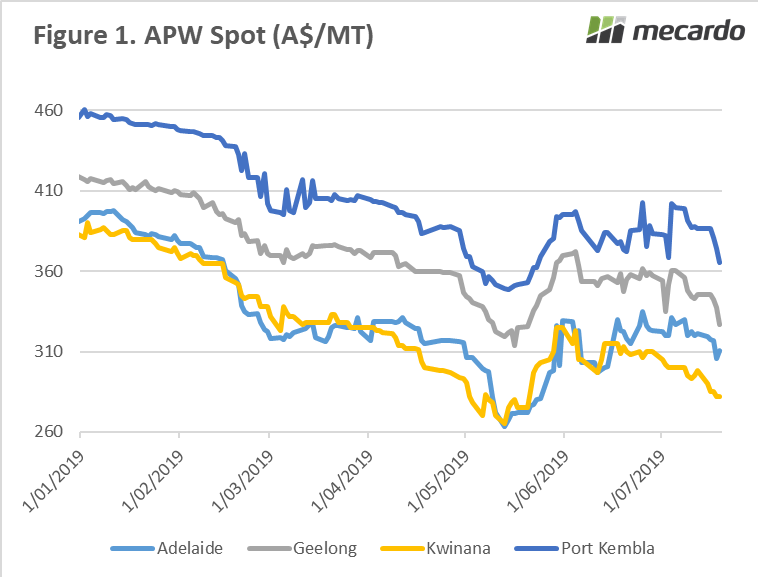

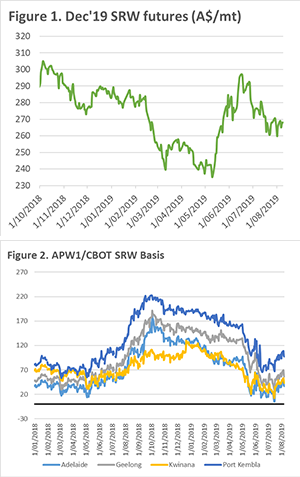

With a new month comes new opportunities. This week we take a look at the futures market and basis levels around Australia.

Let’s start with the global picture. The market has largely traded in a sideways motion since the end of July, with December Chicago futures up 1¢/bu. However, the falling A$ has led to an increase of A$3.

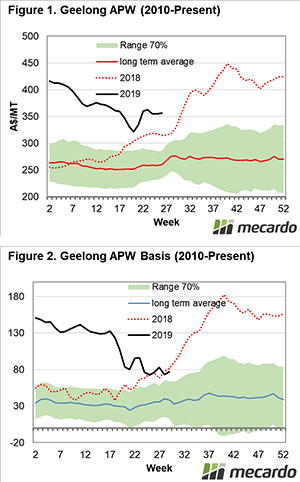

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

Although international markets are typically our biggest driver of prices in Australia, memories of the recent 12 months tell us that we can go it alone. The basis levels during last season were record high, but what about this coming harvest?

At present, the basis levels for the major Australian ports have declined and are now back to the same levels as this time last year. These levels are obviously high in areas of deficit (east coast), however far from the peaks.

The basis levels for new crop have been improving in recent weeks, although the recent rains in Victoria and South Australia will likely temper some of the gains. There is a lot of water to go under the bridge between now and harvest – so a nervous environment is likely to persist.

Remember to listen to our podcast

Next week?:

The WASDE report will be released next week which will provide some clarity on supply of both wheat and corn. The question of the validity of USDA forecasts always remain but it’s still a market driver.

The recent rains in Victoria and South Australia will provide some confidence to producers, but will it push buyers away from the market?

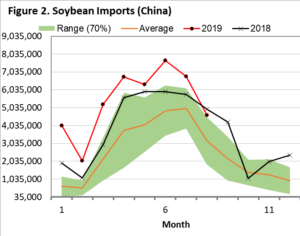

African Swine Fever is one of the worst ailments to hit pigs, and it is currently flowing its way throughout China. There are a wide range of estimates of the potential damage, ranging from very low government estimates (1m head) through to industry estimates of >200m.

African Swine Fever is one of the worst ailments to hit pigs, and it is currently flowing its way throughout China. There are a wide range of estimates of the potential damage, ranging from very low government estimates (1m head) through to industry estimates of >200m. In figure 2, the seasonality of soybean imports into China are shown from 2012 to present. Interestingly when I ran these numbers, I was expecting soybean imports to trending downwards. At present this is not the case with soybean imports appearing to be well above the range expected.

In figure 2, the seasonality of soybean imports into China are shown from 2012 to present. Interestingly when I ran these numbers, I was expecting soybean imports to trending downwards. At present this is not the case with soybean imports appearing to be well above the range expected.

