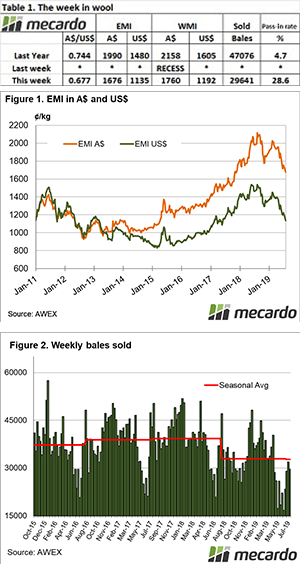

Wool prices are crashing, and while still historically strong, yesterday hitting one and a half and two and a half year lows for the 19 and 21MPG’s respectively. The wether flock was already falling, here we take a look at how lower wool and strong sheepmeat prices might see further declines in wether flocks.

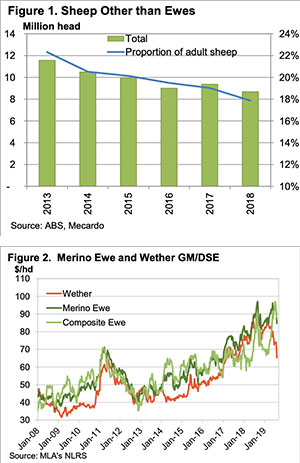

The Australian Bureau of Statistics (ABS) flock numbers report total adult sheep numbers and the number of breeding ewes. By deducting the number of breeding ewes from total sheep we get ‘Sheep other than Ewes’. While this includes Rams, most of them are wethers.

Figure 1 shows the decline in ‘Sheep other than Ewes’, with the new low hit in June 2018 of 8.7 million head. It’s not just a function of the declining flock, with the proportion of adult sheep falling from 22% to 18% over the last five years.

Strong wool prices were threatening to see the wether flock steady or grow when seasonal conditions allowed. But the latest fall in wool prices, combined with strong sheepmeat prices, might see wether numbers continue to decline.

We have a basic gross margin per dry sheep equivalent (DSE) calculation for Merino Ewes and Wethers, and it shows the spread is growing. The assumptions are a 1 DSE wether cutting 5kgs of 19 micron wool. The ewe gross margin is more complicated, 4.5kgs of 19 micron wool, producing 0.7 lambs at 12.6kgs cwt. The ewe averages 1.5 DSE over a year.

Figure 2 shows that the latest move in the wool market has wiped $20 per head off the gross margin for wethers since the start of the year and this time last year. The Merino Ewe gross margin per DSE is down $10 on this time last year, and very close to that of the start of the year.

Composite ewes are another alternative to Merino Wethers, and Ewes for that matter. We can run a gross margin per DSE calculation for them too. Production assumptions are 4kgs of 32 micron wool, 1.25 lambs at 15.4kgs cwt (35kg lwt) and a DSE rating of 2.

The latest fall in wool prices and strong lamb prices has composite ewes, back at the top of the table, but only marginally, making $3 more per DSE.

What does this mean?

Despite a lower cost of production, it’s hard to see the wether flock growing with such a divide in the value of outputs. Wether gross margins per DSE are now further behind Merino and Composite Ewes than they have been at any time over the last ten years.

With strong sheepmeat prices unlikely to go away and plenty of uncertainty in wool markets, there might be more wethers headed to the market once they are shorn this year. We can expect a new low for ‘Sheep other than Ewes’ in the coming year, both in absolute numbers and as a proportion of the flock.

Key Points

- The wether and ram flock hit a new low in June 2018, but strong wool prices might have propped the flock up.

- Expect further declines in wether flocks, as returns are at 10 year lows in relative terms.

