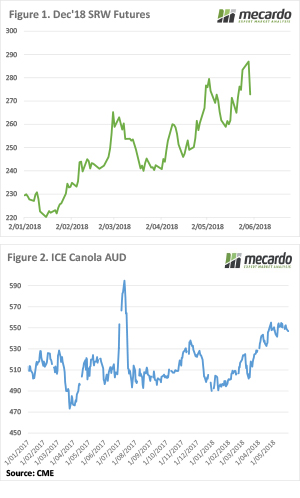

Chicago Soft Red Wheat managed to maintain its upward trend this week. It had an attempt at moving lower but bounced stronger on Wednesday night. Local wheat prices also tried to go lower but found strength on Thursday.

Chicago Soft Red Wheat managed to maintain its upward trend this week. It had an attempt at moving lower but bounced stronger on Wednesday night. Local wheat prices also tried to go lower but found strength on Thursday.

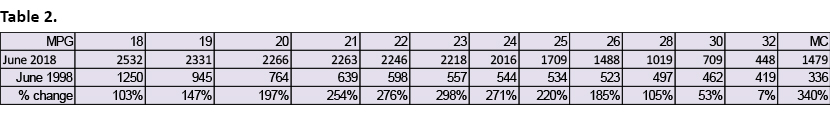

Figure 1 shows CBOT wheat in AUD/t sitting just below the highs hit at the end of May. Still, $267/t is close to the best swap price we have seen for the December contract since 2015. The market did move a little lower earlier in the week before recovering. Apparently there was some speculator profit-taking triggered by the higher levels, and the Aussie dollar found some strength this week.

The AUD is actually back at 76.5US¢, its highest level in six weeks thanks to some stronger economic data.

Locally wheat prices followed CBOT’s trend, finishing the week on a high. While new crop APW basis in the Newcastle zone is at around $100/t basis, in the south it’s close to $50/t (Figure 2). If crop prospects continue to weaken Geelong basis could rally to $80-100/t as well, so at $320/t it could end up being cheap.

Old crop markets continue to tighten, with any remaining grain being held tight, and buyers having to pump up prices to get hold of it. A good rain and some grass growth might take some of the pressure off demand, but supply relief won’t turn up until the new crop arrives; if it does at all.

The week ahead

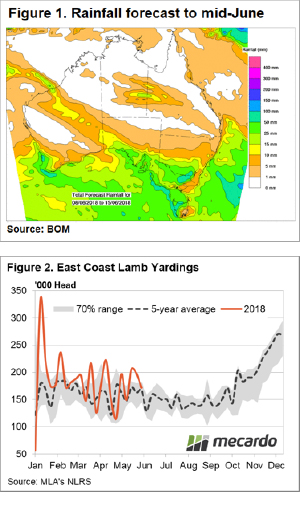

Figure 3 shows some good rain forecast for Victoria and southern NSW this week. In fact, most of the Mallee, parts of the Riverina and SA are expected to get their monthly average rainfall over the coming 8 days. This will give crops a start, but with no subsoil moisture, follow up will be required before the heat comes out of markets.

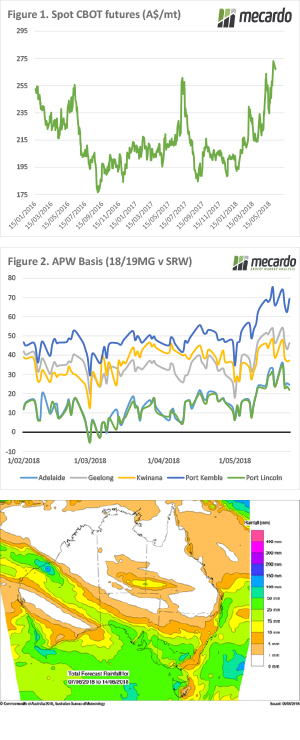

Another week and another high for slaughter rates. It seems, however, supply may have eased a little this week, as the Eastern Young Cattle Indicator managed to gain ground for the first time in a month and posted its biggest gain since March.

Another week and another high for slaughter rates. It seems, however, supply may have eased a little this week, as the Eastern Young Cattle Indicator managed to gain ground for the first time in a month and posted its biggest gain since March.

