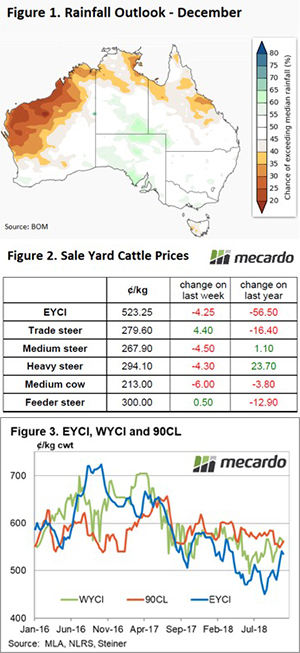

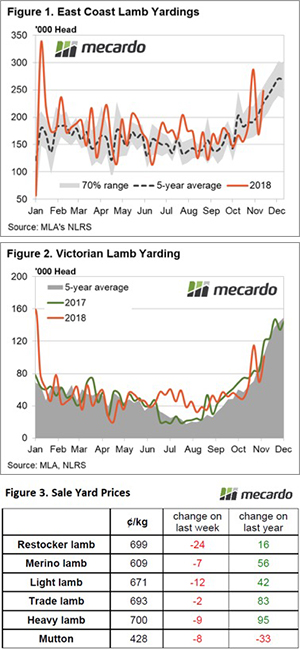

With some wild variation in lamb and sheep markets this year it is unusual to see a relatively steady week. But this is how it panned out this week, with relatively steady prices across the east coast indicators. However, delving deeper into state data hints at what may be to come.

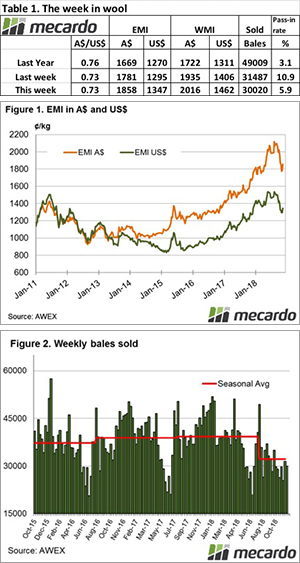

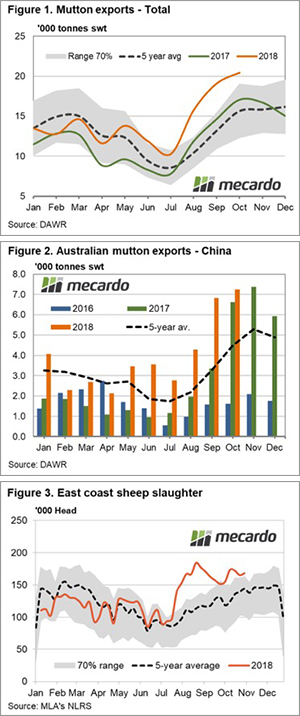

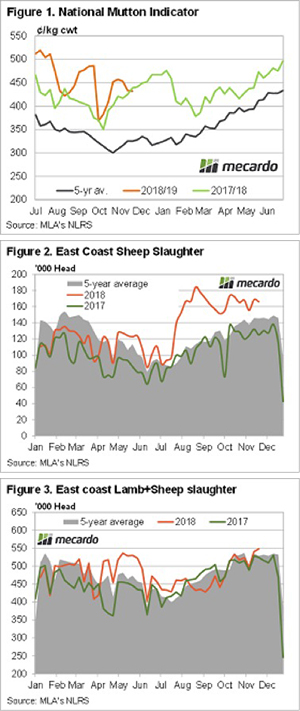

Mutton prices remain well above the five-year average (Figure 1), but this week have again fallen below last year’s levels. With the National Mutton Indicator at 431¢/kg cwt, it was well outstripped by NSW Mutton this week, which sits at 460¢.

Dragging the national average back was Victoria (404¢) and South Australia (336¢). In the West, the Mutton market is close to the national average at 421¢/kg cwt.

