Usually the market is relatively busy at the start of harvest, however, at the start of November things are going off with a whimper. In this update we talk about the lack of bids & volume on ASX.

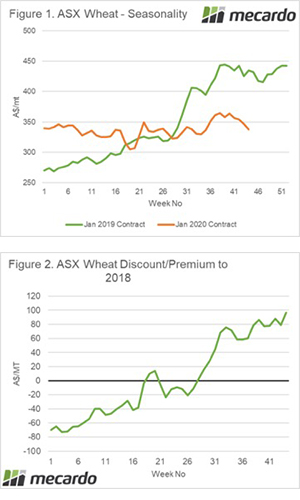

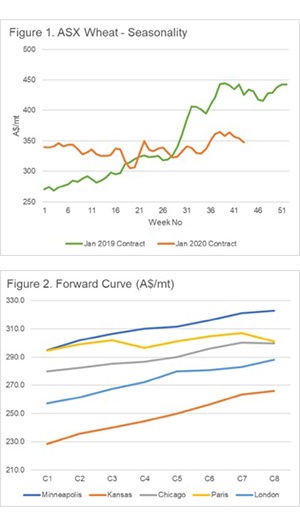

The ASX wheat contract has been relatively inactive this week. The contract for Jan 2020 has been settling in a very narrow range of A$337-339/mt for the past nine days. The spread between bid and offer has remained wide during this time, and traded volume is low.

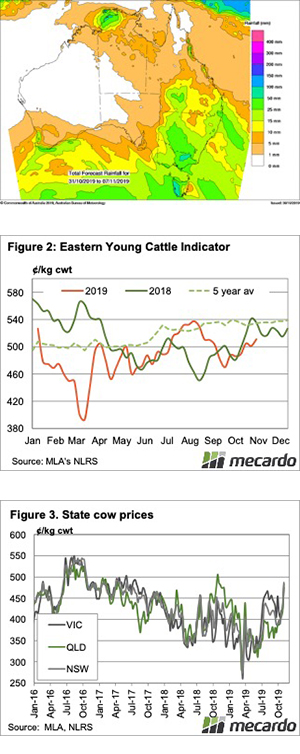

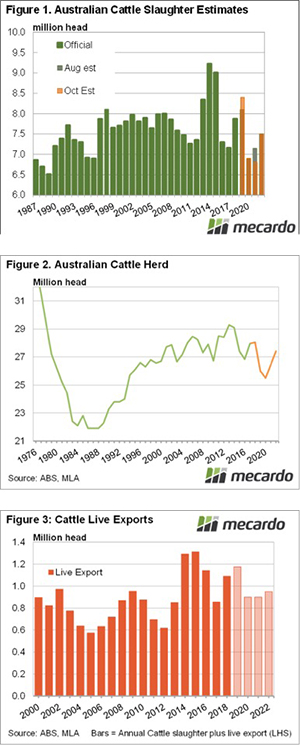

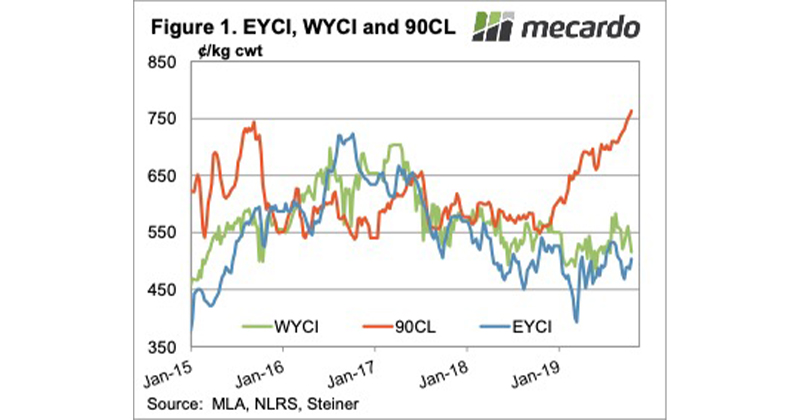

In figure 1, the seasonality of ASX volume is displayed. Throughout most of this year, volume has followed the 2019 contract. This week however, volume has dropped to 75 contracts (or 1500mt). This volume is likely to increase into December as positions are closed.

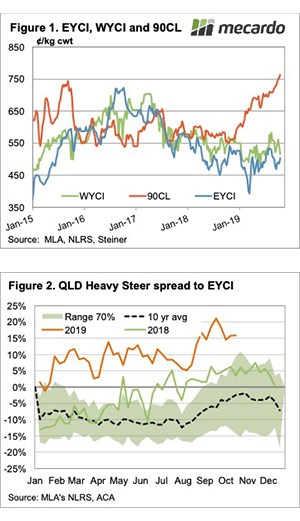

The big talking point with consumers and growers is barley pricing. This week prices have declined marginally, however, they have been on a downward plunge since seeding. Due to this discount to wheat, barley is now far more attractive to feed consumers. Bids from buyers have dried up with consumers buying hand to mouth.

The big question at present is the result of the anti-dumping investigation by China. As the investigation was instigated last November, the results should be published this month. The World Trade Organisation stipulates that anti-dumping investigations must be completed within a year, although there is the possibility of a six-month extension.

This uncertainty has meant that exporters are unwilling to take a ‘punt’ on the resolution, especially after many trading businesses made large losses during the past financial year. This has removed a large proportion of demand, with domestic being the only available avenue open.

What does it mean next week?

The uncertainty around the barley anti-dumping probe is impacting trades capacity to purchase large volumes of barley. In addition, there is a question mark in relation to Chinese feed demand due to the African Swine Fever outbreak.

The WASDE report will be released overnight. At this point of the year, the report should provide some stable numbers for this season. This will give some clarity on carryout.