Key Points

- Hay prices have fallen from the highs of last harvest.

- Wheat holds a premium over hay in Victoria (+30%).

- Hay holds a premium over wheat on the Darling Downs (-10%).

- DD hay has held an average premium of A$144 over Victoria.

Our team covers a range of commodities, from goats to fertilizer. One of the agri products which we have not covered in much detail has been fodder due to the lack of available data. However we will now start to include the fodder market on a regular basis.

Our team covers a range of commodities, from goats to fertilizer. One of the agri products which we have not covered in much detail has been fodder due to the lack of available data. However we will now start to include the fodder market on a regular basis.

We would like to thank our friends at the Australian Fodder Industry Association (AFIA), who have provided us with datasets to assist in price reporting. This wouldn’t be possible without this data, and our analysis will help increase transparency for both farmers and buyers.

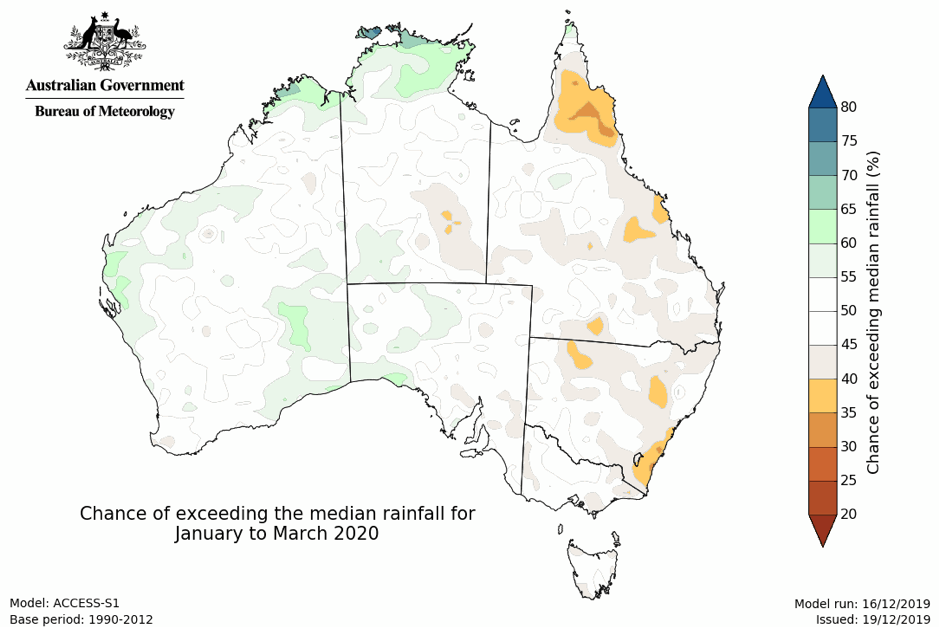

In this initial analysis we will examine the price structure of cereal hay market versus the wheat market.  The focus is on the Darling Downs and Victoria. This is since the Darling Downs is the primary demand driver and Victoria is likely to be the supplier this season.

The focus is on the Darling Downs and Victoria. This is since the Darling Downs is the primary demand driver and Victoria is likely to be the supplier this season.

