Key points

- An annual average National Heavy Steer price of 335¢/kg lwt during 2020 would suggest forecast National Feeder Steer price of around 385¢/kg lwt, provided grain prices continue to soften toward the 2020/21 harvest.

- A forecast of 345¢/kg lwt for Heavy Steers in 2021 places the National Feeder Steer forecast nearer to 400¢/kg lwt.

- The difficulty in forecasting for the 2021 season is the long-term impact of Covid-19 on global beef, global grain prices and the A$.

Article

In a Meat and Livestock Australia (MLA) funded webinar that Mecardo delivered for Holmes and Sackett on restockers last week we were asked a great question on what our national heavy steer forecast means for feeder steer prices for the 2020/21 season. This piece looks at the relationship between heavy steer, feeder steer and feed grain prices and what it can tell us about feeder steer forecast levels for the next few years.

To access a copy of the MLA restocker webinar recording click here.

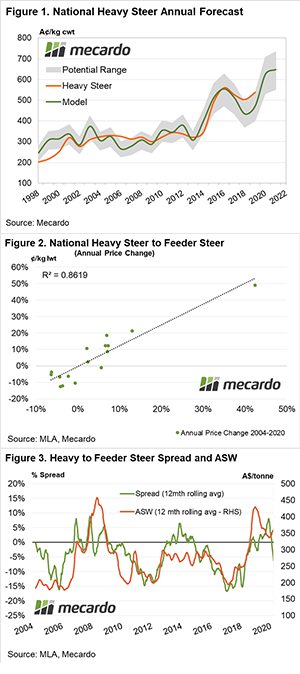

The Mecardo National Heavy Steer (NHS) forecast model is used to predict the annual average price of heavy steers in Australia using predictive inputs to the model such as the A$ level, global beef prices and domestic supply considerations.

