According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not?

According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not?

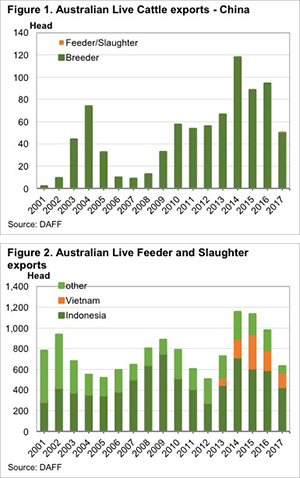

Breeding cattle dominate the Australian live export trade with China. Last year Australia had its second biggest year on record for breeder cattle exports, with 94,341 head shipping out (figure 1). There has been no tariff on breeder cattle exports for some time.

The latest announcement refers to the cutting of the tariff on slaughter and feeder cattle. This is a market which has only just started to move. For the year to October, feeder and slaughter cattle exports to China have totalled just 1,195 head. This is 2.3% of total export to China.

The abolishment of the 10% tariff on feeder and slaughter cattle exports to China will make cattle 10% cheaper for Chinese importers, while Australian sellers will receive the same price. In reality, when tariffs are removed (or applied), the benefit is split between seller and buyer, so there should be some price rise at the exporter end as well, which will no doubt benefit growers.

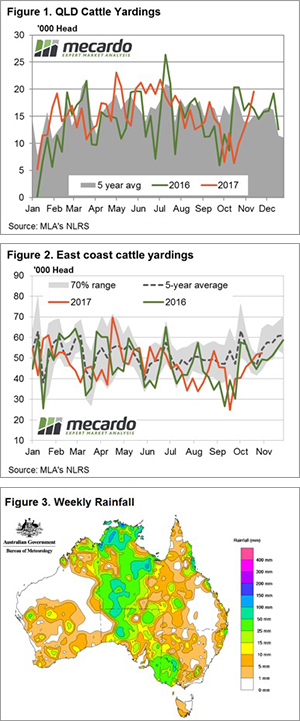

So where will these cattle come from? There is competition for China in the feeder and slaughter cattle market. The main player is obviously Indonesia, while Vietnam has grown in the last five years to be easily the second largest importer of Australian live cattle.

Figure 2 shows just how large the Indonesian and Vietnam markets are compared to China. As such it would take a very large push to see Chinese live export demand start to impact prices in Indonesia and Vietnam.

The feeder and slaughter cattle which have been exported to China were actually sent out of Portland earlier this year. This is where many of the breeder cattle which are sent to China come from, and increasing live exports could add support to feeder and slaughter cattle prices in the south when a boat is going.

The 10% tariff was also lifted on sheep, but sheep exports to China don’t even rate a mention in the data. They are lumped in with ‘other’.

Key points:

- China have lifted the 10% tariff on live feeder and slaughter cattle and sheep imports from Australia.

- The current trade with China in live feeders and slaughter cattle is very small, but could grow with opening of the trade.

- Over time increasing demand for beef in China is likely to see the market grow and support prices.

What does this mean?

The lifting of the tariff from China is not going to see a rapid jump in prices tomorrow. It is an indication, however, that China are serious about taking more live cattle from Australia to bolster beef supplies. While the market is currently very small, any opening up of trade is good for cattle producers, as boats create competition and support prices.

Figure 1 shows that breeder cattle exports have grown rapidly in some years, so don’t be surprised if you start hearing more and more about boats going to China.

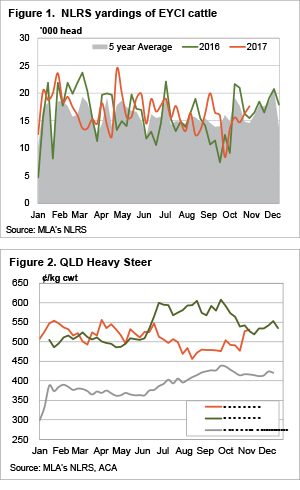

Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State.

Figure 1 shows the steady rise in Queensland cattle yardings since mid-October and based off last week’s figures we saw another 27% gain in cattle at the saleyards this week. Queensland Restocker, Feeder, Vealer, Medium and Heavy Steers all fetching the strongest prices for their categories across the country this week, so it is probably no surprise that we are seeing producers bring forward supply in the Sunshine State.

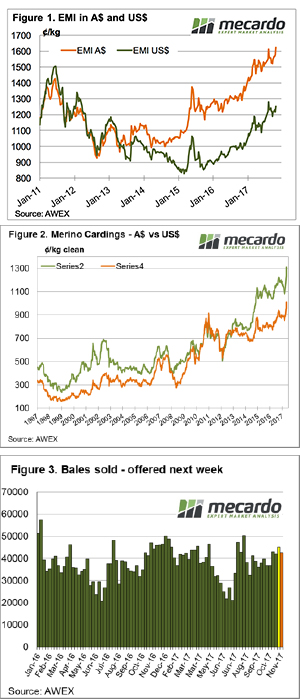

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced.

