Forecast rain in the South-East corner of near biblical proportions for the week ahead keeps restocker interest high at the saleyard and young cattle prices across the country firm slightly in response.

Forecast rain in the South-East corner of near biblical proportions for the week ahead keeps restocker interest high at the saleyard and young cattle prices across the country firm slightly in response.

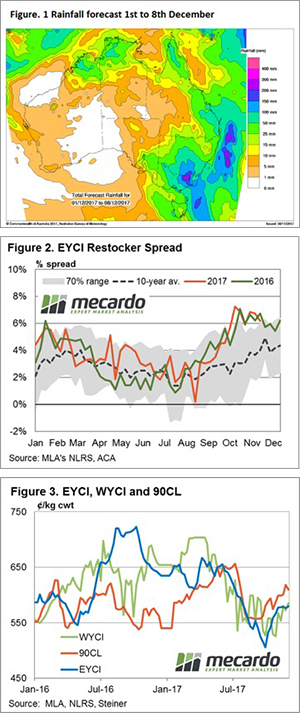

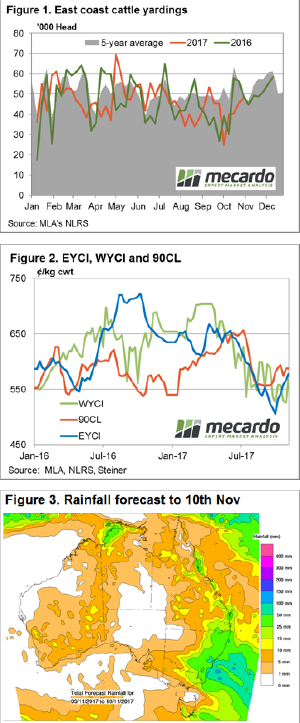

Figure 1 highlights the anticipated rain event, with falls noted into the 200-300 mm level in Northern Victoria and falls of at least 50mm to much of Victoria and NSW. While its not great for many out there trying to complete this season’s harvest it’s a boost to backgrounders, with the high moisture and warm weather giving a lift to pasture growth in the coming weeks.

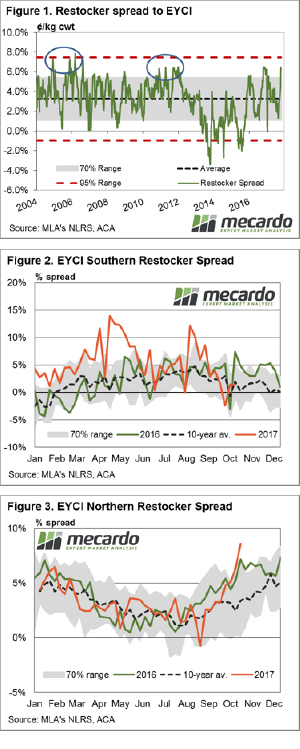

Indeed, spirits of restockers across the east coast have been encouraged and this has played out in restockers continuing to pay above average premiums at the saleyard for young cattle. The East coast restocker spread pattern showing that they are happy to pay over 6% more than the headline EYCI to secure stock – figure 2.

In an analysis piece released on Mecardo last month the main driver for the increased restocker spread was coming from Northern restockers. However, in recent weeks the Southern restocker premium has lifted too with premiums over the EYCI of 4-5% noted during November being paid, reflecting the growing optimism for a good Summer grazing potential as we head toward the end of the year.

The EYCI finished the week up 2.5¢ to 579.75¢ and the Western Young Cattle Indicator (WYCI) was also higher, lifting 13¢ to 585¢. This was despite the 90CL Frozen Cow easing slightly to close at 609¢/kg CIF – figure 3.

The week ahead

Its hard to see young cattle prices ease into the coming week with the amount of moisture that is forecast. Producers know its going to translate into decent pasture and they hate seeing grass going uneaten when they know cattle could be getting fat on it.

Make sure you stay safe out there this weekend and remember – don’t drive through flood waters. Oh, and spare a thought for the frantic lot trying to get as much harvested before the deluge.

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle.

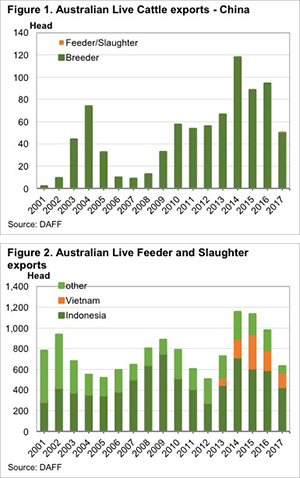

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle. According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not?

