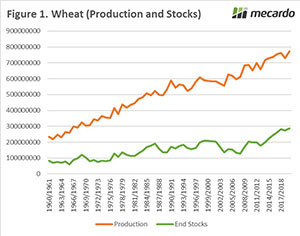

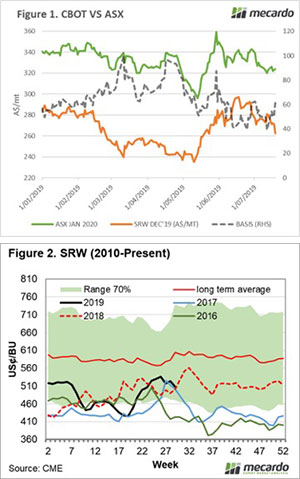

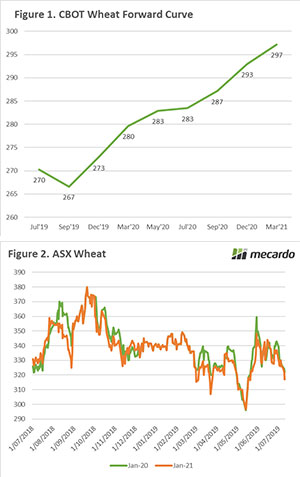

However, when we look further out to next December (2020), we can see that the futures contract is trading at A$293/mt. This may be a more attractive proposition when using CBOT futures as it provides a level which will most likely end with an overall price well above A$300/mt when basis is added.

However, when we look further out to next December (2020), we can see that the futures contract is trading at A$293/mt. This may be a more attractive proposition when using CBOT futures as it provides a level which will most likely end with an overall price well above A$300/mt when basis is added.