- Soybean prices hit 12 year lows earlier in the month but have recovered some ground.

- Canola and Rapeseed futures have also rallied, taking new crop Australian prices higher.

- Current new crop prices look like good selling with plenty of uncertainty in Canola markets.

International oilseed markets have been in the doldrums, with heavy supplies and weakening demand seeing prices hit a 12 year low. There are suggestions that the soybean market might have found a base, with local canola prices to benefit.

The United States Department of Agriculture’s (USDA) production forecast for 2019-20 is a new record. Despite an increase in consumption, ending stocks are expected to increase marginally.

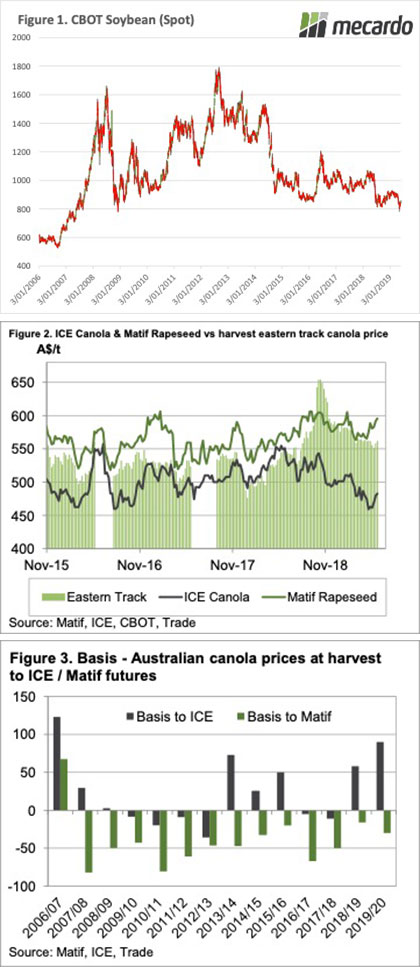

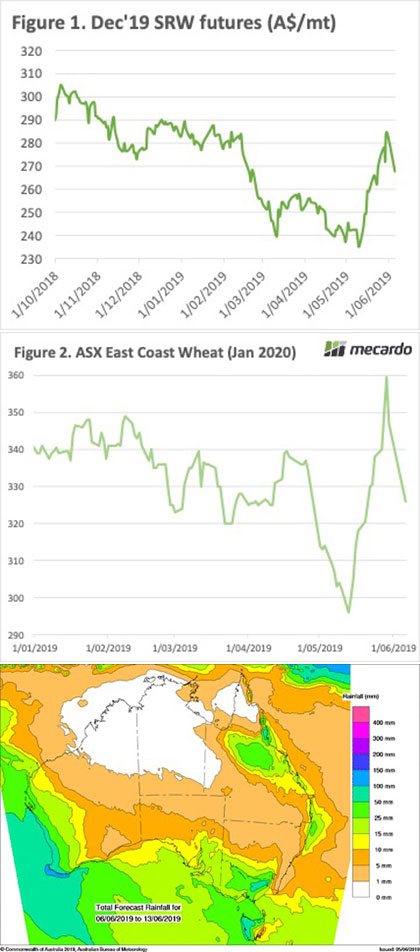

The increase in stocks, along with concerns around the demand from China given trade wars and African Swine Fever, drove soybeans to new lows. In fact, it was only two weeks ago that soybeans hit a 12 year low of 780¢/bu (Figure 1).

In the last two weeks, soybean prices have rebounded, gaining 8%. The wet weather afflicting the spring cropping areas of the US was initially expected to be positive for soybean production. Later planting is better for soybeans than corn. With the wet continuing, support has started to come for soybeans, although it is way behind corn, which hit a one year high yesterday.

Adding to momentum in oilseeds is dry weather in Canada, which is helping ICE Canola move higher. It has gained $21 in the last fortnight in our terms, moving higher from doldrums, induced by weak soybeans and China’s ban on Canadian Canola.