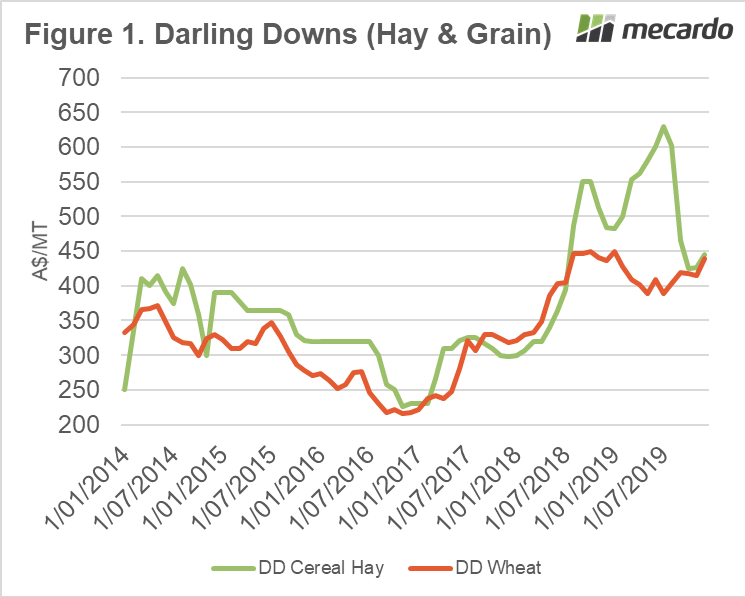

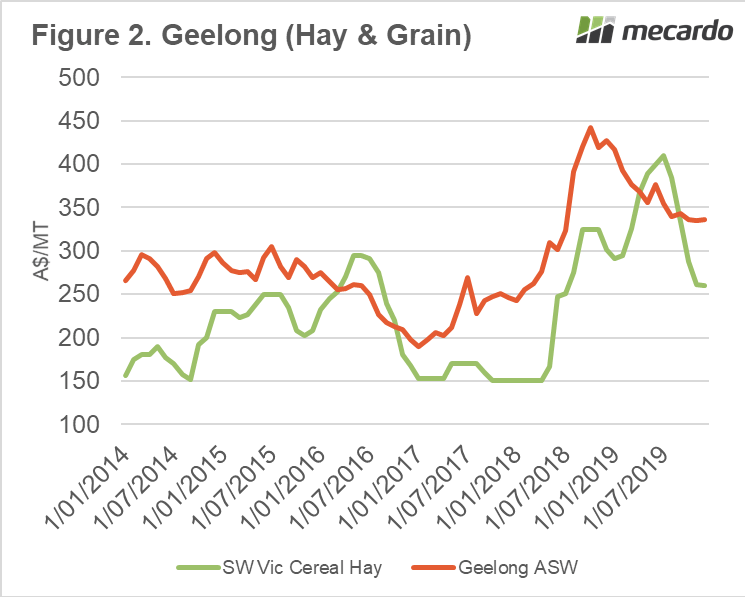

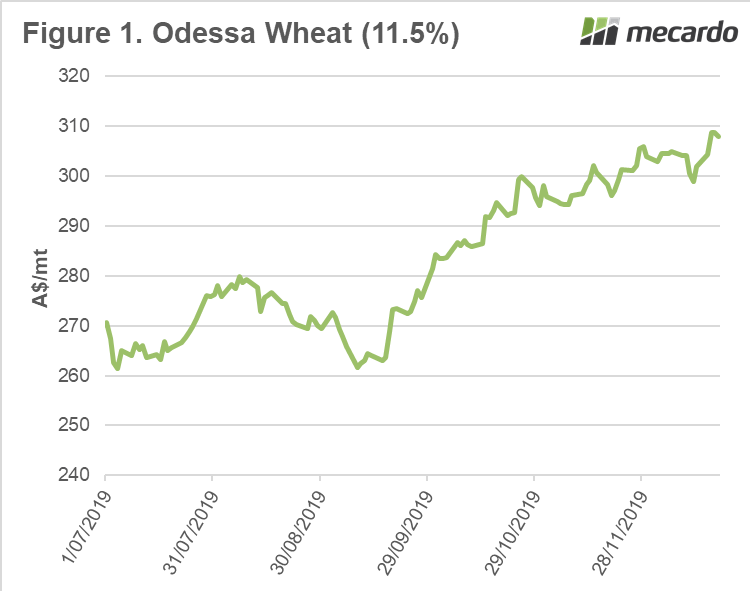

In figure 1 & 2, the cereal hay and wheat price for both areas are displayed. The price for both hay and grain has increased during the past two years due to the drought, however both have seen the market fall from last years highs.