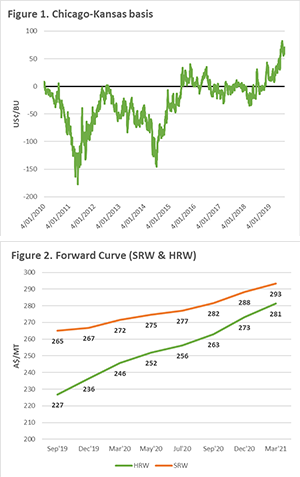

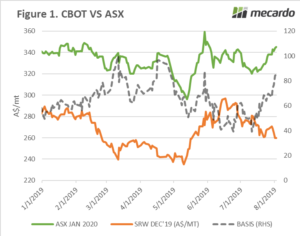

In figure 2, the forward curve is shown for both contracts (in A$/mt). It is always important to examine the curve as it can provide a strong insight into hedging opportunities. As we can see the Kansas contract is at a strong discount to Chicago at present, however it does start to converge further down the horizon.

In figure 2, the forward curve is shown for both contracts (in A$/mt). It is always important to examine the curve as it can provide a strong insight into hedging opportunities. As we can see the Kansas contract is at a strong discount to Chicago at present, however it does start to converge further down the horizon.

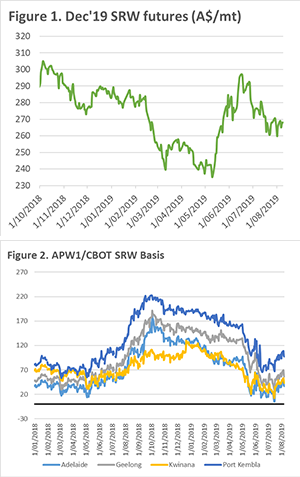

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

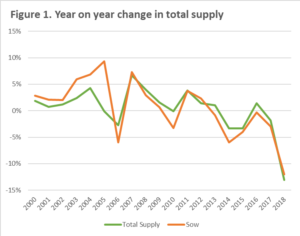

African Swine Fever is one of the worst ailments to hit pigs, and it is currently flowing its way throughout China. There are a wide range of estimates of the potential damage, ranging from very low government estimates (1m head) through to industry estimates of >200m.

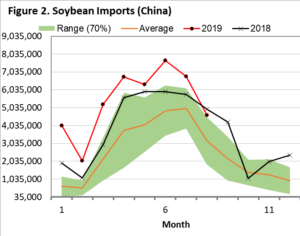

African Swine Fever is one of the worst ailments to hit pigs, and it is currently flowing its way throughout China. There are a wide range of estimates of the potential damage, ranging from very low government estimates (1m head) through to industry estimates of >200m. In figure 2, the seasonality of soybean imports into China are shown from 2012 to present. Interestingly when I ran these numbers, I was expecting soybean imports to trending downwards. At present this is not the case with soybean imports appearing to be well above the range expected.

In figure 2, the seasonality of soybean imports into China are shown from 2012 to present. Interestingly when I ran these numbers, I was expecting soybean imports to trending downwards. At present this is not the case with soybean imports appearing to be well above the range expected.

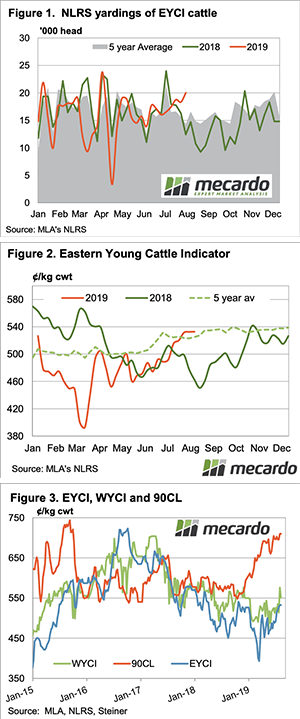

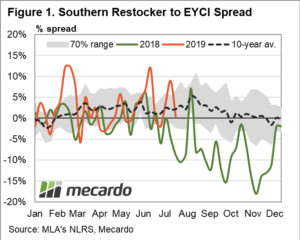

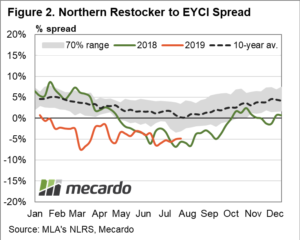

A recent discussion with some livestock industry representatives this week suggested that in the southern regions, at least, restocker buyers were becoming more active. Certainly, the Eastern Young Cattle Indicator (EYCI) continues its grind higher closing at 532.5¢/kg cwt yesterday, up 1¢ on the week. But is it being supported across the eastern seaboard or by southern restockers?