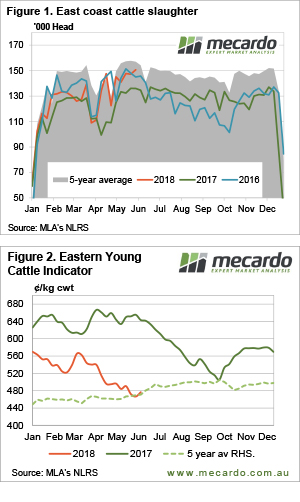

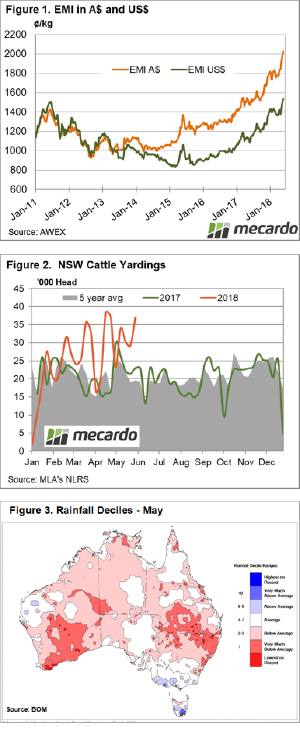

The most recent update to the ABS cattle slaughter data shows a jump in the ratio of female cattle slaughtered as a proportion of the total kill. The average annual ratio now sits at 48% signifying that we are technically in a herd destocking phase.

The most recent update to the ABS cattle slaughter data shows a jump in the ratio of female cattle slaughtered as a proportion of the total kill. The average annual ratio now sits at 48% signifying that we are technically in a herd destocking phase.

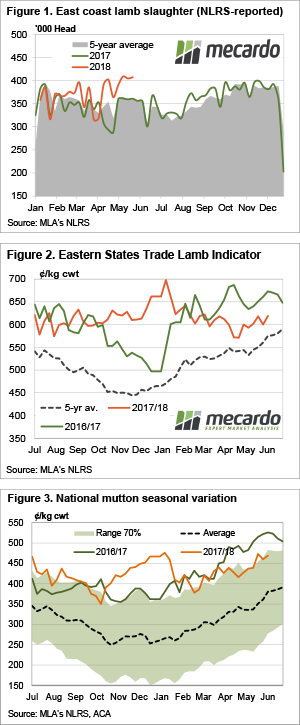

For the first time in a while, there is the prospect of 25-50 mm of rainfall into parts of southern NSW desperate for some relief. Falls are expected to extend into South Australia and Victoria and this has encouraged a drop in lamb throughput levels this week from the elevated trend we have seen during May, in turn providing a boost to lamb prices.

For the first time in a while, there is the prospect of 25-50 mm of rainfall into parts of southern NSW desperate for some relief. Falls are expected to extend into South Australia and Victoria and this has encouraged a drop in lamb throughput levels this week from the elevated trend we have seen during May, in turn providing a boost to lamb prices.

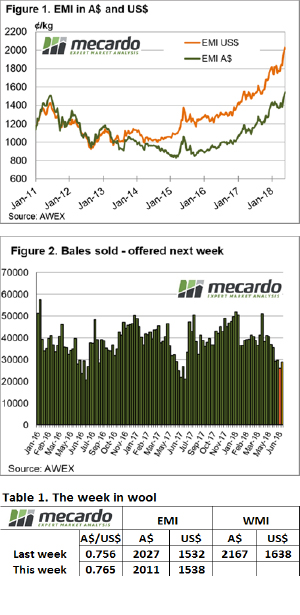

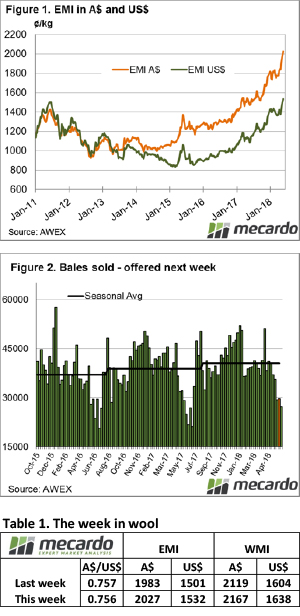

For the last month the wool market has gone from strength to strength, but alas, the upwards stream has come to a halt. That is, unless you look from a US$ perspective. Despite the small offering due to no sales in Fremantle, most categories retracted from the outset on Tuesday.