There is a distinct difference however in both areas when it comes to the spread to wheat. On the Darling Downs cereal hay tends to trade at a premium to wheat, whereas in Victoria wheat trades at a premium.

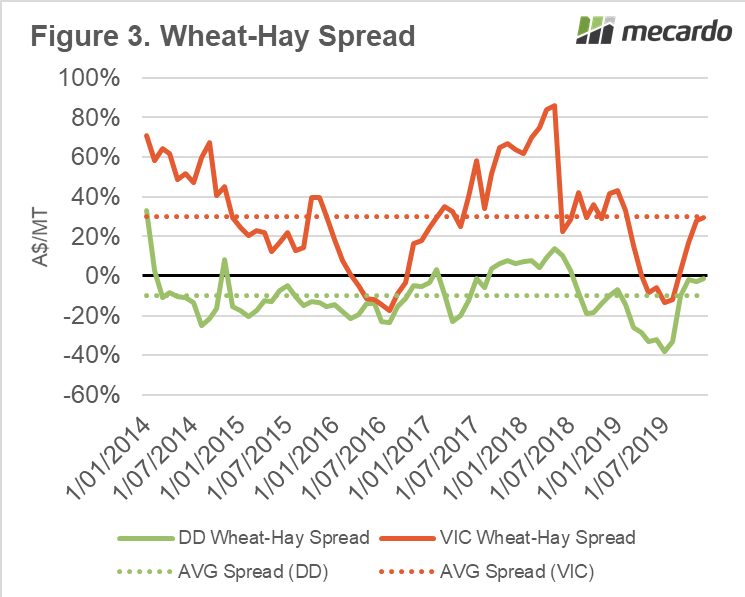

This spread is shown as a percentage since 2014 in figure 3. On average wheat is at 10% discount on the Darling Downs, whereas Victoria holds a 30% premium.

This spread is shown as a percentage since 2014 in figure 3. On average wheat is at 10% discount on the Darling Downs, whereas Victoria holds a 30% premium.

A large volume of hay is required for the numerous feedlot operations in QLD/NNSW. This is shown in the large premium for DD hay over Victorian, which has averaged A$144/mt since 2014 – which is approximately the freight required to supply from Victoria.

What does it mean next week?:

The large number of cattle feedlots in Queensland (and northern New South Wales) has resulted in strong premiums in Queensland for hay. This is exacerbated due to the drought conditions and the requirement to supply from Victoria.

In Queensland the hay market trades at a premium to wheat, which potentially points towards the replaceability of wheat with other feed materials (cottonseed/sorghum etc).

