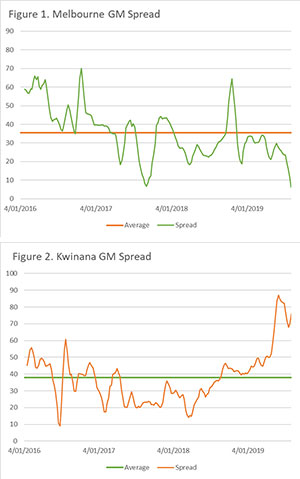

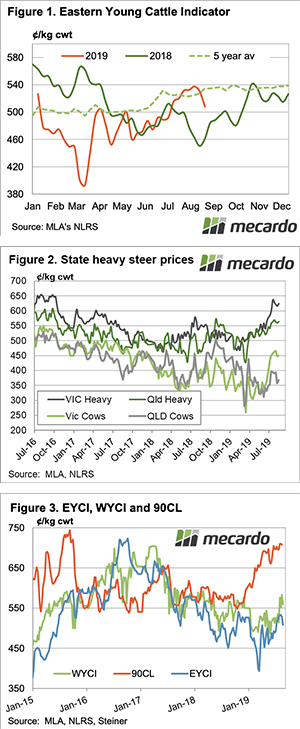

The new key support level of 800¢ has held this week for the Eastern States Trade Lamb Indicator (ESTLI). Prices steadied in all states, but it was the sucker lambs coming out of NSW which were priced the best.

After dropping like a stone for five weeks the ESTLI found some support this week, right on the 800¢ mark. The ESTLI had lost 150¢ over the previous five weeks, which equates to $30/head for a 20kg lamb.

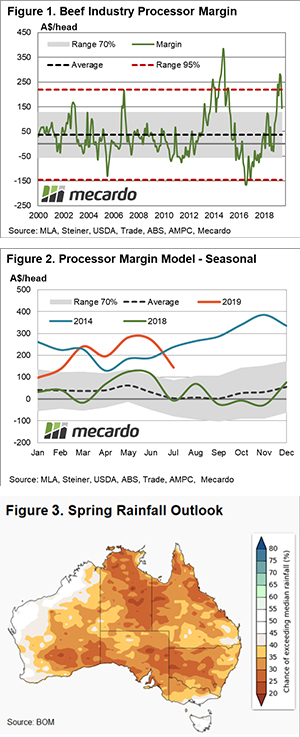

There is plenty of speculation around as to the level at which processors can make money. They might not be there yet, as lamb supply remains tight, but it is not far away.

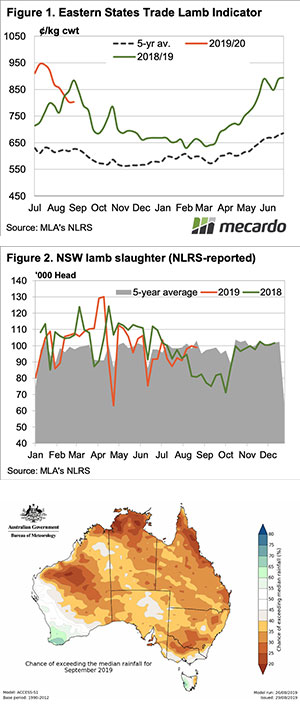

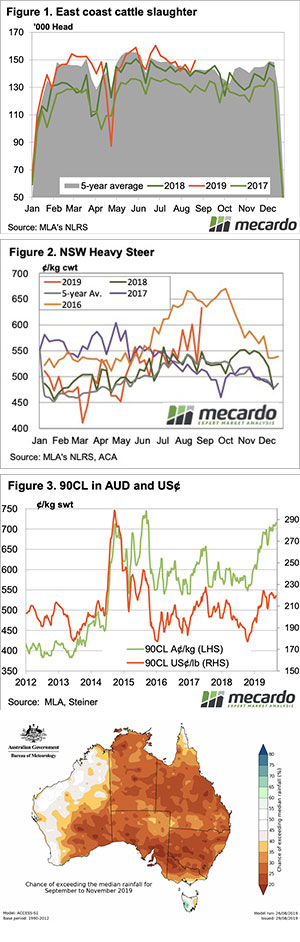

In NSW lamb supply doesn’t seem so tight. Figure 2 shows that at the end of last week (23/8) NSW lamb slaughter had returned to five year average levels, and sits 22.5% above the same time last year.

Prices are better in NSW, with trade lambs at 816¢ versus 748¢ in Victoria. Much of this could be put down to a larger proportion of sucker lambs in NSW, and more old lambs in Victoria. But it does seem demand for slaughter lambs is stronger in NSW.

National Mutton prices lost a little ground this week, down 11¢ to finish at 574¢/kg cwt. Mutton is, however, the only ovine indicator which is stronger than last year’s levels, and a lot stronger, sitting 101¢ above the same week last year.

Low volumes in WA saleyards throw up some interesting moves. This week restocker lambs in WA were down 128¢ to 481¢/kg cwt, while heavy lambs were up 122¢ to 687¢. The heavy lamb price looks realistic, but restocker lambs look very cheap. There should be a bounce next week.

What does it mean/next week?:

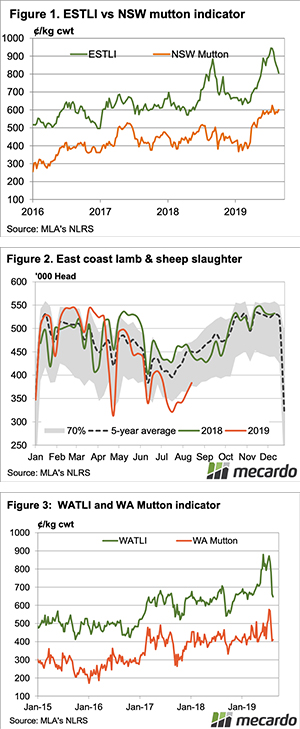

The short and medium term rain forecasts are depressing. South West WA is the only area which is expected to enjoy somewhere near normal conditions. South East SA and South West Vic are forecast for a reasonable September, which should ensure some sort of spring (figure 3). However October and November have a smaller chance of median rainfall.

For prices the basic take from this is store lambs will get cheaper in the east, in a relative sense, more expensive in the west, while slaughter lambs might be hard to produce after Christmas.

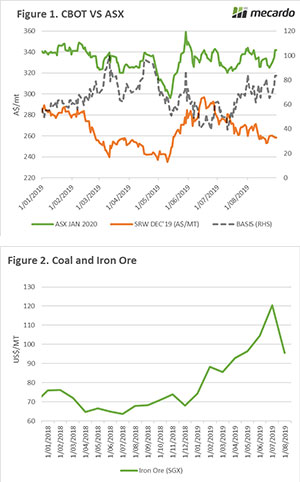

Despite rising slaughter rates, and more dry weather, the Eastern Young Cattle Indicator (EYCI) managed to find some support at 500¢. The demand from export markets remains rampant, with slaughter cattle prices hitting new peaks.

Despite rising slaughter rates, and more dry weather, the Eastern Young Cattle Indicator (EYCI) managed to find some support at 500¢. The demand from export markets remains rampant, with slaughter cattle prices hitting new peaks.