When we set out to write this article, we thought it was going to be about how restocker demand was on the wane, and one of the reasons the cattle market was falling. While restockers are paying less, they are still buying plenty of cattle.

When we set out to write this article, we thought it was going to be about how restocker demand was on the wane, and one of the reasons the cattle market was falling. While restockers are paying less, they are still buying plenty of cattle.

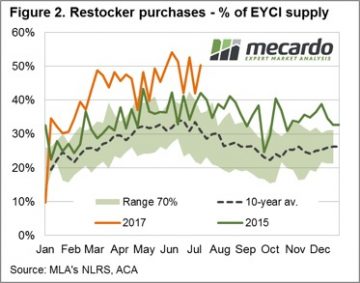

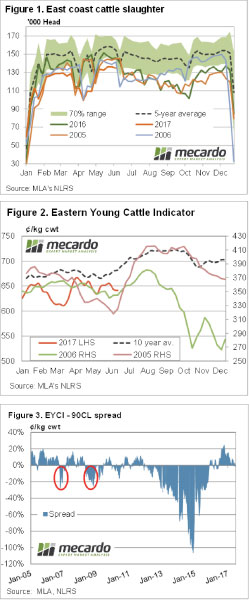

With the dry weather being experienced across much of the east coast, we expected to find restocker demand had been weaker. Figure 1 shows the spread of the price paid by restockers for EYCI cattle, compared to the EYCI itself.

Restockers are not paying as much of a premium as they were, but it has only fallen back to average. Last spring and summer restockers were paying 4-6% more than the EYCI. As the restocker premium eased in March, as did the EYCI. When restocker demand ramped up again, the EYCI rallied, and subsequently fell again, seemingly on the back of the restocker premium falling from 4% to 2%.

With the weakening in the restocker premium, figure 2 shows that restockers are not buying any smaller proportion of cattle. Over the last 9 weeks restockers have bought 49% of EYCI cattle, compared to just 38% over the same period last year. It would seem the falling premium being paid by restockers is more due to increased supplies of suitable cattle.

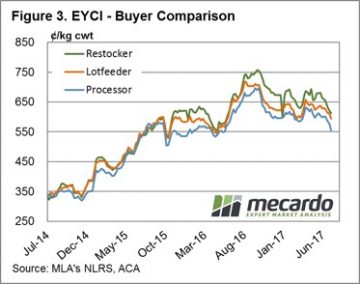

This is somewhat confirmed by the smaller fall in the price paid by feeders for EYCI cattle over the last six weeks. Figure 3 shows that feeders are paying 7% less than at the start of June, while restockers are down 10% and processors price have weakened 8%.

This is somewhat confirmed by the smaller fall in the price paid by feeders for EYCI cattle over the last six weeks. Figure 3 shows that feeders are paying 7% less than at the start of June, while restockers are down 10% and processors price have weakened 8%.

It does stand to reason that during dry times more light cattle, suitable for restockers, will come to market. This also means that fewer heavier store cattle suitable feeders will be available, while the supply of finished cattle, for processors will be even weaker.

We are still some way from the drought spreads of 2014-15, when restockers, feeders and processors were all paying the same price.

Key points:

- Dry weather has pushed the EYCI lower, with the restocker premium falling back to average levels.

- Restockers are still buying plenty of EYCI cattle, which suggests supplies of restockers types are higher.

- Widespread rain would see a turnaround in light cattle supply and restocker demand.

What does this mean?

Stronger supply of light store cattle is not the only reason for the weaker EYCI, but it is contributing. For those lucky enough to have feed on hand, the fact the restocker cattle are now more in line with historical premiums to the EYCI means they are reasonable buying.

Stronger supply of light store cattle is not the only reason for the weaker EYCI, but it is contributing. For those lucky enough to have feed on hand, the fact the restocker cattle are now more in line with historical premiums to the EYCI means they are reasonable buying.

Widespread rainfall on the east coast would see a rapid turnaround in young cattle supply and prices, but there isn’t much encouragement on the forecast. Further dry weather is likely to see the EYCI continue to ease, and the restocker premium fall back to zero.

