The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle.

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle.

In order to determine if a premium exists for SA producers we need to be able to compare markets that are interdependent and share a degree of correlation in price movement to ensure that we are measuring like for like. We have run a series of correlation analysis over historic cattle price movements contrasting SA to other states and a variety of cattle categories and have selected to compare SA to Victorian Trade Steers.

On an annual basis, the returns correlation between SA and Vic Trade Steers shows a very strong interdependence scoring an r2 of 0.9405 – Figure 1. This means that nearly all of the time the annual price movement in SA Trade Steers and Victorian Trade Steers follow each other.

Figure 2 highlights the average monthly price achieved by SA and Victorian Trade Steer producers at the saleyard according to the weekly MLA reported statistics. A cursory glance at the chart illustrates two fairly obvious characteristics of the two price patterns; namely, that the prices of SA and Vic Trade Steers share a close interdependence and that SA prices usually run at a discount to Victorian prices.

An overview of the historic percentage spread between SA and Victorian Trade Steer monthly average prices from 1998 to 2017, as outlined in Figure 3, demonstrates how few times SA producers have enjoyed a premium over their Victorian counterparts. Indeed, there have only been four brief periods over the last two decades when SA Trade Steers achieved a premium over Victorian Trade Steers on a monthly basis – as identified by the blue circles.

Analysis of the monthly spread data shows that Victorian Trade Steers have posted a long run average premium of 8.3% over SA Trade Steers (black dotted line) and the orange spread trendline shows that over the last two decades the premium spread in favour of Victoria has actually been expanding, as denoted by the upward slope to the trendline.

Related GM articles

Key points:

- Correlation analysis shows that SA Trade Steer and Victorian Trade Steer markets share a strong degree of price interdependence on an annual basis

- Average monthly price data confirms the strength of the relationship between Victorian and SA Trade steer prices and also shows that SA Trade Steer prices run at a discount to Victoria

- Percentage spread analysis demonstrates that Victorian Trade Steer average monthly prices have achieved a long-term average premium in excess of 8% over their SA counterparts and the spread has widened in recent times.

What does this mean?

The Mecardo team have undertaken analysis across a variety of crop and livestock prices comparing the historic spread of the SA prices to comparable markets in other states and we have yet to find any evidence in support of the SA Greens claims that the moratorium on GM provides a significant price premium for their producers compared to producers from outside of SA.

Indeed, the evidence for cattle suggests otherwise. The long-term average spread for Victorian to SA Trade Steers from 198 to 2017 sits at 8.3% premium. However, measuring the average spread from 2008 to 2017, which encapsulates the period that the GM moratorium has been in effect, shows that the premium spread has widened to 9.1% in favour of Victorian producers.

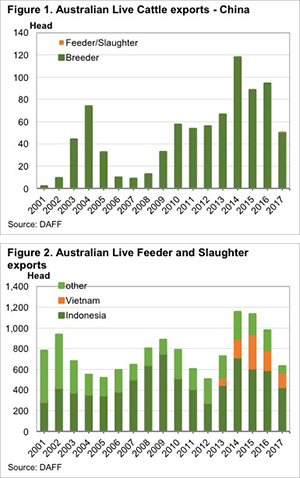

According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not?

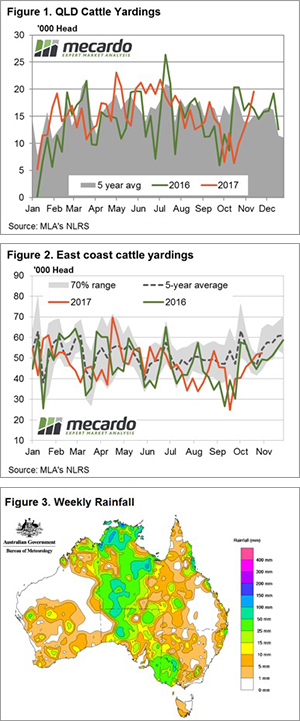

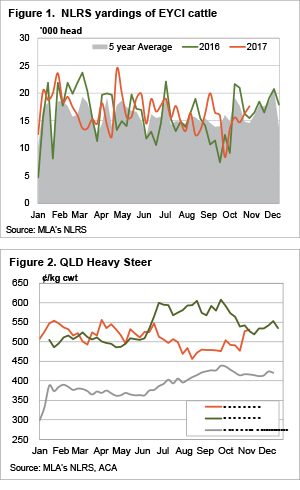

According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not? Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State.

Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State.

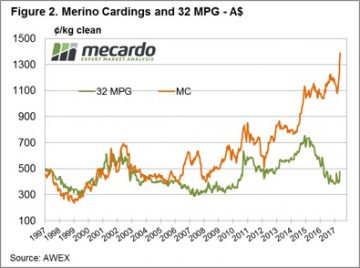

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced.

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced. Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week.

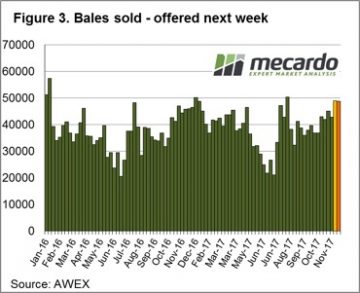

Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week. The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

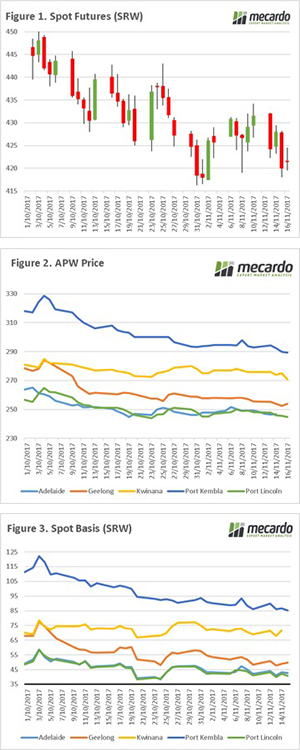

The US Department of Agriculture released their World Agricultural Supply and Demand Estimates overnight. In this week’s comment, we will take a look at the impact on wheat, and report on new import barriers being erected in India.

The US Department of Agriculture released their World Agricultural Supply and Demand Estimates overnight. In this week’s comment, we will take a look at the impact on wheat, and report on new import barriers being erected in India.  The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

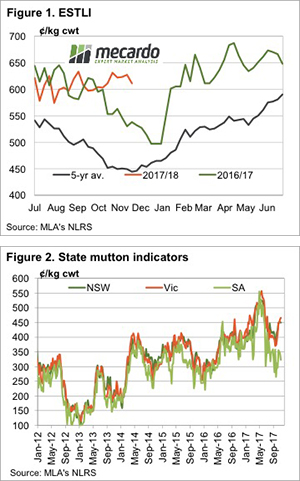

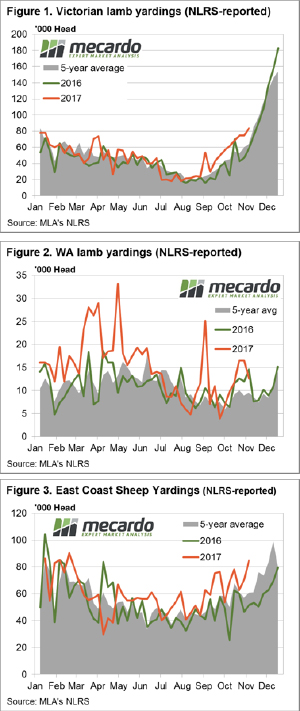

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.

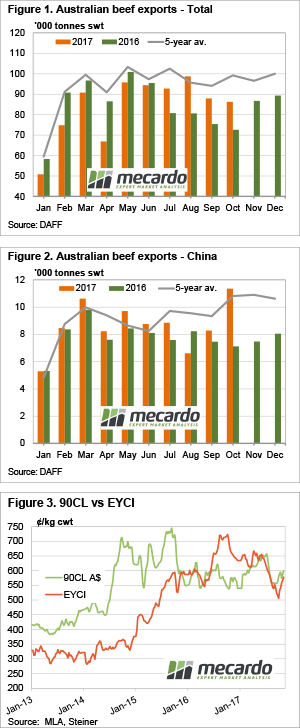

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.  It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.