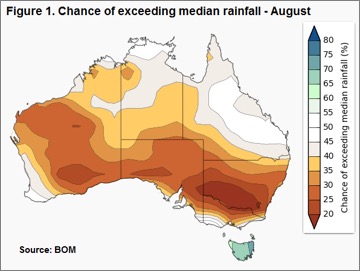

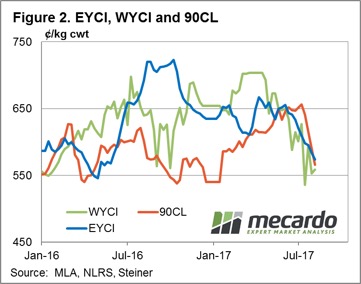

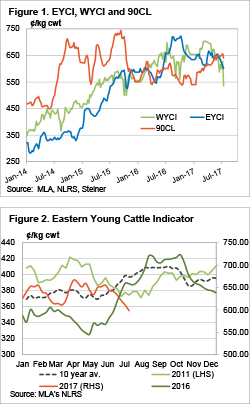

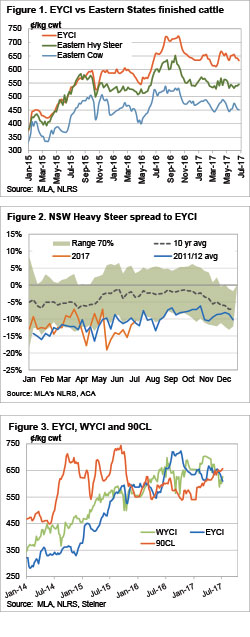

A combination of factors conspiring to see the Australian cattle market soften again this week with the headline Eastern Young Cattle Indicator (EYCI) off another 1.6% to close the week at 574¢/kg cwt. The Bureau of Meteorology (BOM) August rainfall outlook indicates the dry will persist for another month, while the resilient A$ and weaker 90CL continue to act as headwinds on local cattle prices.

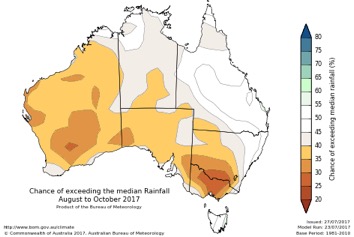

Figure 1 highlights the chance of rainfall exceeding the median levels for this time of year, and it looks particularly unfriendly to southern NSW. Despite much of Queensland enjoying a rosier picture, cattle prices here were among the softest this week with QLD Heavy and Feeder steers bearing the brunt of the negative sentiment – off 6.6% (260¢/kg lwt) and 6.2% (308¢/kg lwt) respectively. Meanwhile, Victorian saleyards registered Feeder steers and Trade steers as their weakest two categories, down 6.2% (301¢/kg lwt) and 4.2% (302¢/kg lwt) between them. In defiance of the BOM outlook the NSW markets were reasonably flat on the week, apart from Medium Cows, marked down 4.3% to 208¢/kg lwt.

Figure 1 highlights the chance of rainfall exceeding the median levels for this time of year, and it looks particularly unfriendly to southern NSW. Despite much of Queensland enjoying a rosier picture, cattle prices here were among the softest this week with QLD Heavy and Feeder steers bearing the brunt of the negative sentiment – off 6.6% (260¢/kg lwt) and 6.2% (308¢/kg lwt) respectively. Meanwhile, Victorian saleyards registered Feeder steers and Trade steers as their weakest two categories, down 6.2% (301¢/kg lwt) and 4.2% (302¢/kg lwt) between them. In defiance of the BOM outlook the NSW markets were reasonably flat on the week, apart from Medium Cows, marked down 4.3% to 208¢/kg lwt.

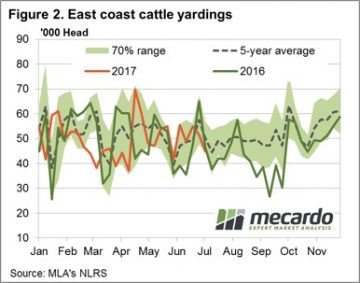

Western young cattle posted a slight rise to 559¢/kg cwt, a gain of 1.1% – figure 2. However, the star performer in WA saleyards were Feeder steers, posting a 9.3% lift to 294¢/kg lwt. Turning off shore, the 90CL frozen cow indicator dropped 4.1% to 566¢/kg CIF as US meat packers reduced their prices in an attempt to encourage an increase in forward orders.