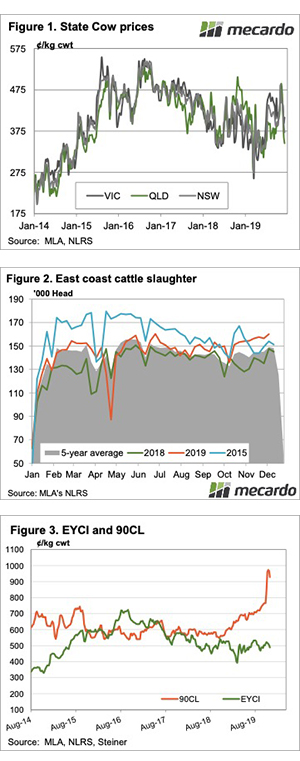

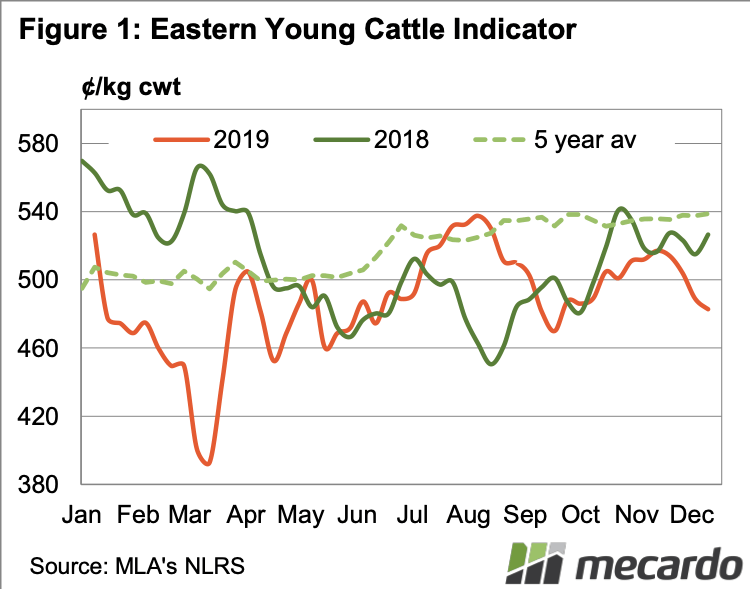

The Eastern Young Cattle Indicator (EYCI) has finished the year at a three month low, but it was on the back of yardings of just over 8,000 head. Figure 1 shows the final price for 2019 of 482.75¢/kg cwt is now 44¢ behind where it ended 2018.

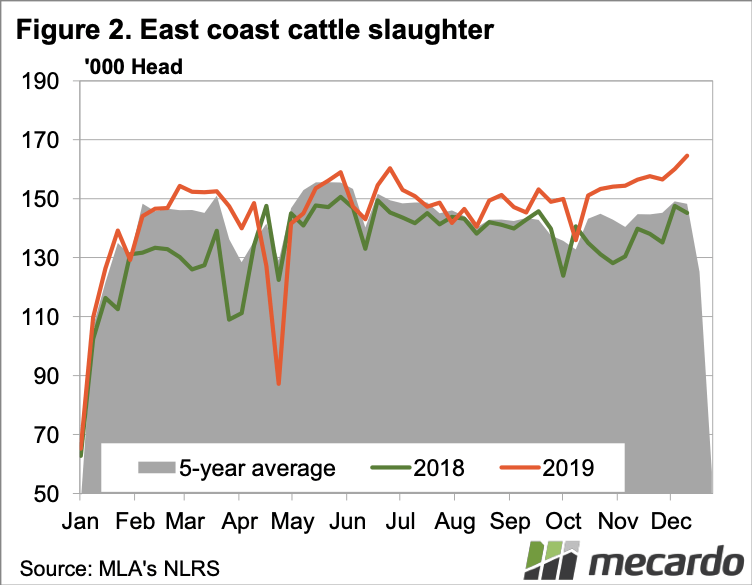

The Eastern Young Cattle Indicator (EYCI) has finished the year at a three month low, but it was on the back of yardings of just over 8,000 head. Figure 1 shows the final price for 2019 of 482.75¢/kg cwt is now 44¢ behind where it ended 2018. it is unusual for it to be the high for the year (figure 2).

it is unusual for it to be the high for the year (figure 2).