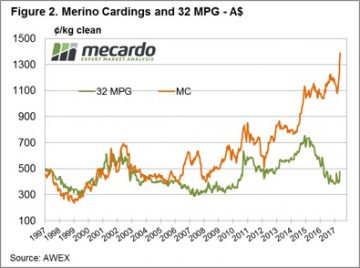

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced. Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week.

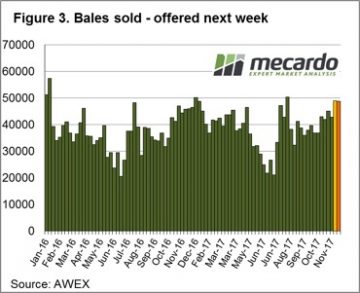

Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week. The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

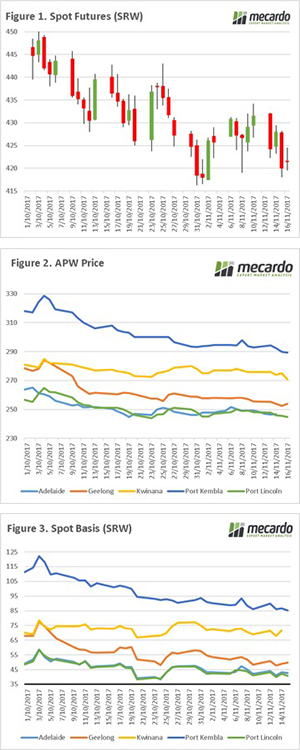

The US Department of Agriculture released their World Agricultural Supply and Demand Estimates overnight. In this week’s comment, we will take a look at the impact on wheat, and report on new import barriers being erected in India.

The US Department of Agriculture released their World Agricultural Supply and Demand Estimates overnight. In this week’s comment, we will take a look at the impact on wheat, and report on new import barriers being erected in India.

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

The cattle market stalled for young cattle this week as more rain fell in part of NSW and Queensland, but supply managed to improve. While young cattle supply was a little stronger, this didn’t stop some solid rises in some interesting indicators.

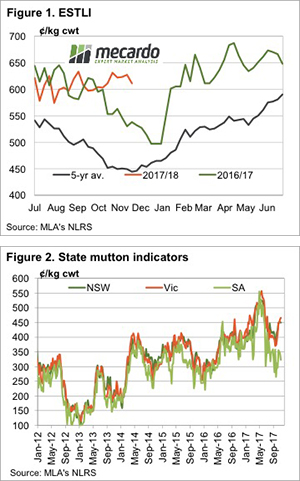

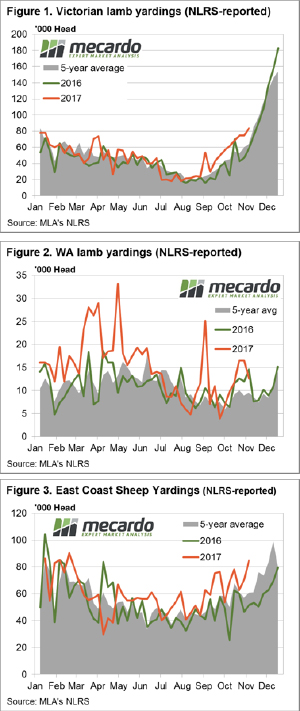

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.

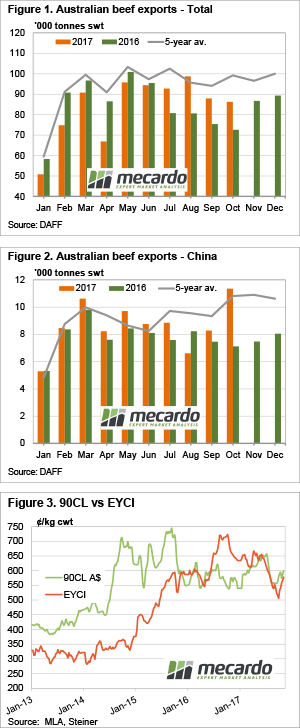

A number of mixed market signals this week across state saleyards for sheep and lamb, as the seasonal Spring price decline looms. Needless to say, on a countrywide level all categories posted price increases between 0.2% to 3%, apart from Restocker Lambs with the national saleyard indicator off 1.2% to 679¢/kg cwt.  It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.

What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.