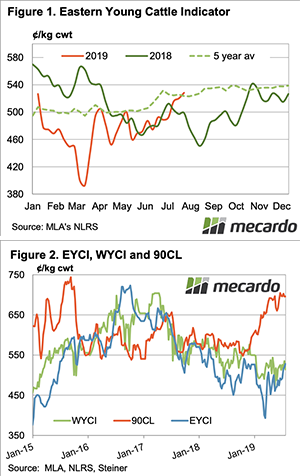

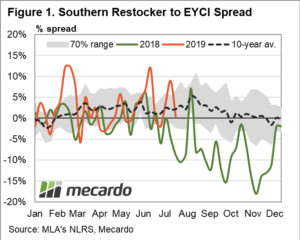

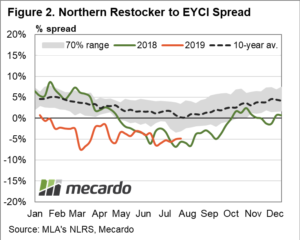

A recent discussion with some livestock industry representatives this week suggested that in the southern regions, at least, restocker buyers were becoming more active. Certainly, the Eastern Young Cattle Indicator (EYCI) continues its grind higher closing at 532.5¢/kg cwt yesterday, up 1¢ on the week. But is it being supported across the eastern seaboard or by southern restockers?

A recent discussion with some livestock industry representatives this week suggested that in the southern regions, at least, restocker buyers were becoming more active. Certainly, the Eastern Young Cattle Indicator (EYCI) continues its grind higher closing at 532.5¢/kg cwt yesterday, up 1¢ on the week. But is it being supported across the eastern seaboard or by southern restockers? Indeed, as of last Friday the southern restocker spread to the EYCI sat at a premium of 0.5% prem compared to the five-year seasonal average for this time of the year at a premium of 2%. Not indicative of southern restockers becoming too enthusiastic about the market, but decidedly better than the 8.8% discount spread that they were paying at this time last season.

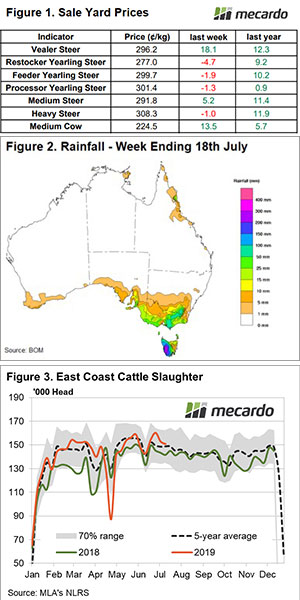

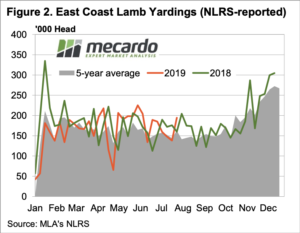

Indeed, as of last Friday the southern restocker spread to the EYCI sat at a premium of 0.5% prem compared to the five-year seasonal average for this time of the year at a premium of 2%. Not indicative of southern restockers becoming too enthusiastic about the market, but decidedly better than the 8.8% discount spread that they were paying at this time last season. National cattle prices at the sale yard reflecting the tepid restocker interest of late with Restocker Yearling Steer prices lifting 3.5¢ on the week to close at 280.3¢/kg lwt. Medium steer the big winner on the week across the national price averages posting a 21.8¢ gain to finish at 293.5¢/kg lwt – Figure 3.

National cattle prices at the sale yard reflecting the tepid restocker interest of late with Restocker Yearling Steer prices lifting 3.5¢ on the week to close at 280.3¢/kg lwt. Medium steer the big winner on the week across the national price averages posting a 21.8¢ gain to finish at 293.5¢/kg lwt – Figure 3.

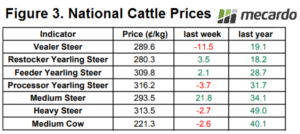

The Eastern States Trade Lamb Indicator fell heavily this week. It’s still at a good level, at 876¢/kg cwt (Figure 1), but it’s now below 900¢ in all states. Last year the ESTLI made a similar heavy decline from its peak, but it was later.

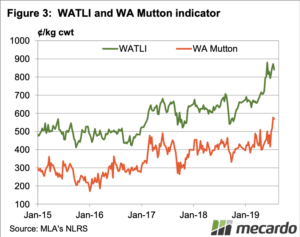

The Eastern States Trade Lamb Indicator fell heavily this week. It’s still at a good level, at 876¢/kg cwt (Figure 1), but it’s now below 900¢ in all states. Last year the ESTLI made a similar heavy decline from its peak, but it was later. Mutton values also lost ground, but not to the same extent as lamb. In WA, mutton managed to hold on to record highs (Figure 3), and is now very close to east coast values. WA Lamb prices are also in the high 800¢ level, so perhaps the east coast is coming back to export parity.

Mutton values also lost ground, but not to the same extent as lamb. In WA, mutton managed to hold on to record highs (Figure 3), and is now very close to east coast values. WA Lamb prices are also in the high 800¢ level, so perhaps the east coast is coming back to export parity.