It’s nice to be right sometimes, even if it is only for a week. The weekly comment last week suggested the slide in lamb prices was about to halt, and halt it did. The market even bounced back above 600¢ as lamb and sheep yardings recorded another weak week.

It’s nice to be right sometimes, even if it is only for a week. The weekly comment last week suggested the slide in lamb prices was about to halt, and halt it did. The market even bounced back above 600¢ as lamb and sheep yardings recorded another weak week.

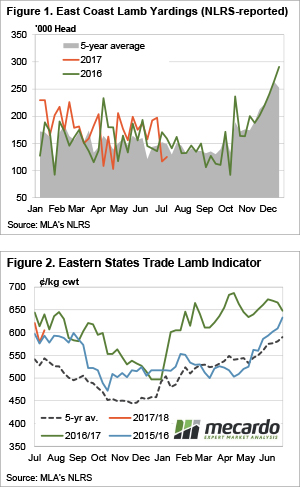

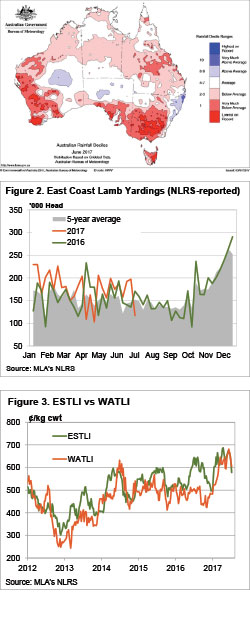

Figure 1 shows what lamb producers think of the saleyard values on offer over the last couple of weeks. East Coast lamb yardings spent their second week in a row close to the lowest levels seen in 2017. It’s been over 12 years since lamb yardings were this low in the first two weeks of July, and it seems to have started to bite on the supply of lambs to works.

The Eastern States Trade Lamb Indicator (ESTLI) bounced this week (figure 2), gaining 27¢ to move back to 605¢/kg cwt. NSW and Victoria both had strong rallies, while in South Australia the trade lamb indicator inexplicably 37¢ to sit in the doldrums at 495¢/kg cwt. SA price are 110¢ behind the ESTLI, and we would expect them to climb back up next week.

In the West trade lambs are keeping pace with their eastern cousins, sitting at 610¢/kg cwt. WA Mutton fell through 400¢ this week, setting an 8 week low of 374¢/kg cwt. East coast mutton values also eased, but remain better than the west, averaging 434¢ in Victoria and NSW. SA has the cheapest mutton as well, sitting at 340¢, and this was up 39¢ for the week.

The week ahead

So was the rise in the ESTLI a dead cat bounce, or a sign of the market steadying. Supply would have to pick up from here to send lamb prices lower, and at this time of year it’s usually hard to find many prime lambs. We might see lamb prices above 600¢ for the rest of July, at least until new season lambs start to hit the market.

Mutton supply is less predictable, as there are always sheep out there is seasonal conditions push them to market. A good rain will see sheep prices rally, but there doesn’t appear to be too much on the forecast.

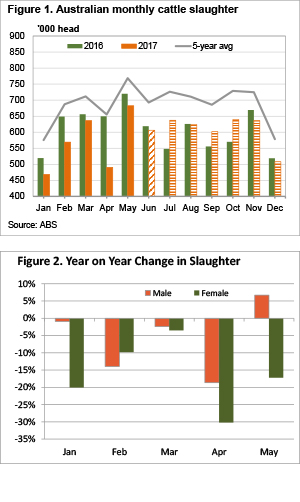

As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate.

As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate.

This week we saw the USDA release their July World Agricultural Supply and Demand estimates, the market has reacted to this news. In this update, we take a short look at Chicago futures & the dollar.

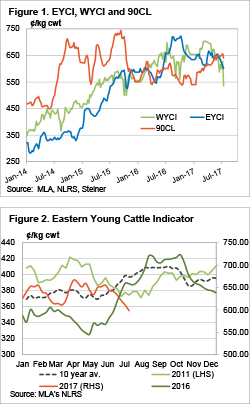

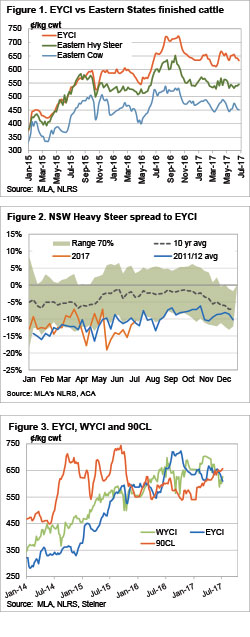

This week we saw the USDA release their July World Agricultural Supply and Demand estimates, the market has reacted to this news. In this update, we take a short look at Chicago futures & the dollar. The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

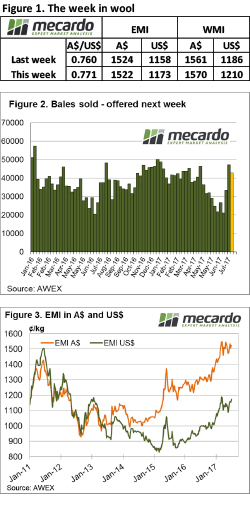

It seems wool growers are selling as soon as the wool is shorn, with another large offering coming forward. Despite this, the market performed well despite receiving no help from a rising A$. AWEX report that W.A.’s unseasonaly dry weather has seen growers bringing forward shearing causing the increase in supply this week.

It seems wool growers are selling as soon as the wool is shorn, with another large offering coming forward. Despite this, the market performed well despite receiving no help from a rising A$. AWEX report that W.A.’s unseasonaly dry weather has seen growers bringing forward shearing causing the increase in supply this week.

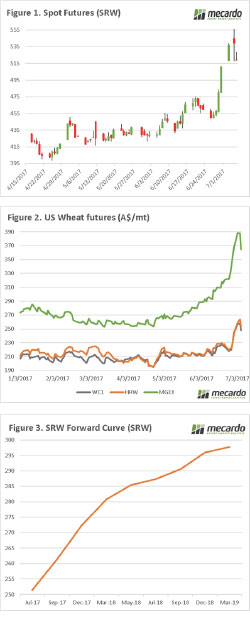

In the late 1600’s Sir Isaac Newton, developed the theory of gravity. It seems that in addition to determining that apples will fall from trees, it seems that what goes up in the grain market also comes down. After a sustained rally over recent weeks, some of the gains have been lost, however there are still good opportunities.

In the late 1600’s Sir Isaac Newton, developed the theory of gravity. It seems that in addition to determining that apples will fall from trees, it seems that what goes up in the grain market also comes down. After a sustained rally over recent weeks, some of the gains have been lost, however there are still good opportunities.

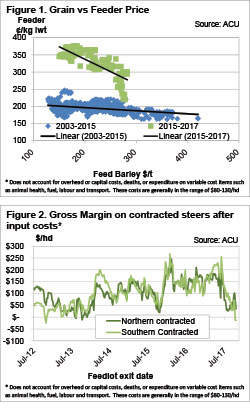

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news.

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news.

It doesn’t take a rocket analyst to work out why sheep and lamb prices have been sliding for the last month. The Eastern States Trade Lamb Indicator (ESTLI) this week broke through the 600¢ mark as the supply of stock direct to works appears to be reaching a peak.

It doesn’t take a rocket analyst to work out why sheep and lamb prices have been sliding for the last month. The Eastern States Trade Lamb Indicator (ESTLI) this week broke through the 600¢ mark as the supply of stock direct to works appears to be reaching a peak. It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.