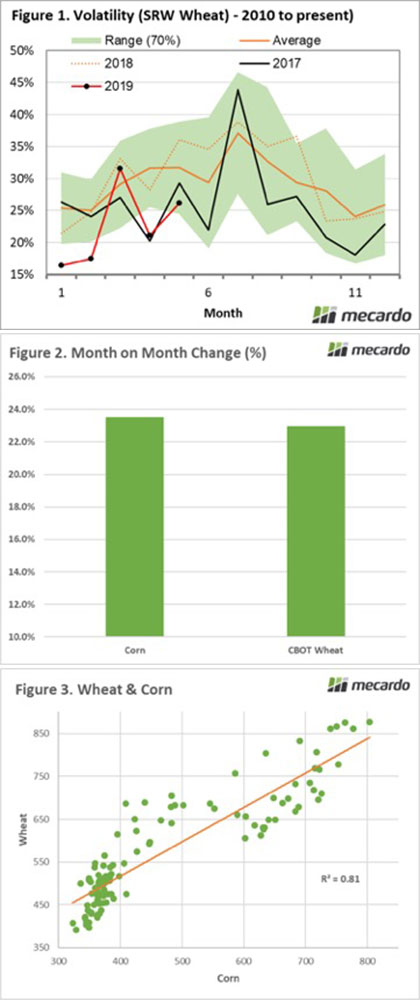

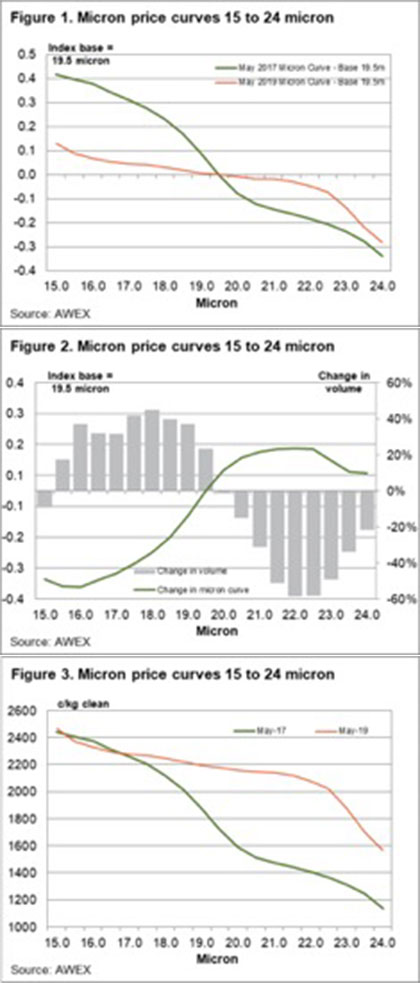

Our canola values have been held above $500 by strong European Rapeseed values. Figure 2 shows Matif Rapeseed prices are almost back to $600/t and this is having more of an impact on new crop prices than old.

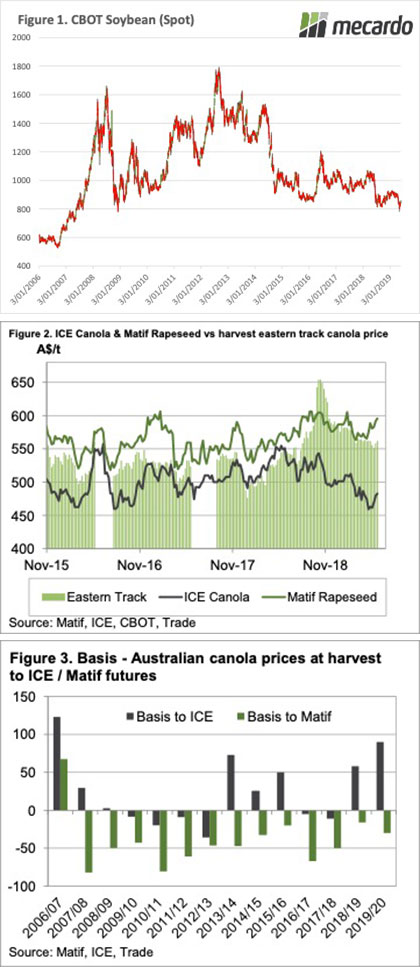

Old crop canola values have found a little strength this week, gaining $10 to hit $560-565/t in southern ports. New crop Canola is $15 above old crop, and importantly, at a $30 discount to Matif. The Australian discount to Matif generally doesn’t get any narrower unless we have a very small crop, like last year.

