Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

Figure 1 shows east coast cattle slaughter jumping higher in the week ending the 17th November. This was largely thanks to Queensland, but slaughter rates moved higher in Victoria and NSW as well. East coast cattle slaughter last week sat just 3% below the same time last year (figure 1).

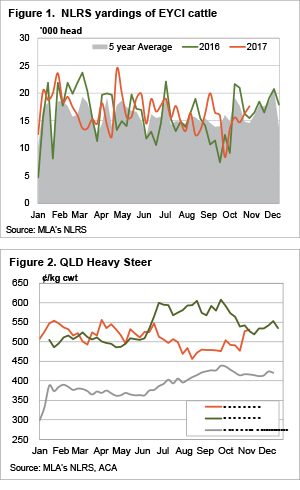

Slaughter cattle prices remained relatively steady this week, maybe due to the sharp jump higher in 90CL export prices. The 90CL Frozen Cow gained 18¢ to hit a five month high of 618¢/kg swt (figure 2). Driving export prices higher has been limited supplies from Australia and New Zealand, along with a weakening Aussie dollar.

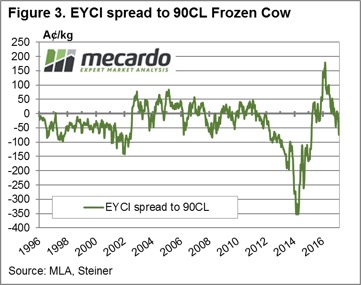

The 90CL export prices is now nearly 7% higher than this time last year. So if export prices are higher than last year, and cattle slaughter lower, prices should be higher, right? Well no, figure 3 shows the Queensland Heavy Steer Indicator has improved, but it’s near the same price as last year.

As we noted earlier in the week, cattle supplies out of feedlots appears to be keeping a lid on cattle price rises, although the latest jump in export prices could see prices creep a bit higher.

In the west young cattle prices are basically the same as those in the east. Normally WA cattle prices start to head towards lows at this time of year, but limited supplies continues to support values.

The week ahead

The good wet season is set to continue for Northern NSW cattle producers, with 50-100mm forecast for next week. This bodes well for young cattle prices to at least hold current levels, and possibly improve. Finished cattle could see some benefit as well, but processors will have to want to push slaughter above last year’s levels. The weakening Aussie dollar should help on this front.

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle.

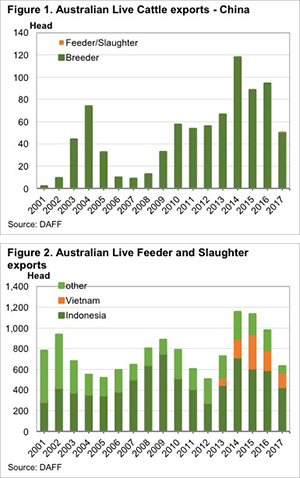

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle. According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not?

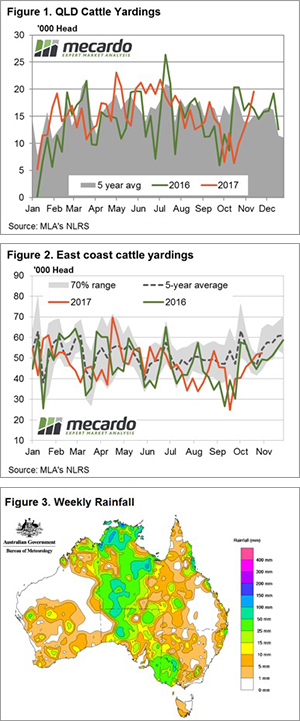

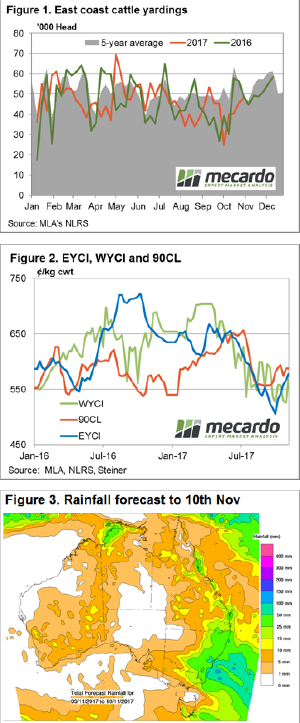

According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not? Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State.

Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State. The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

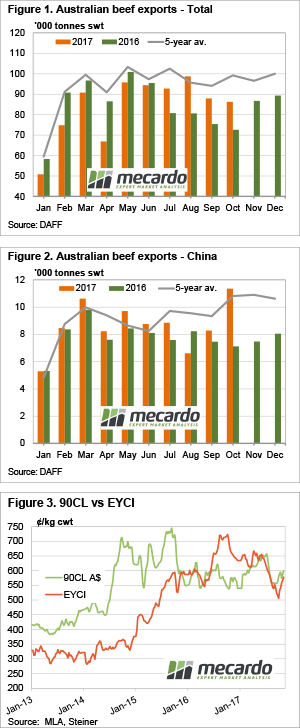

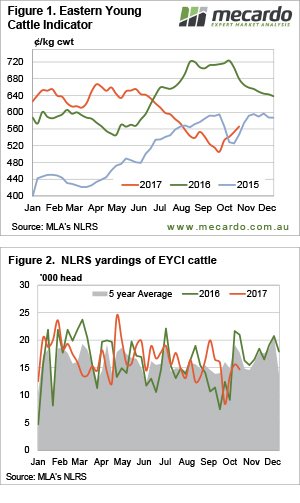

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators. It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October. Most of the eastern states received rainfall this week and despite higher throughput young cattle prices continued to climb, with the benchmark Eastern Young Cattle Indicator (EYCI) closing up 1.8% to see it at 577.50¢/kg cwt this week.

Most of the eastern states received rainfall this week and despite higher throughput young cattle prices continued to climb, with the benchmark Eastern Young Cattle Indicator (EYCI) closing up 1.8% to see it at 577.50¢/kg cwt this week.

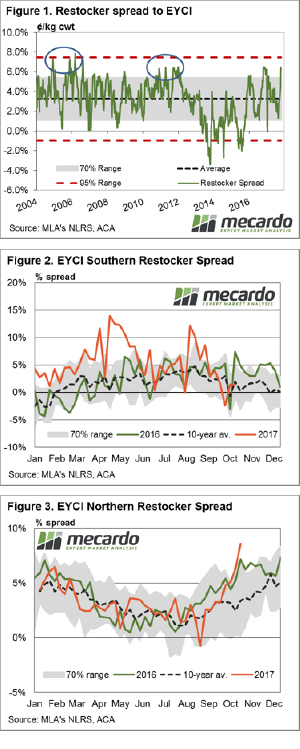

Analysis of the underlying saleyard data that is used to create the Eastern Young Cattle Indicator (EYCI) shows that optimism of restockers has been increasing during October as they appear more prepared to pay a premium to secure young cattle. This piece delves a bit deeper into the figures to see if the renewed restocker interest is part of the normal seasonal cycle or if there is something more behind it.

Analysis of the underlying saleyard data that is used to create the Eastern Young Cattle Indicator (EYCI) shows that optimism of restockers has been increasing during October as they appear more prepared to pay a premium to secure young cattle. This piece delves a bit deeper into the figures to see if the renewed restocker interest is part of the normal seasonal cycle or if there is something more behind it. More wet weather this week cut cattle yardings in Queensland, and encouraged restockers to return to the market in NSW. At a time of year when prices generally fall, or are steady, we saw a further appreciation in the Eastern Young Cattle Indicator (EYCI), but not in all categories.

More wet weather this week cut cattle yardings in Queensland, and encouraged restockers to return to the market in NSW. At a time of year when prices generally fall, or are steady, we saw a further appreciation in the Eastern Young Cattle Indicator (EYCI), but not in all categories.

The Eastern Young Cattle Indicator (EYCI) lifted again this week, recovering a further 3% to see it close at 558.50¢/kg cwt with some good rainfall to much of Queensland providing a bit of a boost. Gains noted too across the East coast for Heavy and Feeder Steers, up 1-2% to round out a reasonably firm performance for cattle markets.

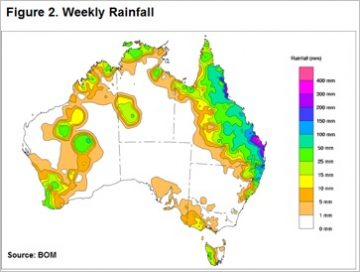

The Eastern Young Cattle Indicator (EYCI) lifted again this week, recovering a further 3% to see it close at 558.50¢/kg cwt with some good rainfall to much of Queensland providing a bit of a boost. Gains noted too across the East coast for Heavy and Feeder Steers, up 1-2% to round out a reasonably firm performance for cattle markets. It points to how much optimism was sapped out of restocker buying activity during the Winter dry spell, but that may change if the northern rains continue and NSW starts to get a bit of decent rainfall too. Figure 2 shows the national rain tally over the last week with Queensland the clear beneficiary and next week’s forecast calls for a continuation across much of the north and spreading into NSW which should continue to support demand for young cattle by restockers.

It points to how much optimism was sapped out of restocker buying activity during the Winter dry spell, but that may change if the northern rains continue and NSW starts to get a bit of decent rainfall too. Figure 2 shows the national rain tally over the last week with Queensland the clear beneficiary and next week’s forecast calls for a continuation across much of the north and spreading into NSW which should continue to support demand for young cattle by restockers. After a recent lift the 90CL is knocking on the door of 600¢/kg CIF again and with the Bureau forecast of a fairly normal November rainfall pattern and a good chance of a slightly wetter than average December all indications are for continued support for young cattle prices in the coming weeks.

After a recent lift the 90CL is knocking on the door of 600¢/kg CIF again and with the Bureau forecast of a fairly normal November rainfall pattern and a good chance of a slightly wetter than average December all indications are for continued support for young cattle prices in the coming weeks.