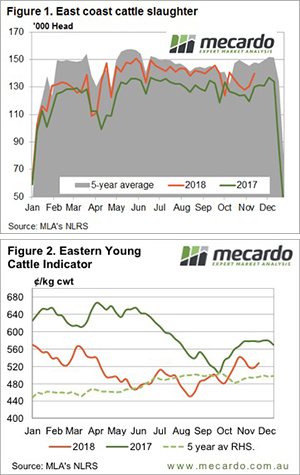

Still, Mutton is being slaughtered hand over fist. Figure 2 shows mutton slaughter 33% above the same time last year and 14% above the five-year average. The last time we saw slaughter at this level in the spring was in 2014.

Total Ovine slaughter is shown hitting 548,000 head in Figure 3. It has been four years since the supply of lamb and mutton has been this strong. At that time the Eastern States Trade Lamb Indicator (ESTLI) was at 466¢ and mutton at 295¢. This is a good snapshot of how far demand has come.

The ESTLI finished Thursday at 684¢/kg cwt, supported by NSW where Trade Lambs were 728¢, but dragged lower by all the other states.

What does it mean/next week?:

Rain in NSW this week should continue to help boost demand and should start to limit supply. The flow of mutton has been very strong and we suspect it can’t continue once grass is available. With lamb price still well above last year’s levels, we expect mutton to make up some ground before lamb makes its next move higher.

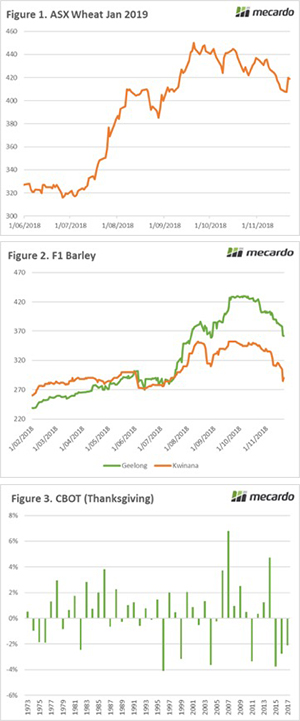

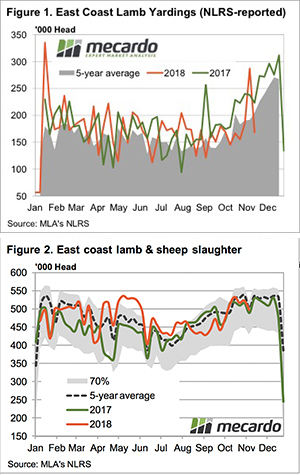

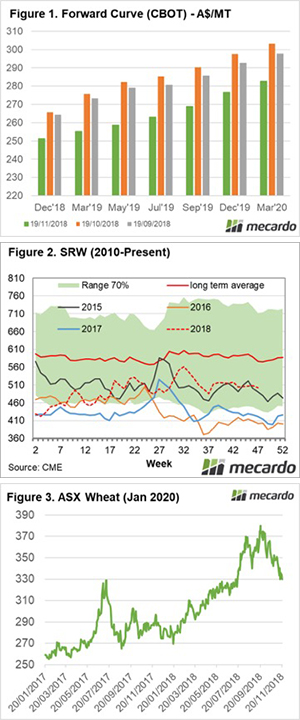

Lamb throughput levels increased 47% on last week’s lull in saleyard offerings, to see it back above the seasonal average by 10% as nearly 250,000 head changed hands (Figure 1). All mainland states contributed to the increase in lamb yarding with NSW lamb throughput levels showing uncharacteristically high volumes for this time in the year, sitting 36% above the five-year average.

Lamb throughput levels increased 47% on last week’s lull in saleyard offerings, to see it back above the seasonal average by 10% as nearly 250,000 head changed hands (Figure 1). All mainland states contributed to the increase in lamb yarding with NSW lamb throughput levels showing uncharacteristically high volumes for this time in the year, sitting 36% above the five-year average.