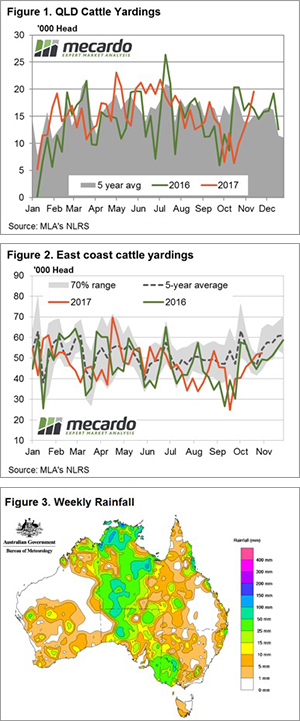

According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not? Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State.

Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State. The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

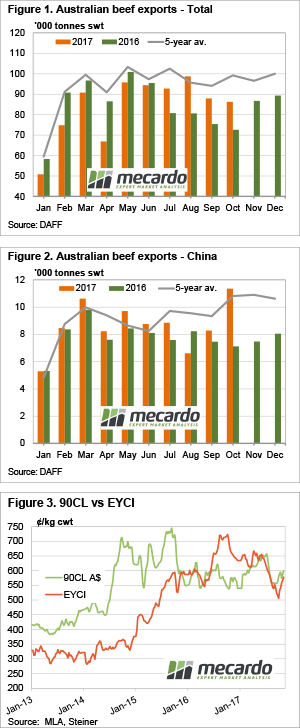

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators. It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October. Most of the eastern states received rainfall this week and despite higher throughput young cattle prices continued to climb, with the benchmark Eastern Young Cattle Indicator (EYCI) closing up 1.8% to see it at 577.50¢/kg cwt this week.

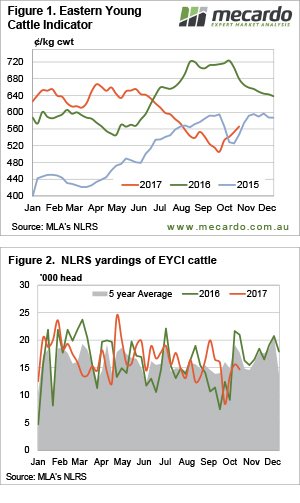

Most of the eastern states received rainfall this week and despite higher throughput young cattle prices continued to climb, with the benchmark Eastern Young Cattle Indicator (EYCI) closing up 1.8% to see it at 577.50¢/kg cwt this week.

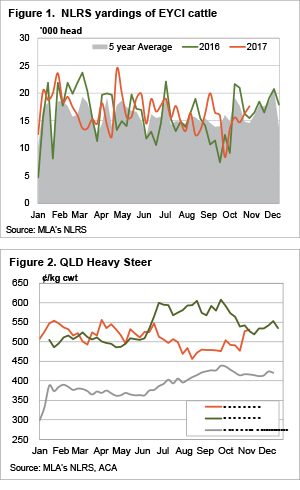

Analysis of the underlying saleyard data that is used to create the Eastern Young Cattle Indicator (EYCI) shows that optimism of restockers has been increasing during October as they appear more prepared to pay a premium to secure young cattle. This piece delves a bit deeper into the figures to see if the renewed restocker interest is part of the normal seasonal cycle or if there is something more behind it.

Analysis of the underlying saleyard data that is used to create the Eastern Young Cattle Indicator (EYCI) shows that optimism of restockers has been increasing during October as they appear more prepared to pay a premium to secure young cattle. This piece delves a bit deeper into the figures to see if the renewed restocker interest is part of the normal seasonal cycle or if there is something more behind it. More wet weather this week cut cattle yardings in Queensland, and encouraged restockers to return to the market in NSW. At a time of year when prices generally fall, or are steady, we saw a further appreciation in the Eastern Young Cattle Indicator (EYCI), but not in all categories.

More wet weather this week cut cattle yardings in Queensland, and encouraged restockers to return to the market in NSW. At a time of year when prices generally fall, or are steady, we saw a further appreciation in the Eastern Young Cattle Indicator (EYCI), but not in all categories.