The hay market is set for another hot year. Supplies have dwindled but there are reports of plenty of crop being cut. Part of Victoria, South Australia and Tasmania are having good seasons, after dry summers, and this week we look at the numbers on cutting hay, or buying cattle.

Having excess feed is a good problem to have, but deciding how to use it can be tricky. Hay is expensive, and making it will be preferable to buying in supplementary feed, but the numbers are tighter this year than last.

Last year we went through the costs of making hay in grassfed sheep and cattle operations and the same calculations apply this year. The cost of making 5t of hay per hectare comes in at $567/ha, or $113/t.

With Dairy Australia quoting good quality pasture hay at $250-300 ex-farm for good quality pasture hay there appears to be a solid margin of $685-835/ha in making hay this year. Historically we haven’t seen much better margins in hay, but there are always other options.

We know store cattle prices are at all-time lows relative to feeder and finished cattle, so we might be better off converting excess feed into beef rather than selling it to someone else to do the same.

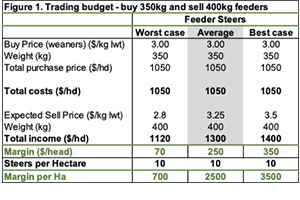

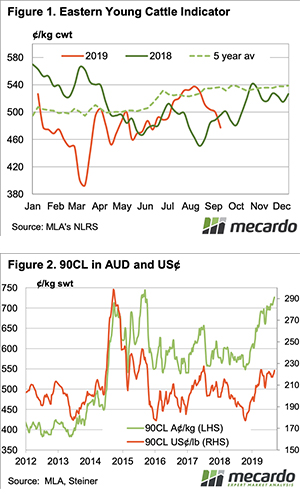

Figure 1 shows some rough numbers on buying 350kg steers and adding 50kgs to take to feeder weight of 400kgs. We are assuming cattle will take off 5t per hectare, and pastures should be able to handle the heavy stocking rate of 10 steers per hectare at this time of year. After 60 days cattle should have at least gained 50kgs and possibly more.

Lower end feeder prices of 280¢/kg lwt would result in a margin of $700/ha before any costs were included. As feeder prices increase the margins improve rapidly. Angus feeder steers are currently making up to 350¢/kg lwt, which gives a margin per hectare of $3,500, way in front of hay making margins.

What does it mean/next week?:

While making hay will be cheaper than buying hay or grain this year, if grass is surplus to requirements there is likely to be better money in converting it to beef directly. Obviously there is price and production risk involved in cattle trading, but there is also plenty of risk in making hay.

Those planning to make hay to supplement feed in summer and autumn might be better off trading stock and using the profit to buy grain. Obviously detailed calculations need to be done on this, but it’s worth thinking about.

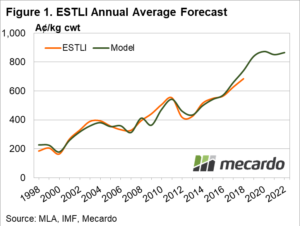

Predictor inputs to the lamb and mutton pricing models include an annual average A$ forecast, annual slaughter volumes (as outlined by MLA sheep industry projections), an annual climate factor, per capita, GDP levels of key importing nations and sheepmeat export volumes to key destinations.

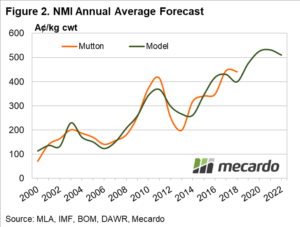

Predictor inputs to the lamb and mutton pricing models include an annual average A$ forecast, annual slaughter volumes (as outlined by MLA sheep industry projections), an annual climate factor, per capita, GDP levels of key importing nations and sheepmeat export volumes to key destinations. National Mutton Indicator modelling shows similarly strong predictions for the next four years with the forecast tool indicating an annual average NMI remaining above 500¢ for the 2020 to 2022 period (Figure 2). The 2020 season is expected to see an annual NMI of 525¢, with a potential range of 405¢ to 640¢ from the seasonal trough to peak during the year. The NMI for 2021 is expected to average 531¢, easing to 510¢ for the 2022 season.

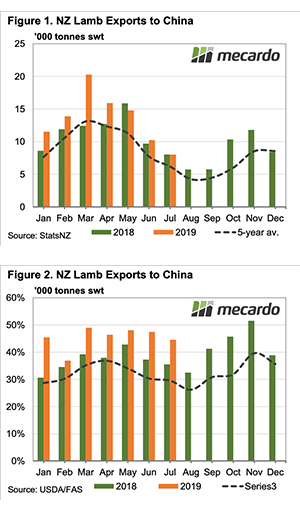

National Mutton Indicator modelling shows similarly strong predictions for the next four years with the forecast tool indicating an annual average NMI remaining above 500¢ for the 2020 to 2022 period (Figure 2). The 2020 season is expected to see an annual NMI of 525¢, with a potential range of 405¢ to 640¢ from the seasonal trough to peak during the year. The NMI for 2021 is expected to average 531¢, easing to 510¢ for the 2022 season. A scenario of dramatically increased demand for sheepmeat from China would see forecast price levels elevated further.

A scenario of dramatically increased demand for sheepmeat from China would see forecast price levels elevated further.