A recent discussion with some livestock industry representatives this week suggested that in the southern regions, at least, restocker buyers were becoming more active. Certainly, the Eastern Young Cattle Indicator (EYCI) continues its grind higher closing at 532.5¢/kg cwt yesterday, up 1¢ on the week. But is it being supported across the eastern seaboard or by southern restockers? Indeed, as of last Friday the southern restocker spread to the EYCI sat at a premium of 0.5% prem compared to the five-year seasonal average for this time of the year at a premium of 2%. Not indicative of southern restockers becoming too enthusiastic about the market, but decidedly better than the 8.8% discount spread that they were paying at this time last season.

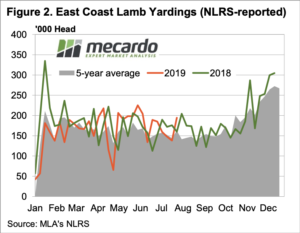

Indeed, as of last Friday the southern restocker spread to the EYCI sat at a premium of 0.5% prem compared to the five-year seasonal average for this time of the year at a premium of 2%. Not indicative of southern restockers becoming too enthusiastic about the market, but decidedly better than the 8.8% discount spread that they were paying at this time last season. National cattle prices at the sale yard reflecting the tepid restocker interest of late with Restocker Yearling Steer prices lifting 3.5¢ on the week to close at 280.3¢/kg lwt. Medium steer the big winner on the week across the national price averages posting a 21.8¢ gain to finish at 293.5¢/kg lwt – Figure 3.

National cattle prices at the sale yard reflecting the tepid restocker interest of late with Restocker Yearling Steer prices lifting 3.5¢ on the week to close at 280.3¢/kg lwt. Medium steer the big winner on the week across the national price averages posting a 21.8¢ gain to finish at 293.5¢/kg lwt – Figure 3.

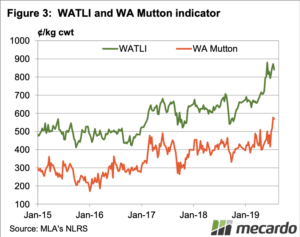

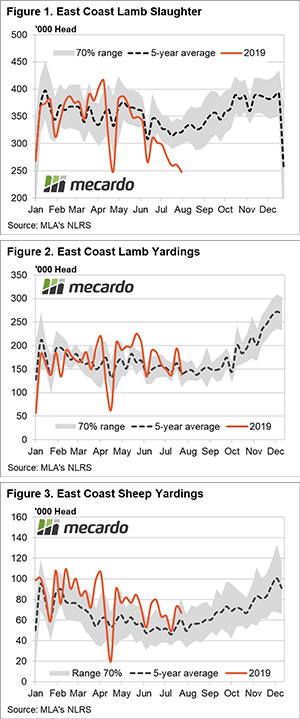

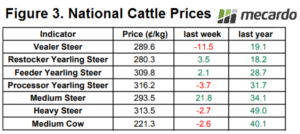

The Eastern States Trade Lamb Indicator fell heavily this week. It’s still at a good level, at 876¢/kg cwt (Figure 1), but it’s now below 900¢ in all states. Last year the ESTLI made a similar heavy decline from its peak, but it was later.

The Eastern States Trade Lamb Indicator fell heavily this week. It’s still at a good level, at 876¢/kg cwt (Figure 1), but it’s now below 900¢ in all states. Last year the ESTLI made a similar heavy decline from its peak, but it was later. Mutton values also lost ground, but not to the same extent as lamb. In WA, mutton managed to hold on to record highs (Figure 3), and is now very close to east coast values. WA Lamb prices are also in the high 800¢ level, so perhaps the east coast is coming back to export parity.

Mutton values also lost ground, but not to the same extent as lamb. In WA, mutton managed to hold on to record highs (Figure 3), and is now very close to east coast values. WA Lamb prices are also in the high 800¢ level, so perhaps the east coast is coming back to export parity.