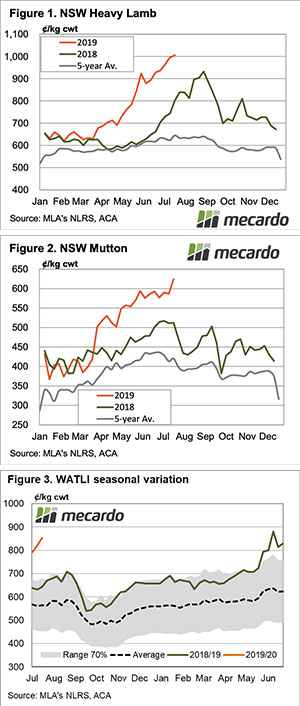

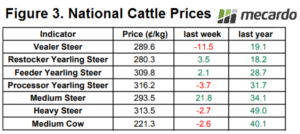

Just over two weeks ago the Eastern States Trade Lamb Indicator (ESTLI) was peaking at 951¢/kg cwt and yesterday it closed at 851¢ – how quickly sale yard sentiment can change as we approach the spring flush.

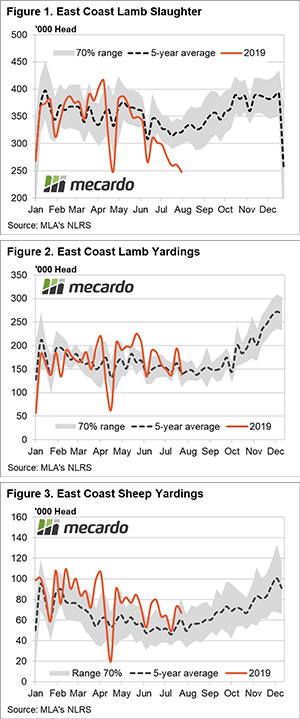

We aren’t in the depths of the spring flush yet, although Meat and Livestock Australia (MLA) reported this week of some early signs of new season lambs starting to show up in NSW. Meanwhile east coast lamb slaughter made a new seasonal low last week with under 248,000 head processed – Figure 1.

The reduced processor activity showing up at sale yard prices this week across the country with all national lamb and sheep indicators reported by MLA posting declines between 9-31¢ on a cwt basis. The National Trade Lamb Indicator (NTLI) easing by the greatest magnitude with a 3.6% drop to 842¢/kg.

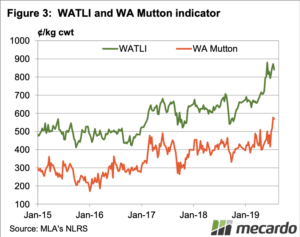

The National Mutton Indicator (NMI) not far behind, reporting a 3.3% fall to rest at 559¢. The NMI feeling the impact of softer mutton price in the West, with WA Mutton off 85¢ to close at 484¢. Mutton prices on the east coast managing to remain at reasonably good historic levels between 565¢-605¢

Restocker Lambs the least impacted, only 1.1% lower to finish at 801¢/kg cwt, boosted by strong gains to Victorian Restocker Lambs which were up 48¢ on the week.

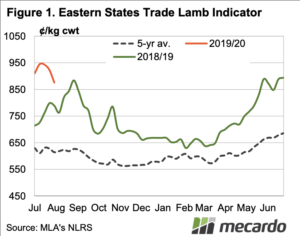

Producers responding to easing lamb prices over the last fortnight by pulling back throughput with the east coast yarding levels easing 29% from the week prior to sit fractionally below the five-year seasonal average levels for this time in the year – Figure 2.

East coast producers seemingly happy with the current mutton prices nearer to the $6 region as mutton throughput continues to trek along the upper boundary of the normal seasonal range averaging over 63,000 head per week over the last month, which is 20% above the five-year trend -Figure 3.

Next week

The magnitude of the recent fall in the ESTLI seems a bit of an over-reaction given we are yet to see any significant numbers presenting at the sale yard. Some good rain again to the southern regions this week will also help stabilise the market so I would anticipate a consolidation of prices at current levels in the short term and the chance of a small rally before we head lower again.

Although, don’t expect to see the ESTLI back near 950¢ this season as I think we have seen peak a few weeks back.

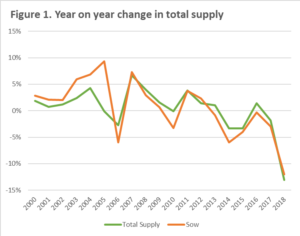

African Swine Fever is one of the worst ailments to hit pigs, and it is currently flowing its way throughout China. There are a wide range of estimates of the potential damage, ranging from very low government estimates (1m head) through to industry estimates of >200m.

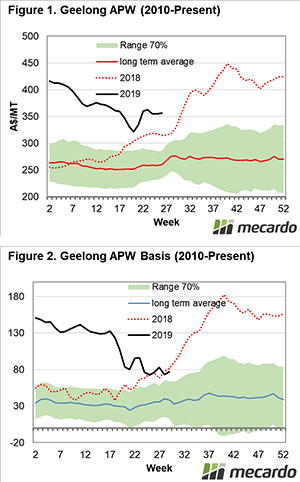

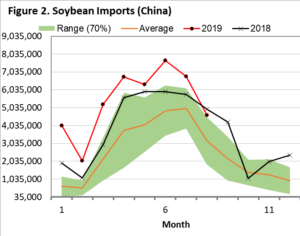

African Swine Fever is one of the worst ailments to hit pigs, and it is currently flowing its way throughout China. There are a wide range of estimates of the potential damage, ranging from very low government estimates (1m head) through to industry estimates of >200m. In figure 2, the seasonality of soybean imports into China are shown from 2012 to present. Interestingly when I ran these numbers, I was expecting soybean imports to trending downwards. At present this is not the case with soybean imports appearing to be well above the range expected.