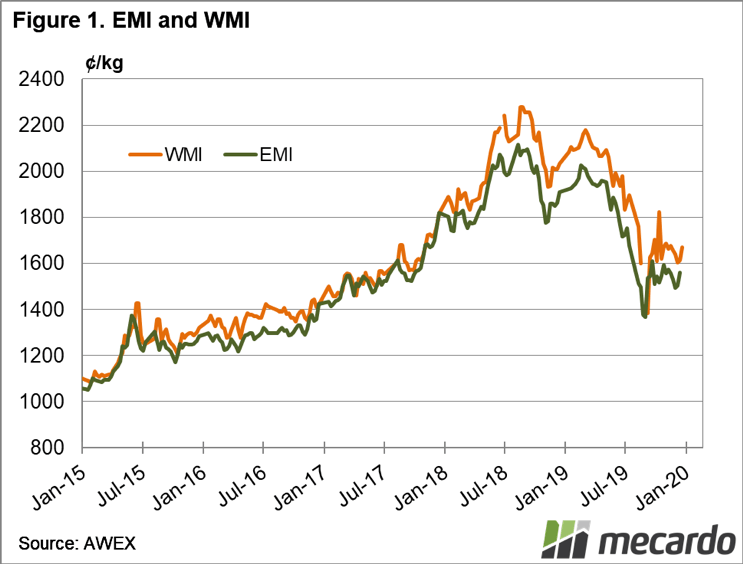

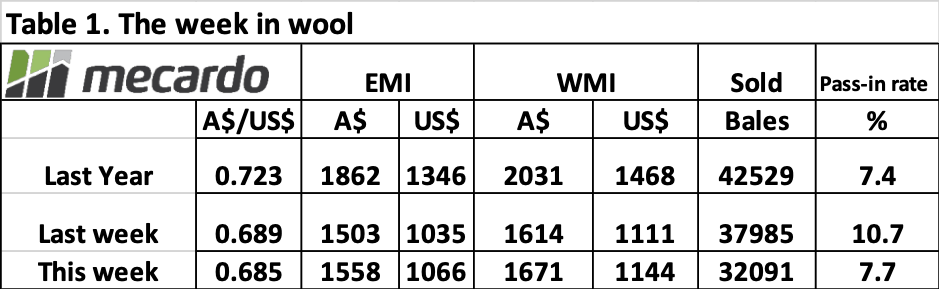

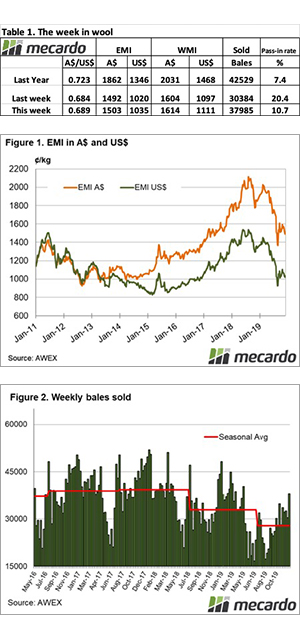

The Eastern Market Indicator (EMI) lifted 55 cents for the week to close at 1,558 cents. The AU$ gave up .05 cents to sit at US $0.645. In US terms, this pushed the EMI up 32 cents to 1,066 cents.

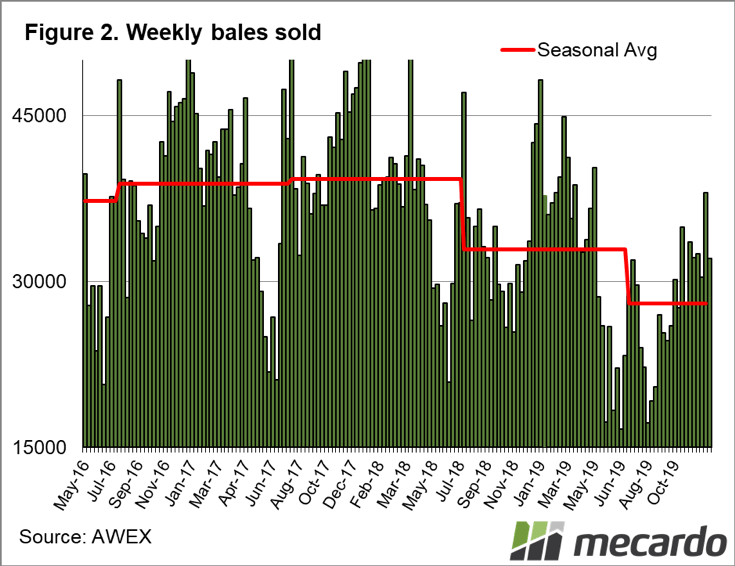

The Eastern Market Indicator (EMI) lifted 55 cents for the week to close at 1,558 cents. The AU$ gave up .05 cents to sit at US $0.645. In US terms, this pushed the EMI up 32 cents to 1,066 cents. Bales sold were 5,895 bales fewer than last week, and 10,438 down on the last week in 2018. The total lag in bale clearance from this season to last is currently at a difference of 119,995 bales.

