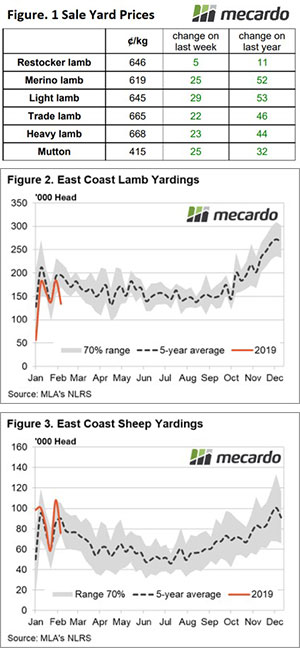

Department of Agriculture and Water Resources (DAWR) trade statistics for January show a 15.6% year on year increase in lamb exports and the gains in mutton export flows aren’t far behind, up 15% on January 2018. Despite posting similar volume gains, a breakdown of key destinations for the lamb and mutton export trade shows that the growth in demand is being driven from different regions.

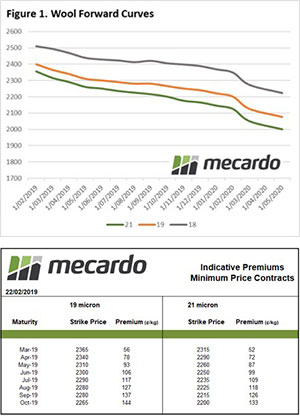

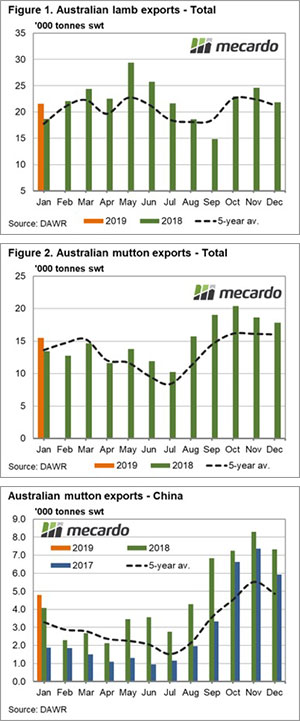

Total lamb exports from Australia were reported at 21,541 tonnes swt, the highest January volume on record and coming in 21.4% higher than the five-year seasonal average for January – Figure 1. The January 2019 lamb export volumes were 15.6% above the 2018 level, boosted by record flows to the Middle East and the USA.

Australian lamb product to the Middle East totaled 6,487 tonnes swt, the highest January total on record, 25% up on January 2018 and 36% higher than the five-year average trend. Even stronger percentage gains were noted for the USA with the January 2019 lamb export volume of 5,593 tonnes swt also posting the highest January figure on record, increasing by 35% on January 2018 levels and 38% above the five-year average for January.

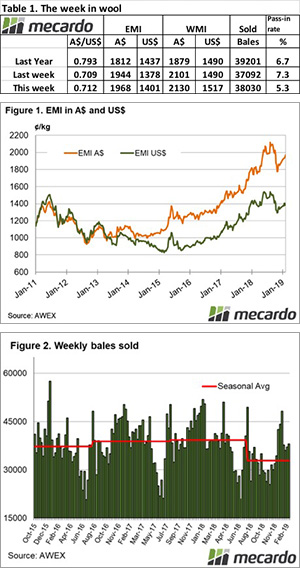

Mutton exports out of Australia for January 2019 show a similar lift in volumes, increasing 15% year on year to 15,485 tonnes swt – Figure 2. However, the significantly above average volumes for mutton during January were limited to Asian destinations, namely China, Singapore and Taiwan, to see the January flows sit 13.7% above the January five-year average.

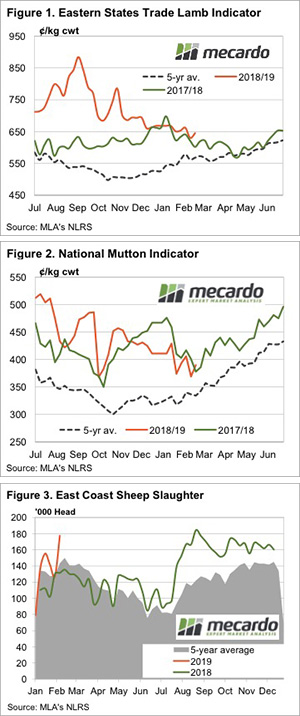

Growth in mutton flows from Australia to China were up 18% year on year for January to see 4,805 tonnes swt consigned, the second highest volume for January and just a fraction short of the record 4,822 tonnes sent during January 2014 – Figure 3.

What does it mean/next week?

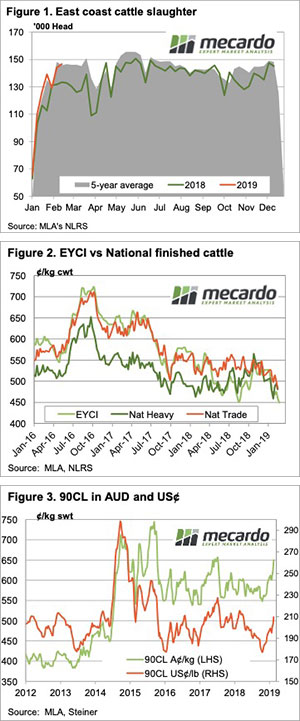

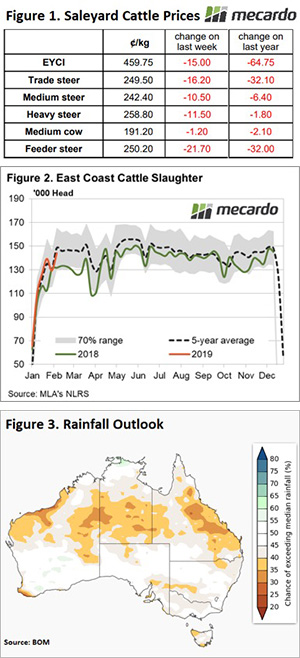

Last week we reported on strong beef export numbers for the start of 2019, fueled by growing Chinese demand, to see China overtake South Korea as the third top destination for Australian beef exports.

Perhaps the issues faced in China currently regarding African Swine Fever (ASF) and the reports of nearly one million pigs being culled due to the contagion are beginning to flow through to additional demand for alternative proteins, such as beef and mutton. It is early days yet, but it will be worthwhile to keep track of the ASF developments in China as the season progresses to determine what impact, if any, it is having on our export markets.

Key points:

- Lamb exports recorded the highest January monthly total on record coming in 21.4% above the January seasonal five-year average at 21,541 tonnes swt.

- Lamb consignments to the Middle East and USA underpinned the strong January results, with both destinations registering record January flows.

- January mutton exports were supported by Asian demand growth, coming in 13.7% higher than the five-year average for January at 15,485 tonnes swt.