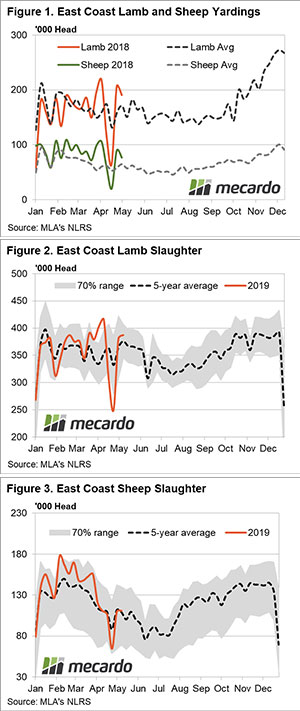

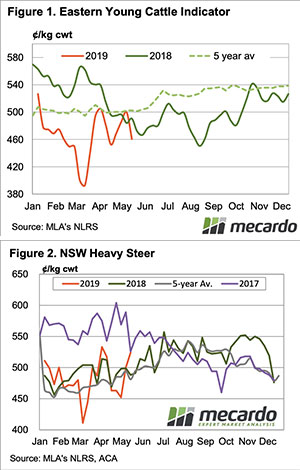

Yarding figures remain elevated for lamb and sheep despite a recent downturn. Lamb slaughter levels are above average too, while sheep slaughter has returned to levels consistent with the five-year average seasonal trend. Perhaps it is a good omen for producers as we approach Winter that prices continue to firm in the face of strong supply.

As reported in last week’s market comment higher prices for lamb and sheep have failed to encourage more throughout at the sale yard with east coast levels for both categories posting a fall from the week prior (Figure 1).

Average weekly east coast lamb yarding levels for May have been running 20% above the five-year average and sheep yarding levels during May have been trending 35% higher than their long term seasonal average pattern indicating that demand for lamb and sheep remain robust as prices have been steadily moving higher.

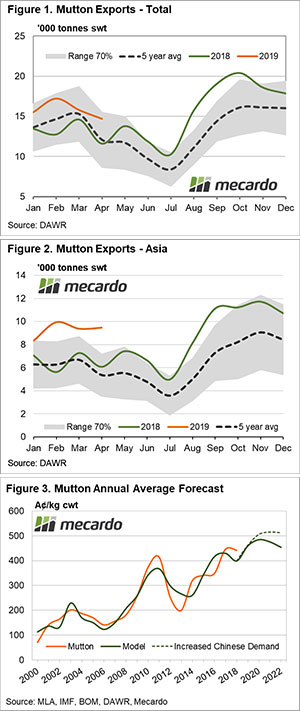

Indeed, at the Ballarat sale earlier in the week heavy export lambs set a Victorian record price of $300 per head, which equates to around 785¢/kg cwt. Higher prices have been replicated across the east coast with the Eastern States Trade Lamb Indicator (ESTLI) climbing 3% to close the week at 787¢/kg cwt. East coast mutton unable to hold ground this week, but only eased 4¢ to close at 557¢/kg cwt.

What does it mean/next week?

A glance at the five-year average seasonal trend for lamb/sheep yarding and slaughter show a clear decline in volumes as we head toward Winter, so a tightening of supply is looming.

A weakening Australian dollar, down around 3.5% over the last month and trading below 70US¢, combined with robust offshore demand for Aussie lamb/sheep exports should continue to provide solid price support across ovine markets in the coming weeks.

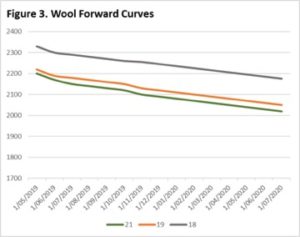

A solid week in the amount of forwards trades this week, especially for crossbreds which were collateral damage in this weeks’ auction market falls. Bets are on to see if prices continue to drop or level out again so it’ll be interesting to see developments in the coming weeks.

A solid week in the amount of forwards trades this week, especially for crossbreds which were collateral damage in this weeks’ auction market falls. Bets are on to see if prices continue to drop or level out again so it’ll be interesting to see developments in the coming weeks.

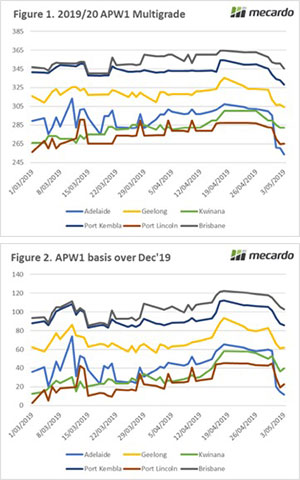

Figure 1 displays the physical contract price for APW1 multigrade and Figure 2 shows the basis versus December Chicago futures. I have selected a number of ports to give a broad spread of the nations’ wheat growing area.

Figure 1 displays the physical contract price for APW1 multigrade and Figure 2 shows the basis versus December Chicago futures. I have selected a number of ports to give a broad spread of the nations’ wheat growing area.