In figure 2, the seasonality of soybean imports into China are shown from 2012 to present. Interestingly when I ran these numbers, I was expecting soybean imports to trending downwards. At present this is not the case with soybean imports appearing to be well above the range expected.

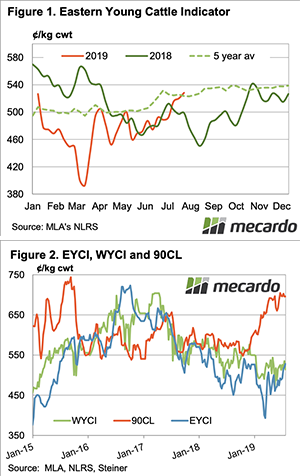

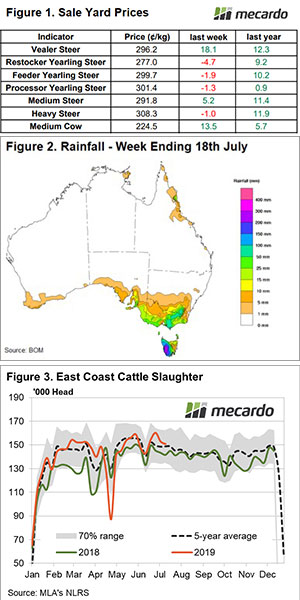

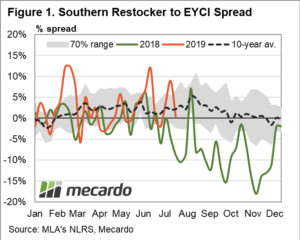

A recent discussion with some livestock industry representatives this week suggested that in the southern regions, at least, restocker buyers were becoming more active. Certainly, the Eastern Young Cattle Indicator (EYCI) continues its grind higher closing at 532.5¢/kg cwt yesterday, up 1¢ on the week. But is it being supported across the eastern seaboard or by southern restockers?

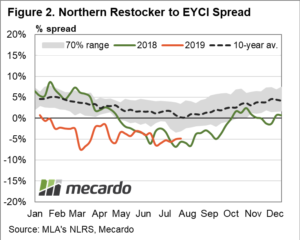

A recent discussion with some livestock industry representatives this week suggested that in the southern regions, at least, restocker buyers were becoming more active. Certainly, the Eastern Young Cattle Indicator (EYCI) continues its grind higher closing at 532.5¢/kg cwt yesterday, up 1¢ on the week. But is it being supported across the eastern seaboard or by southern restockers? Indeed, as of last Friday the southern restocker spread to the EYCI sat at a premium of 0.5% prem compared to the five-year seasonal average for this time of the year at a premium of 2%. Not indicative of southern restockers becoming too enthusiastic about the market, but decidedly better than the 8.8% discount spread that they were paying at this time last season.

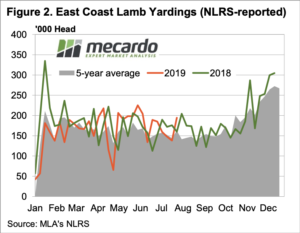

Indeed, as of last Friday the southern restocker spread to the EYCI sat at a premium of 0.5% prem compared to the five-year seasonal average for this time of the year at a premium of 2%. Not indicative of southern restockers becoming too enthusiastic about the market, but decidedly better than the 8.8% discount spread that they were paying at this time last season. National cattle prices at the sale yard reflecting the tepid restocker interest of late with Restocker Yearling Steer prices lifting 3.5¢ on the week to close at 280.3¢/kg lwt. Medium steer the big winner on the week across the national price averages posting a 21.8¢ gain to finish at 293.5¢/kg lwt – Figure 3.

National cattle prices at the sale yard reflecting the tepid restocker interest of late with Restocker Yearling Steer prices lifting 3.5¢ on the week to close at 280.3¢/kg lwt. Medium steer the big winner on the week across the national price averages posting a 21.8¢ gain to finish at 293.5¢/kg lwt – Figure 3.

The Eastern States Trade Lamb Indicator fell heavily this week. It’s still at a good level, at 876¢/kg cwt (Figure 1), but it’s now below 900¢ in all states. Last year the ESTLI made a similar heavy decline from its peak, but it was later.

The Eastern States Trade Lamb Indicator fell heavily this week. It’s still at a good level, at 876¢/kg cwt (Figure 1), but it’s now below 900¢ in all states. Last year the ESTLI made a similar heavy decline from its peak, but it was later. Mutton values also lost ground, but not to the same extent as lamb. In WA, mutton managed to hold on to record highs (Figure 3), and is now very close to east coast values. WA Lamb prices are also in the high 800¢ level, so perhaps the east coast is coming back to export parity.

Mutton values also lost ground, but not to the same extent as lamb. In WA, mutton managed to hold on to record highs (Figure 3), and is now very close to east coast values. WA Lamb prices are also in the high 800¢ level, so perhaps the east coast is coming back to export parity.