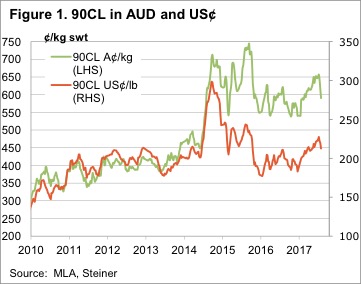

The effect of the stronger A$ being felt too in the 90CL price when converted into local currency terms. Indeed, had the Aussie dollar been at the level it was two months ago, sitting below 75US¢, the 90CL in A$ terms would still be above 600¢ this week.

The week ahead

Some reasonable rainfall is noted for much of WA and Victoria next week, but much of the rest of the country is expected to miss out again. A key factor for the EYCI to find a bit of a base in the next few weeks will be the movement in the 90CL and the A$.

Some reasonable rainfall is noted for much of WA and Victoria next week, but much of the rest of the country is expected to miss out again. A key factor for the EYCI to find a bit of a base in the next few weeks will be the movement in the 90CL and the A$.

Taking into account the unfavourable August forecast for rainfall it is unlikely that there will be significant improvement in cattle prices due to seasonal conditions. Producers keep your fingers crossed for a softening in the A$ and/or a lift in the 90CL to stem the EYCI decline and perhaps provide some stimulus for firmer prices.

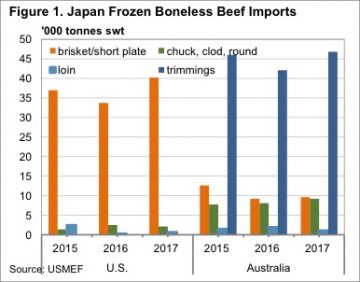

According to the US Meat Export Federation (USMEF), who have produced an excellent fact sheet, a vast majority of US frozen beef exports to Japan are grainfed brisket and short plate cuts. These cuts are used in gyudon beef bowl chain restaurants.

According to the US Meat Export Federation (USMEF), who have produced an excellent fact sheet, a vast majority of US frozen beef exports to Japan are grainfed brisket and short plate cuts. These cuts are used in gyudon beef bowl chain restaurants. The first story states that US herd expansion is continuing. The latest numbers on the US cattle herd from the United States Department of Agriculture (USDA) put the herd at 102.6 million head. This is a 6 year high, and up 7 million head from the 2014 low. The US have added the equivalent of 25% of the Australian herd in just 3 years.

The first story states that US herd expansion is continuing. The latest numbers on the US cattle herd from the United States Department of Agriculture (USDA) put the herd at 102.6 million head. This is a 6 year high, and up 7 million head from the 2014 low. The US have added the equivalent of 25% of the Australian herd in just 3 years. Finally, we come to the fifth story, which is more of the same on the weather forecasting front (Figure 2). While key cattle areas of Queensland and Northern NSW are back at a 50:50 chance of getting more than the median rainfall, the dry is forecast to continue for southern NSW and much of Victoria.

Finally, we come to the fifth story, which is more of the same on the weather forecasting front (Figure 2). While key cattle areas of Queensland and Northern NSW are back at a 50:50 chance of getting more than the median rainfall, the dry is forecast to continue for southern NSW and much of Victoria.

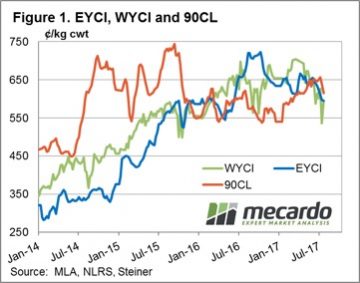

The 90CL frozen cow beef export indicator continued to slide this week, dragged down by a reduction in boxed beef forward sales in the US over the last few weeks. US meatworks report an 18% drop in forward bookings so have realigned their pricing to lower levels in order to attract additional forward sales interest. The 90CL settling 3.1% softer to close at 615¢/kg CIF – Figure 1.

The 90CL frozen cow beef export indicator continued to slide this week, dragged down by a reduction in boxed beef forward sales in the US over the last few weeks. US meatworks report an 18% drop in forward bookings so have realigned their pricing to lower levels in order to attract additional forward sales interest. The 90CL settling 3.1% softer to close at 615¢/kg CIF – Figure 1. Despite the fall in the 90CL this week the indicator remains above the EYCI, combined with the steady decline in cattle yardings, this should start to add some support to cattle prices at the current level. Although, the rain forecast for next week shows limited falls to the southern tip of the nation so it’s unlikely that prices will get too much of a kick up. Consolidation at current levels seems the order of the day.

Despite the fall in the 90CL this week the indicator remains above the EYCI, combined with the steady decline in cattle yardings, this should start to add some support to cattle prices at the current level. Although, the rain forecast for next week shows limited falls to the southern tip of the nation so it’s unlikely that prices will get too much of a kick up. Consolidation at current levels seems the order of the day.

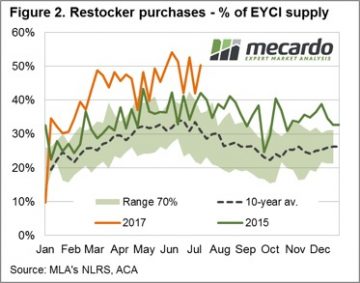

When we set out to write this article, we thought it was going to be about how restocker demand was on the wane, and one of the reasons the cattle market was falling. While restockers are paying less, they are still buying plenty of cattle.

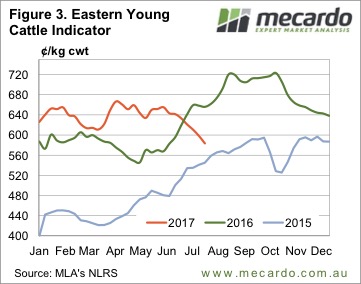

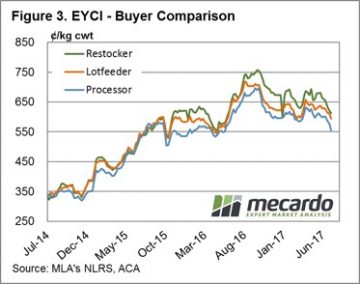

When we set out to write this article, we thought it was going to be about how restocker demand was on the wane, and one of the reasons the cattle market was falling. While restockers are paying less, they are still buying plenty of cattle. This is somewhat confirmed by the smaller fall in the price paid by feeders for EYCI cattle over the last six weeks. Figure 3 shows that feeders are paying 7% less than at the start of June, while restockers are down 10% and processors price have weakened 8%.

This is somewhat confirmed by the smaller fall in the price paid by feeders for EYCI cattle over the last six weeks. Figure 3 shows that feeders are paying 7% less than at the start of June, while restockers are down 10% and processors price have weakened 8%. Stronger supply of light store cattle is not the only reason for the weaker EYCI, but it is contributing. For those lucky enough to have feed on hand, the fact the restocker cattle are now more in line with historical premiums to the EYCI means they are reasonable buying.

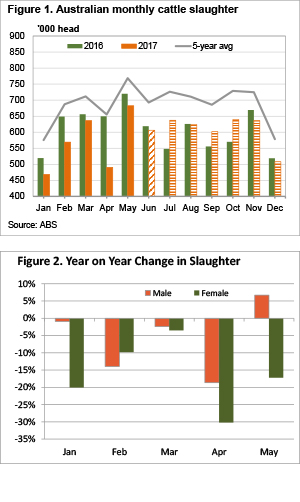

Stronger supply of light store cattle is not the only reason for the weaker EYCI, but it is contributing. For those lucky enough to have feed on hand, the fact the restocker cattle are now more in line with historical premiums to the EYCI means they are reasonable buying. As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate.

As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate. The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

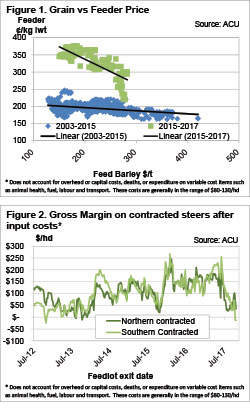

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news.

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news. It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

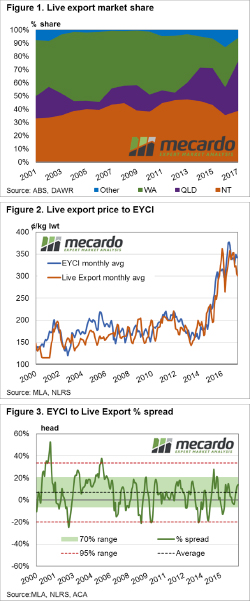

It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle. It has been some time since we had a look at live cattle exports so we thought it timely to focus in on the changing market share of the live cattle trade among the key export states, along with the price relationships that exist between live cattle and domestic young cattle.

It has been some time since we had a look at live cattle exports so we thought it timely to focus in on the changing market share of the live cattle trade among the key export states, along with the price relationships that exist between live cattle and domestic young cattle.