Bales sold were 5,895 bales fewer than last week, and 10,438 down on the last week in 2018. The total lag in bale clearance from this season to last is currently at a difference of 119,995 bales.

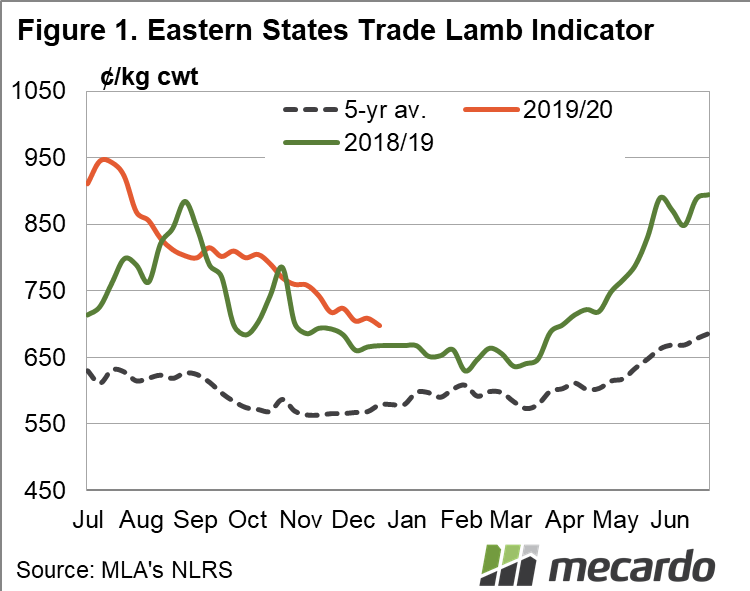

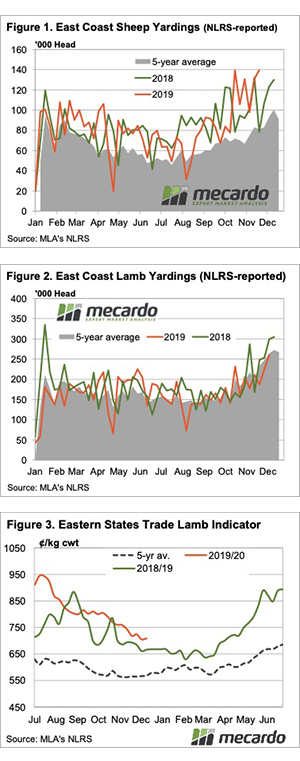

For the first time in 9 months the Eastern States Trade Lamb Indicator (ESTLI) dropped below the 700¢ threshold to end the week at 698¢. A hard number to swallow considering we’ve seen the ESTLI drop off nearly 250¢ from the record highs in July. That being said, this time last year the ESTLI was sitting at 668¢, so while the decline has been fast and hard, prices are still 4.5% higher than 2018.