Canada’s issues with China see our Canola at an even stronger basis to ICE than last harvest. Australia’s strong basis is likely being helped by demand which has shifted from China, with few other major Canola producers to fill the hole.

What does it mean?:

By most measures, new crop canola prices look pretty good. Obviously, another drought affected crop could see canola rise further before harvest, as basis to Matif rose to $50 last October. There is some downside risk if China changes their view on Canadian imports, and if we get a big local crop.

With political issues clouding normal pricing relationships, it’s even harder than normal to forecast prices, but there is some merit in looking at prices which are at the top of the historical range.

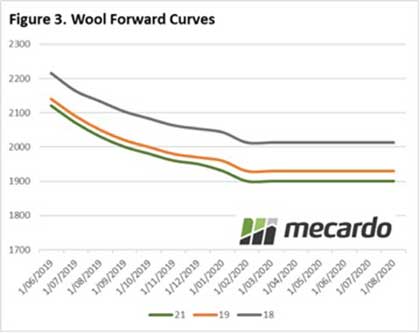

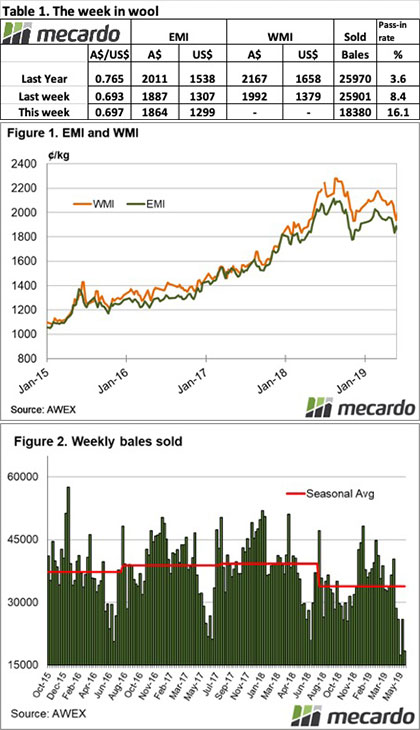

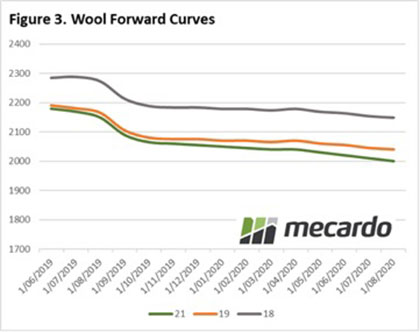

Another solid week in the forwards market, with 21 micron being the main MPG dealt. One trade was dealt for 19 micron wool for August and agreed at 2,180¢. Four trades were dealt for 21 micron wool. One of those was for September at 2,080¢ and one for October at 2,050¢. Two trades were agreed for November at 2,050¢ and 2,075¢ respectively. Two trades were dealt for 28 micron wool and were agreed at 1,100¢ and 1,130¢ for August.

Another solid week in the forwards market, with 21 micron being the main MPG dealt. One trade was dealt for 19 micron wool for August and agreed at 2,180¢. Four trades were dealt for 21 micron wool. One of those was for September at 2,080¢ and one for October at 2,050¢. Two trades were agreed for November at 2,050¢ and 2,075¢ respectively. Two trades were dealt for 28 micron wool and were agreed at 1,100¢ and 1,130¢ for August.