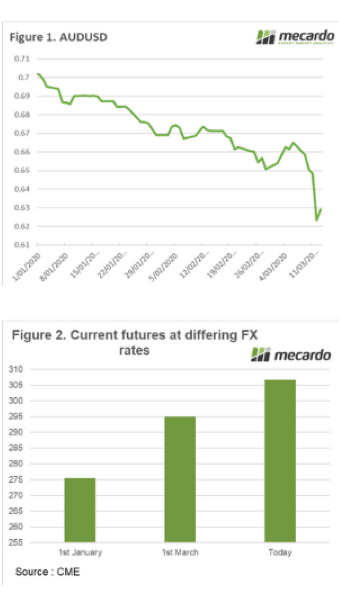

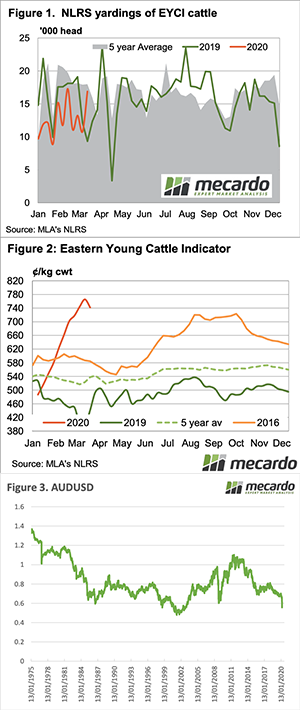

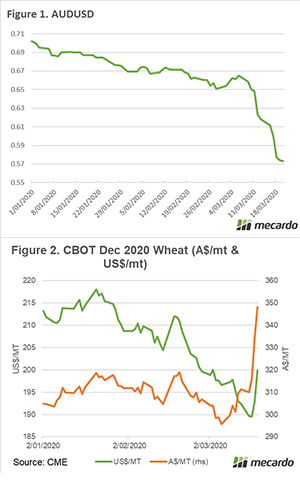

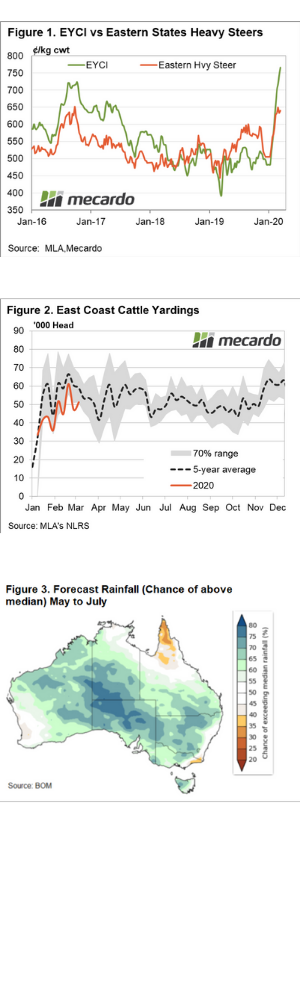

The current forecast for 2020 is an annual average of 625¢/kg cwt (approx. 335¢/kg lwt), which is based on an A$ annual average of 67US¢ and an annual average US Live Cattle futures price of 110US¢/lb (Figure 1). At the moment both of these inputs are much lower on the back of Covid-19 speculative selling, with the Aussie dollar under 60US¢ and US Live Cattle below 100US¢/lb.

A comparison of the annual price change for National Heavy Steer and National Feeder Steer shows that there is a very strong correlation between the two (with an r2 of 0.8619) (Figure 2). This demonstrates that we can safely use the Nation Heavy Steer forecast model output to get an idea of the likely price forecast for National Feeder Steers, once we allow for how climatic factors and feed cost influence the historic spread between heavy steer prices and feeder steer prices.

Analysis of the percentage spread of heavy steer to feeder steer compared to the ASW price (smoothed over a 12-month average) highlights that during periods where there is a low feed price environment, the heavy steer moves to a discount of approximately 15% to the feeder steer (Figure 3).

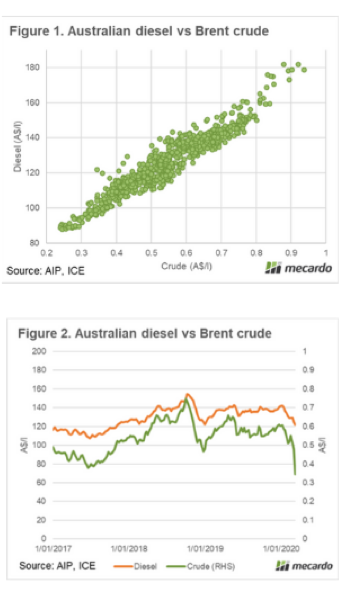

The big unknown at the moment is the long-term impact of Covid-19 on global beef, global grain prices and the A$. Local grain prices rallied last week despite softer international grain prices due to the collapse in the A$ under 60US¢.

What does it mean?

Assuming an annual average National Heavy Steer price of 335¢/kg lwt during 2020 would suggest an annual average National Feeder Steer price of around 385¢/kg lwt, provided grain prices continue to soften toward the 2020/21 harvest.

For 2021, the Mecardo National Heavy Steer model forecasts an annual average price of 640¢/kg cwt (345¢/kg lwt) but this is based on an A$ of US70¢ and US Live Cattle at 115US¢/lb. If the Covid-19 impact is short-lived and the A$/US Live Cattle futures can rebound from their current levels, there isn’t any reason why we can’t achieve these forecast levels for the heavy steer.

Furthermore, based on an assumption of cheaper domestic feed prices and a 15% discount of heavy steer to feeder steers into the 2021 season the feeder steer forecast would be nearer to 400¢/kg lwt.

