Mid-January saw China and the USA sign off on phase one of a new trade deal, using pre-trade war volumes from 2017 as a benchmark for expansion in trade volumes. While it is still early days in the negotiation a key aim of the Trump administration is to get China to import more US agricultural products, with US beef and pig farmers excited by this prospect.

As part of the broader deal, China has agreed to increase purchases of US agricultural products with an aim to hit $US43 billion in trade value by 2021. In 2017 China imported less than $US25 billion of US agricultural products – the bulk of which was soybean to feed their huge pig inventory.

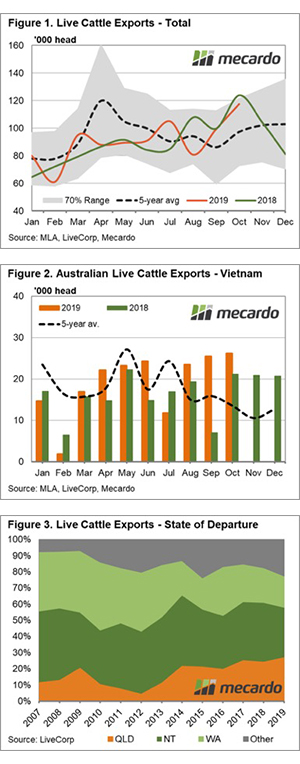

In terms of meat imports into China from the US the beef industry never really gained a foothold, with the US holding less than 1% of the market share of Chinese beef imports in 2017. US pork producers had a far better penetration with 12% of Chinese pork imports in 2017.

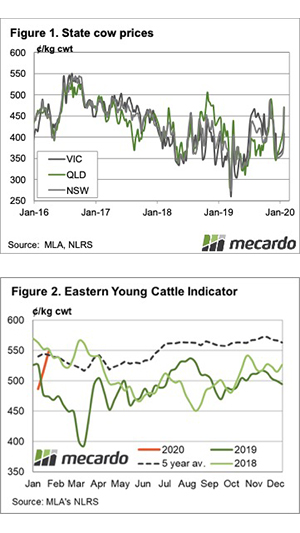

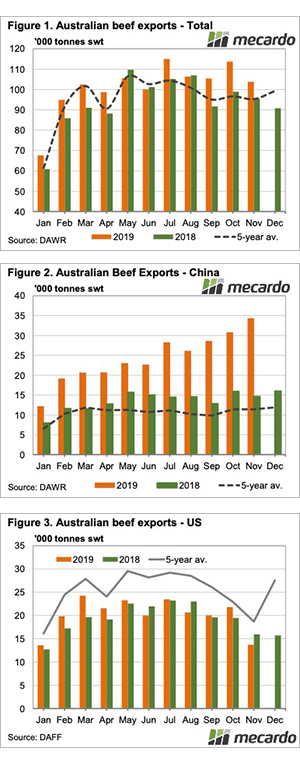

A comparison of meat imports into China (of all types of meat except fish/seafood) during the 2017-2018 period shows that US market share declined significantly compared to other key trading nations from 12.5% to 4.9%, due to the increase of tariffs imposed by China and growing trade hostilities – Figure 1.

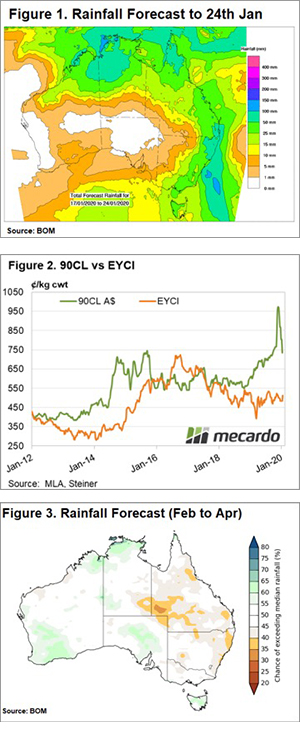

The US market share of Chinese meat imports dropped by 60%. In contrast, Argentina captured nearly 60% more market share, while Brazil, Australia, and NZ all saw their market share increase by over 20% during the 2017 to 2018 period – Figure 2.

To hit the $US43 billion target in two years’ time there would need to be a significant shift in trade flows into China, with a clear preference for US product. In terms of pork and sheepmeat, this isn’t a huge direct competition for Australian producers as Australia doesn’t export significant volumes of pork to China and the US don’t really have a sheep/lamb export presence on an international level.

Historically, there have been a few barriers to entry into China for US beef producers, namely the lack of traceability and concerns around the use of hormone growth promotants. However, part of the trade negotiations agreed to this month was seeking to address these barriers and open a clearer path for US beef into China.

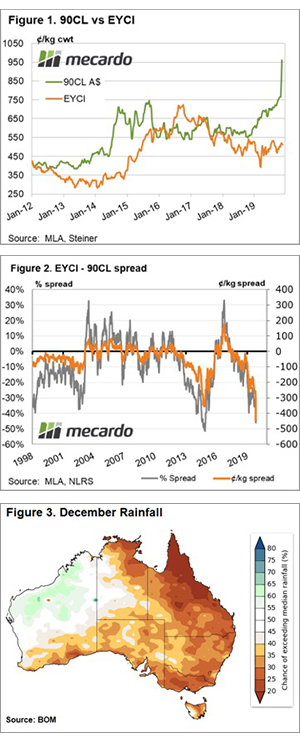

Remember to look out for our upcoming podcast delving further into this topic, including an assessment of the impact across a variety of Australian agricultural sectors – Figure 3. It is still in the recording studio at present, but you will be able to find the podcast by clicking the link to “Commodity Conversations” after Australia day.

What does it mean/next week?

Matters of trade are highly complex situations with many moving parts. Addressing the implications for the Australian agricultural sector of this new trade deal between the US and China is a topic too broad for a standard Mecardo analysis piece, but we will be discussing it at length in our podcast series entitled “Commodity Conversations”.

The abridged summary of our thoughts in relation to the impact on Australian sheepmeat and pork producers is that it is limited. In terms of the impact on our beef sector, the jury is out when assessing over the longer term. But in the short term, we don’t see any immediate risk to Australian beef flows into China from the US during 2020.