For the last month the wool market has gone from strength to strength, but alas, the upwards stream has come to a halt. That is, unless you look from a US$ perspective. Despite the small offering due to no sales in Fremantle, most categories retracted from the outset on Tuesday.  The wheat yo-yo continued in the US as they approach harvest. Chicago Soft Red Wheat rallied to new highs this week, before easing back again. The charts are pointing to more upside, but supply will soon start rolling in.

The wheat yo-yo continued in the US as they approach harvest. Chicago Soft Red Wheat rallied to new highs this week, before easing back again. The charts are pointing to more upside, but supply will soon start rolling in.

The Eastern Young Cattle Indicator (EYCI) continues to trek lower as cattle yardings reach a five-week peak, underpinned by high NSW cattle throughput. The EYCI closed this week 1.1% lower at 466.5¢/kg cwt, while its Western counterpart shed 3.2%. Despite the bigger fall in WA young cattle prices, producers there are still enjoying an 11% premium over their East coast neighbours, with the Western Young Cattle Indicator (WYCI) closing the week at 523.75¢/kg cwt.

The Eastern Young Cattle Indicator (EYCI) continues to trek lower as cattle yardings reach a five-week peak, underpinned by high NSW cattle throughput. The EYCI closed this week 1.1% lower at 466.5¢/kg cwt, while its Western counterpart shed 3.2%. Despite the bigger fall in WA young cattle prices, producers there are still enjoying an 11% premium over their East coast neighbours, with the Western Young Cattle Indicator (WYCI) closing the week at 523.75¢/kg cwt.

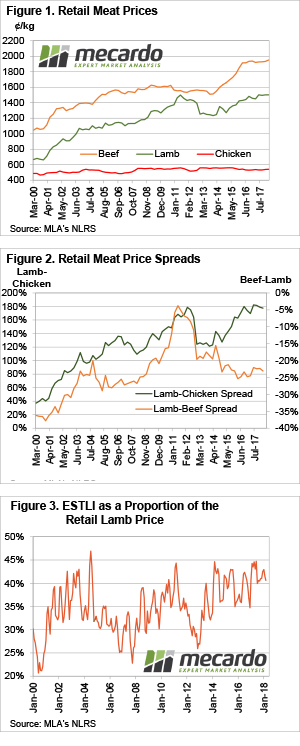

Since hitting a peak back at the start of the year, lamb prices have eased and found somewhat of a base around the 600¢/kg cwt mark. We know that strong demand has been driven by export markets, but there appears to be a limit to how much the local consumer is prepared to pay for their lamb.

Since hitting a peak back at the start of the year, lamb prices have eased and found somewhat of a base around the 600¢/kg cwt mark. We know that strong demand has been driven by export markets, but there appears to be a limit to how much the local consumer is prepared to pay for their lamb.

After the TFI fire in January, you’d have been thought crazy if you said that weekly east coast lamb slaughter would spend most of May above 400,000 head. Even crazier if you said sheep slaughter would be 30,000 head higher than last year, yet here we are.

After the TFI fire in January, you’d have been thought crazy if you said that weekly east coast lamb slaughter would spend most of May above 400,000 head. Even crazier if you said sheep slaughter would be 30,000 head higher than last year, yet here we are.

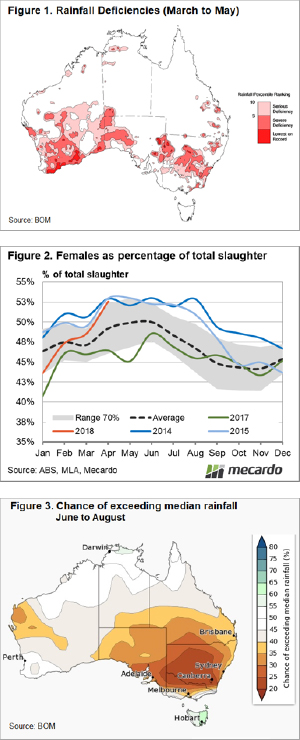

Who would have thought that 2,000 cents were possible for the EMI, or that only the 25 MPG and broader would sit below the 2000 cent level?

Who would have thought that 2,000 cents were possible for the EMI, or that only the 25 MPG and broader would sit below the 2000 cent level?