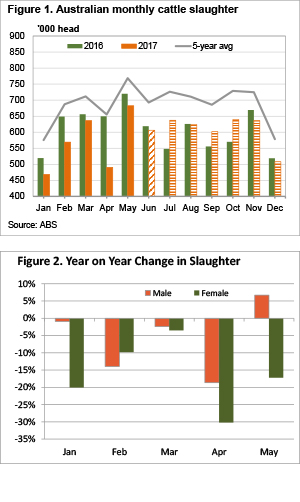

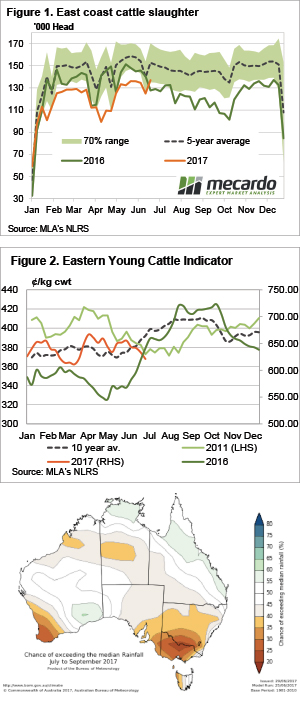

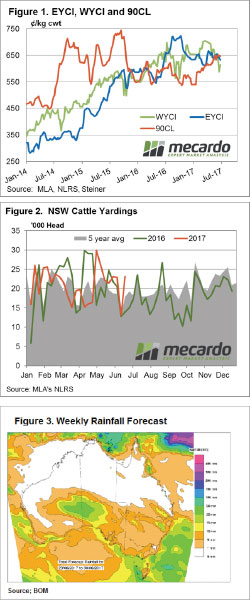

As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate.

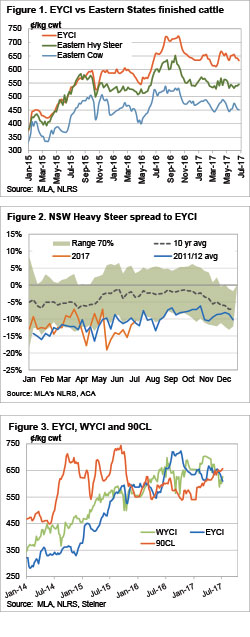

As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate. The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

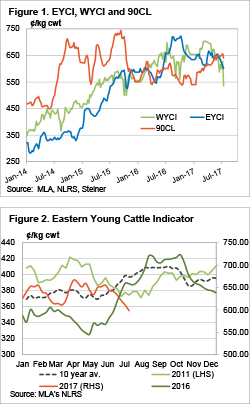

The Eastern Young Cattle Indicator (EYCI) fell for the sixth straight week, and took most other indicators with it. In the West prices tanked, but it might be an outlier. The story remains the same, with dry weather and relatively high prices encouraging offloading of stock.

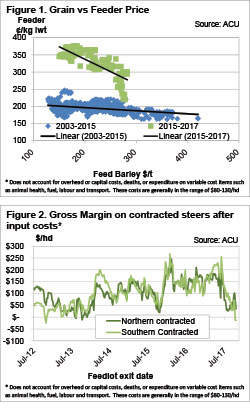

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news.

Grain prices have been on the rise. So what? A cattle producer might ask. How will it impact me? It depends what sort of cattle are being produced, but if it’s feeder cattle, rising grain prices are not good news. It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle.

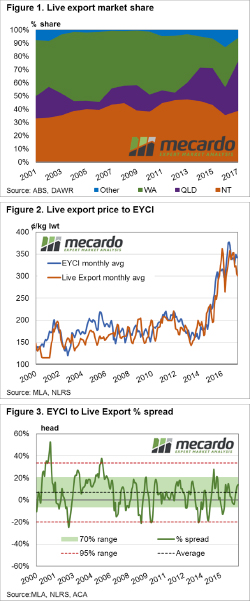

It was a better week for rainfall, with sporadic showers across the country, but it didn’t help the young cattle market. The Eastern Young Cattle Indicator (EYCI) continued its fall this week, but there was some support for slaughter cattle. It has been some time since we had a look at live cattle exports so we thought it timely to focus in on the changing market share of the live cattle trade among the key export states, along with the price relationships that exist between live cattle and domestic young cattle.

It has been some time since we had a look at live cattle exports so we thought it timely to focus in on the changing market share of the live cattle trade among the key export states, along with the price relationships that exist between live cattle and domestic young cattle. Here’s a quiz question. When was the last time the Eastern Young Cattle Indicator (EYCI) finished June lower than it started? You’ll have to read the article to find out….

Here’s a quiz question. When was the last time the Eastern Young Cattle Indicator (EYCI) finished June lower than it started? You’ll have to read the article to find out…. A good recovery staged by Queensland across the board, while NSW disappoints… no I’m not talking about the State of Origin – although the phrase fits there too! Actually, it’s the cattle market this week. Despite the national market indicators posting largely flat results, with weekly moves of less than 2% either way some state based indicators saw more substantial action.

A good recovery staged by Queensland across the board, while NSW disappoints… no I’m not talking about the State of Origin – although the phrase fits there too! Actually, it’s the cattle market this week. Despite the national market indicators posting largely flat results, with weekly moves of less than 2% either way some state based indicators saw more substantial action.  Whether or not you believe the Bureau of Meteorology (BOM) three month forecast, there is always the chance the current dry spell could continue. Dry winter’s and springs are not great for cattle prices, but given the current historically strong values, how bad could it get?

Whether or not you believe the Bureau of Meteorology (BOM) three month forecast, there is always the chance the current dry spell could continue. Dry winter’s and springs are not great for cattle prices, but given the current historically strong values, how bad could it get? It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices.

It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices.