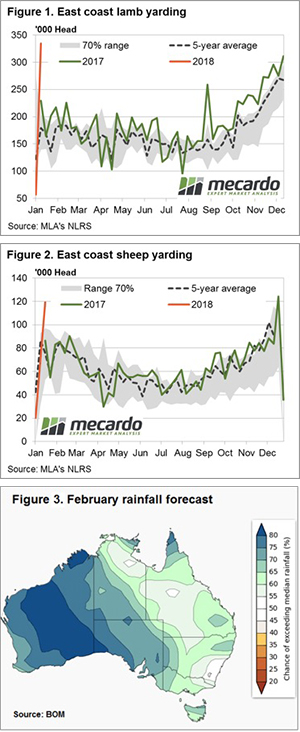

There was a bit of rain about in the south this week, and the markets stopped falling, and even gained some ground in some categories. There is good rain forecast in Queensland over the coming week, so we might expect a bit more upside.

There was a bit of rain about in the south this week, and the markets stopped falling, and even gained some ground in some categories. There is good rain forecast in Queensland over the coming week, so we might expect a bit more upside.

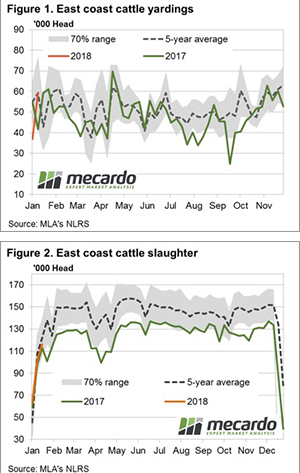

There was plenty of rain in the country’s North West, but this has little bearing on cattle markets on the east coast. Eastern and Northern Victoria also saw some reasonable falls, which seems to have tightened supply. It’s hard to know now that weekly yarding figures are almost a week old.

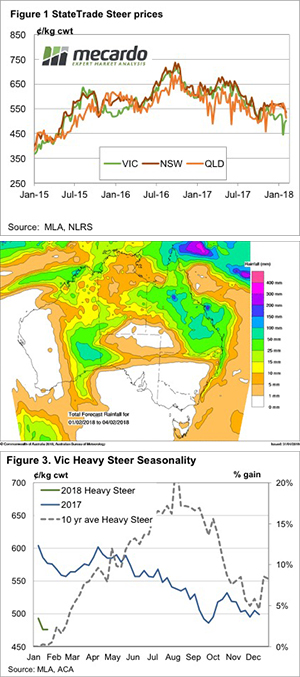

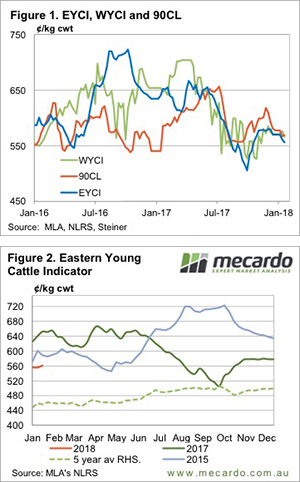

Figure 1 shows that Victorian Trade Steers had a solid rebound this week, after dropping to a two and a half year low. The Vic trade steer indicator is sitting at 502¢/kg cwt, and NSW and Queensland have fallen to almost meet it, at 536 and 513¢/kg cwt respectively.

Feeder prices were relatively steady, and restockers a bit weaker, but the Eastern Young Cattle Indicator (EYCI) rallied 7¢ for the week, getting back to 538¢. More interesting is the very weak EYCI supply. At 13,787 head EYCI yardings were at winter levels.

Export markets had a small rise, with the 90CL indicator gaining 4¢ to 568.6¢/kg cwt, to move to a 5% premium to the EYCI. Cattle prices seem to be a little underpriced, relative to the export market, and some rain in Queensland over the coming days might help correct this.

In the West the WYCI appears to be closer to ‘fair value’. It lost 16¢ today to hit 573¢/kg cwt, but remains at a strong premium to its east coast counterpart.

The week ahead

Figure 2 shows us that it’s going to be a wet few days in most of Queensland. Whether this is enough to move the market over all of the east coast is questionable, but figure 3 shows it’s about this week that southern supply starts to tighten, and prices start to rise.

We didn’t see a late summer rise last year, but you might say we are due.

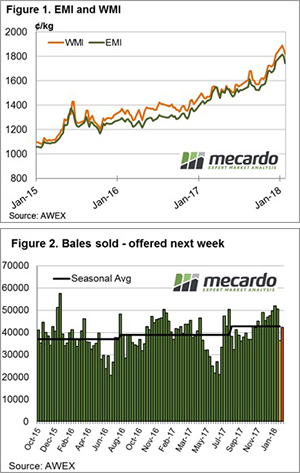

The wool market took a bit of a hit this week with most categories losing ground, with the exception of the very fine end. Cardings were hit particularly hard with the combined average fall for all three centres coming off nearly 200¢.

The wool market took a bit of a hit this week with most categories losing ground, with the exception of the very fine end. Cardings were hit particularly hard with the combined average fall for all three centres coming off nearly 200¢.

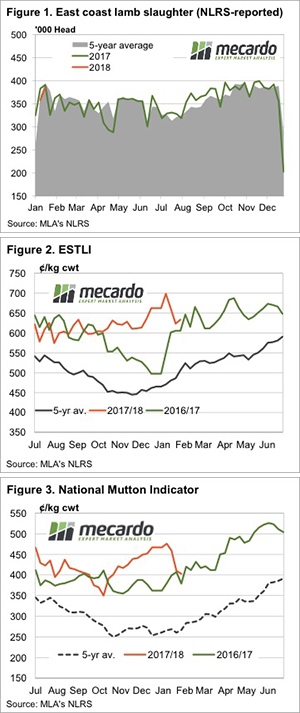

Despite the issues with slaughter capacity in South Australia it seems that we once again managed to achieve a slaughter spike in the middle week of January. In some years the weaker demand in early February has led to weaker prices, but last year it was met with weaker supply, and strong prices.

Despite the issues with slaughter capacity in South Australia it seems that we once again managed to achieve a slaughter spike in the middle week of January. In some years the weaker demand in early February has led to weaker prices, but last year it was met with weaker supply, and strong prices.

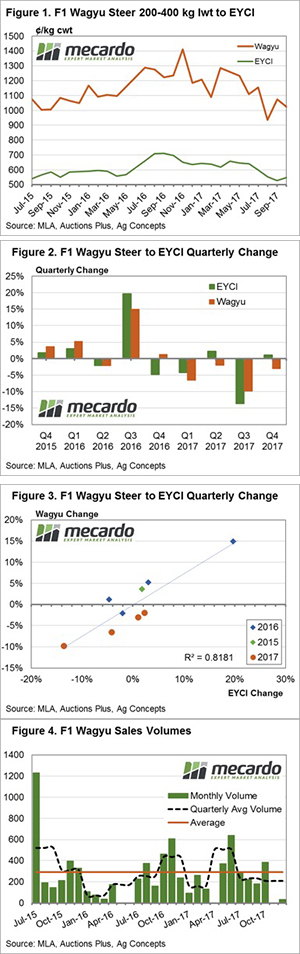

On international Star Wars day last year (May the 4th be with you) the Mecardo team took a look at Wagyu spreads to the Eastern Young Cattle Indicator (EYCI) and a recent subscriber request for a follow up article prompted us to have another look at how the 2017 season played out… and besides we couldn’t resist the chance for another pun in the heading!

On international Star Wars day last year (May the 4th be with you) the Mecardo team took a look at Wagyu spreads to the Eastern Young Cattle Indicator (EYCI) and a recent subscriber request for a follow up article prompted us to have another look at how the 2017 season played out… and besides we couldn’t resist the chance for another pun in the heading! Weekly supply statistics showed a fairly normal pattern for the start of the season, with East coast figures hovering near to the longer term seasonal averages. Although Queensland and NSW throughput were slightly elevated for this time in the year as the Northern wet season continues to be delayed, weighing on prices.

Weekly supply statistics showed a fairly normal pattern for the start of the season, with East coast figures hovering near to the longer term seasonal averages. Although Queensland and NSW throughput were slightly elevated for this time in the year as the Northern wet season continues to be delayed, weighing on prices.

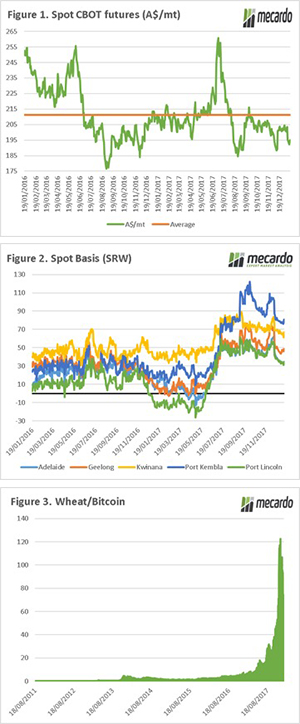

For the first time in over a month we have the full suite of Meat and Livestock Australia (MLA) data to analyse. Even with all the data, the conclusions look the same. Markets are easing slightly thanks to a lack of moisture and a rising Aussie dollar.

For the first time in over a month we have the full suite of Meat and Livestock Australia (MLA) data to analyse. Even with all the data, the conclusions look the same. Markets are easing slightly thanks to a lack of moisture and a rising Aussie dollar.