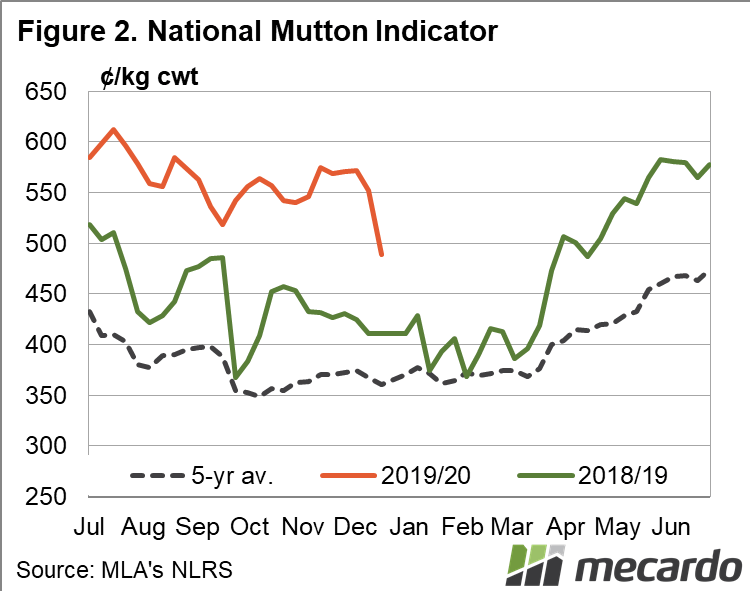

For the first time in 9 months the Eastern States Trade Lamb Indicator (ESTLI) dropped below the 700¢ threshold to end the week at 698¢. A hard number to swallow considering we’ve seen the ESTLI drop off nearly 250¢ from the record highs in July. That being said, this time last year the ESTLI was sitting at 668¢, so while the decline has been fast and hard, prices are still 4.5% higher than 2018. Mutton prices couldn’t hold on to finish the year at unbelievable levels. The National Mutton Indicator lost 79¢ on the week to close at 489¢. Another week of heavy mutton supply and the likely poor quality in NSW were the main drivers. All states contributed to the fall but NSW really took a dive. NSW mutton declined 13% on the week to 471¢/kg cwt.

Mutton prices couldn’t hold on to finish the year at unbelievable levels. The National Mutton Indicator lost 79¢ on the week to close at 489¢. Another week of heavy mutton supply and the likely poor quality in NSW were the main drivers. All states contributed to the fall but NSW really took a dive. NSW mutton declined 13% on the week to 471¢/kg cwt. Next Week.

Next Week.

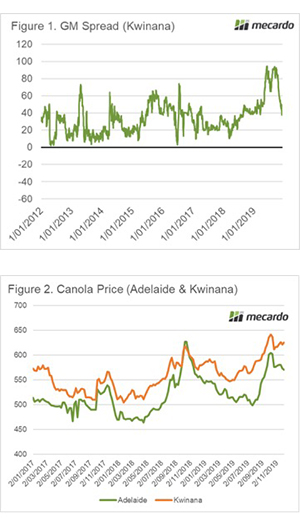

The South Australian government is debating a bill to end the moratorium on GM crop cultivation. I received information from a contact related to claims from anti-gm activists. I thought it was time to dispel some of the activist’s misunderstandings.

The South Australian government is debating a bill to end the moratorium on GM crop cultivation. I received information from a contact related to claims from anti-gm activists. I thought it was time to dispel some of the activist’s misunderstandings.

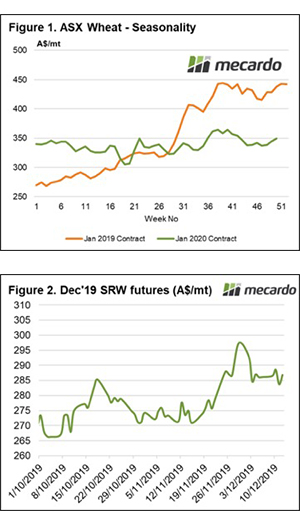

The ASX contract has risen dramatically during the past week, at the end of last week the December 2020 was trading at a weekly average of A$344 and has now moved up to A$349 (figure 1). There are concerns from feed consumers related to the slow pace of harvest in Victoria, which is driven both physical and futures levels higher.

The ASX contract has risen dramatically during the past week, at the end of last week the December 2020 was trading at a weekly average of A$344 and has now moved up to A$349 (figure 1). There are concerns from feed consumers related to the slow pace of harvest in Victoria, which is driven both physical and futures levels higher.