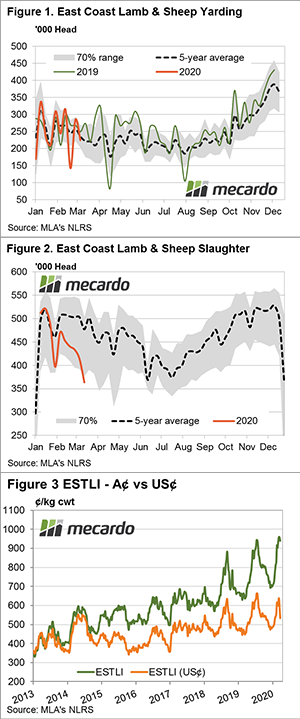

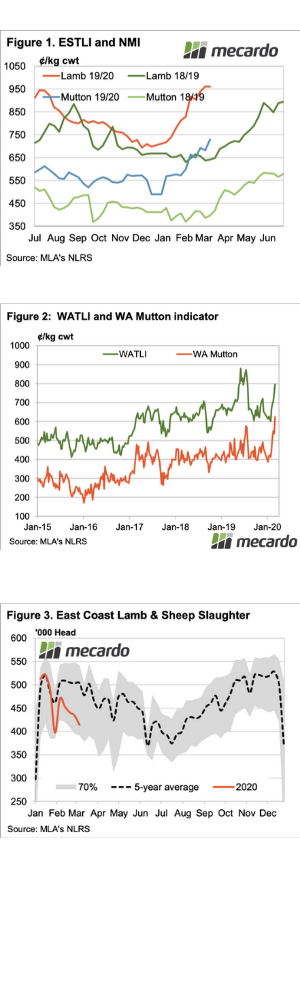

supermarkets are keen to restock after a run on red meat. With the A$ collapse and concern over a Covid19 economic growth hit the uncertainty has filtered through to sheep and lamb prices.

supermarkets are keen to restock after a run on red meat. With the A$ collapse and concern over a Covid19 economic growth hit the uncertainty has filtered through to sheep and lamb prices.

Across the eastern states the NLRS service from Meat and Livestock Australia report strong gains for yearling steers up nearly 10% on the week to close at 381.75¢/kg on a liveweight basis.

Across the eastern states the NLRS service from Meat and Livestock Australia report strong gains for yearling steers up nearly 10% on the week to close at 381.75¢/kg on a liveweight basis.

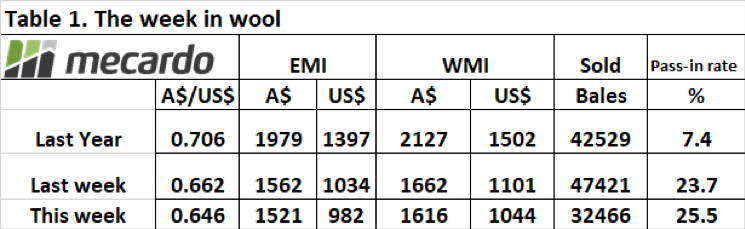

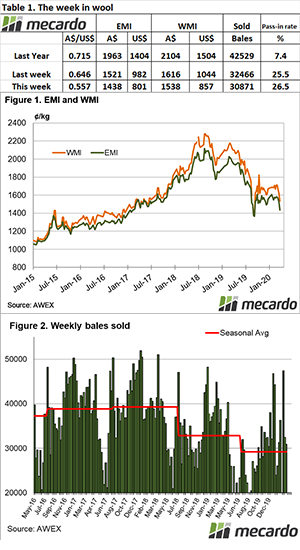

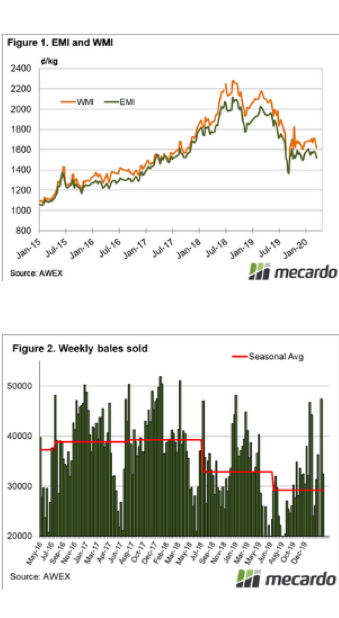

MI) lost 41 cents to close at 1,521 cents. The Australian dollar remained under pressure falling 1.6 cents to sit at its lowest level since early 2003 at the close of sales on Thursday at US$0.646. This pulled the EMI in US terms down 52 cents to 982 cents.

MI) lost 41 cents to close at 1,521 cents. The Australian dollar remained under pressure falling 1.6 cents to sit at its lowest level since early 2003 at the close of sales on Thursday at US$0.646. This pulled the EMI in US terms down 52 cents to 982 cents.